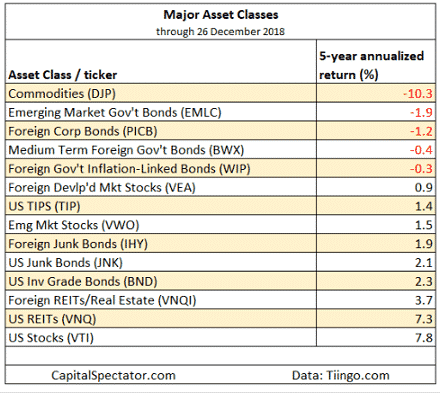

The US stock market has plunged in recent months, but the spike in volatility hasn’t stopped American equities from topping the list of the best performing asset classes over a trailing five-year period.

At the other end of the spectrum, commodities have been the worst performing asset class over the last five years.

The chart below comes courtesy of the Capital Spectator and shows commodities, emerging market government bonds and foreign corporate bonds as the three worst asset classes.

US stocks, US REIT’s and foreign REIT’s were the best.

Something I like to do at the end of each year is take a look at some of the worst performing asset classes, sectors and industries with a contrarian, long-term view that they might bounce back at some point.

That’s how I found the renewable energy sector which ended up being a great trade in 2017.

In terms of sectors, oil and gas has been particularly hard hit in the last five years with the Oil & Gas Equipment & Services ETF (XES) returning a -25.9% five-year annualized return.

The contrarian in me think this sector is a good candidate for a bounce back in 2019, but on the flip side I also just read that China just built the world’s largest floating solar power plant, so then again, maybe not…

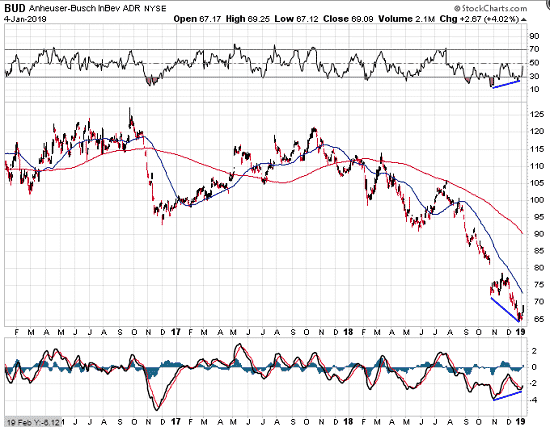

From other poor performers in 2018, BUD and JD have caught my eye.

BUD is currently trading at 69.09 which is almost 50% below it’s June 2016 high of 131.68. The stock also pays a 4.98% dividend and I would think it would be somewhat immune to a US recession (people might even drink more right?).

JD is another one that piqued my interest. A lot of people refer to this company as “The Amazon of China”, but with the trade war and general slowdown in China, the stock has dropped from over $50 to around $22.

It looks like the stock is trying to put in a bottom and there is some positive divergence that has been building since September.

According to a recent article the “Chinese e-commerce giant is already using drones to deliver packages.”

On thing I’ll be looking for in 2019 is a turnaround in China. The Shanghai Composite peaked in 2015 and if Chinese stocks can rebound, they may just drag the rest of the world with them

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.