It’s been a tough few months for option traders with volatility going through the roof and stocks moving around all over the place (both down and up).

It’s now more important than ever to choose the best option strategies for this new market environment. Strategy selection is even more important than market timing and using the wrong strategies in 2019 could prove painful to you ego and your hip pocket.

With that in mind, let’s take a look at 3 powerful option strategies for this year.

Poor Man’s Covered Put

The opposite of a Poor Man’s Covered Call, but instead we use puts and the strategy profits when markets fall. Buying a long-term in-the-money put is much cheaper than outright shorting a stock and by selling a short-dated put we can offset the cost of the long put.

A Poor Man’s Covered Put can be traded as a stand-alone trade, or it can be used as an effective way to protect a portfolio of stocks.

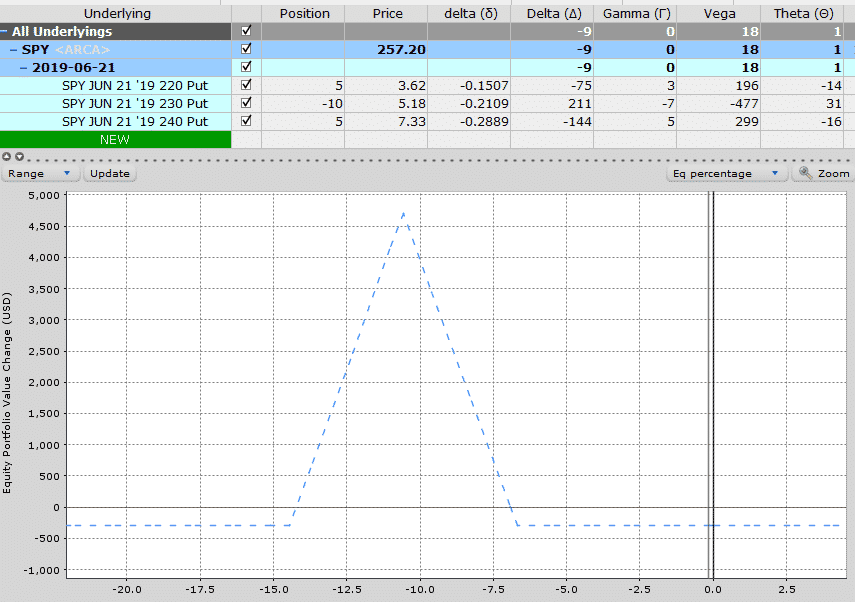

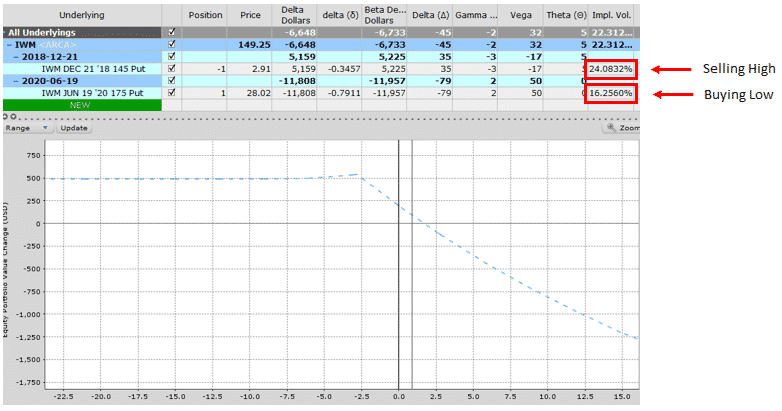

The great thing about this trade is that when the market is in Backwardation, the puts you buy have lower volatility than the puts you sell. You can see an example in a recent trade below:

Wheel Trade

The Wheel Strategy is basically Covered Calls on steroids. This is also a favorite strategy of Warren Buffett.

The downside is that trades may go under water in the event of a bear market. But, if investors choose quality stocks that pay a good dividend, they will do well in the long run. That’s the key with this one is taking a long-term approach. I’ve had a few examples including GE in 2008-2009 that took a long time to come good.

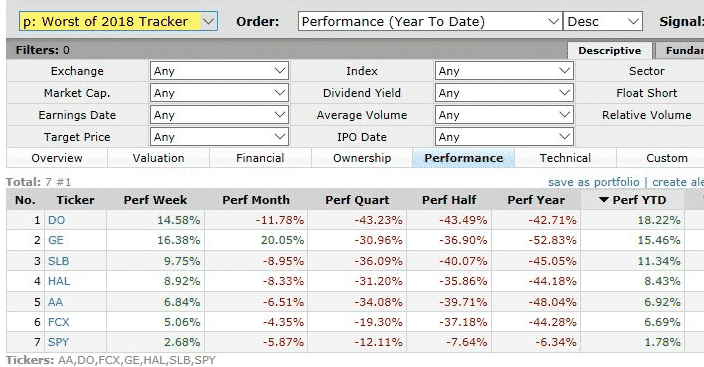

If you’re willing to take on some risk, these are some big name stocks that had a terrible 2018.

One way to reduce the stock specific risk, is to trade sector or country ETF’s. The consumer discretionary ETF is a lower risk sector that pays and good dividend and should decline less than the more risky tech and consumer discretionary sectors.

Directional Butterflies or Calendars

These are one of my favorite ways to take a view on a stock but only requires a fraction of the cost to gain the exposure.

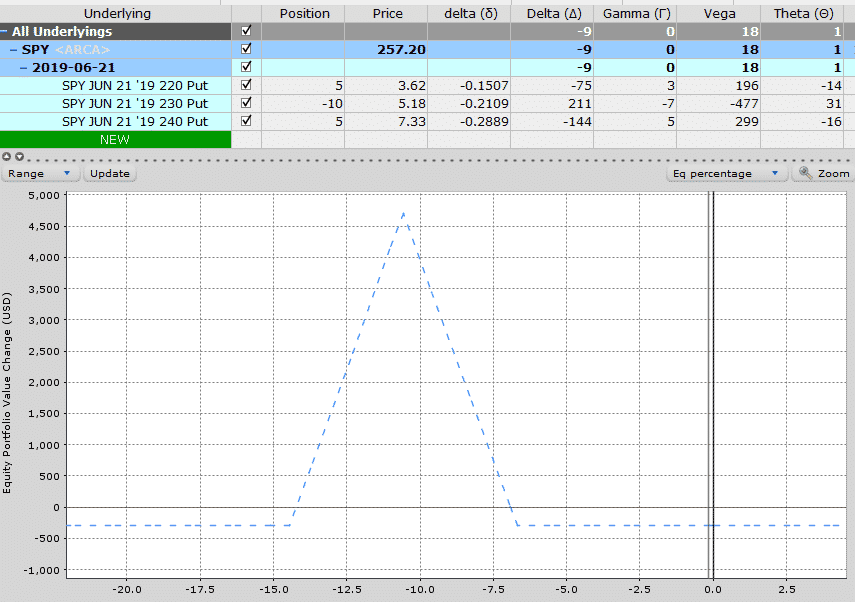

Let’s say you think SPY is going to be roughly 10% lower by June. Instead of buying an expensive put option and getting killed by time decay, traders could by a butterfly centred at 230.

This trade gives a very nice profit potential should the ETF fall into that zone and the trade costs very little at around $290.

The downside is that if SPY only drops a little, or it drops a lot, then it may end up out of the profit zone.

I like these trades as a means of protecting a portfolio of stocks. I had a trade like this on AMZN last year, but unfortunately my timing was slightly off.

Traders could also try a bullish butterfly if they think the market is going to recover, but are reluctant to commit too much capital.

Summary

This year is shaping up to be very different to last year and it’s important as trader’s to realize that what worked in 2018 may not work in 2019.

With these 3 strategies, you have a few new ways to trade the market and hopefully make some nice profits.

Let me know in the comments section below what you think about these 3 option strategies.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.