Anyone who started trading the markets 6 months ago could be forgiven for thinking that volatility was a thing of the past. But the last few weeks, and today in particular, provided a staggering reminder of how far and fast the market can move.

I’ve already had an email from one reader whose weekly iron condor has blown up in his face, showing us again that gamma risk is not something to be taken lightly.

So, with markets seemingly melting down, what’s the plan of action from here? Let’s look at a few different ideas using my favourite trading instrument, RUT.

BEARISH STRATEGIES

Markets are pretty oversold, so you may be a little late to the party if you are looking for a bearish play. However, if you think stocks are going to continue to plummet, here’s a couple of ideas for you:

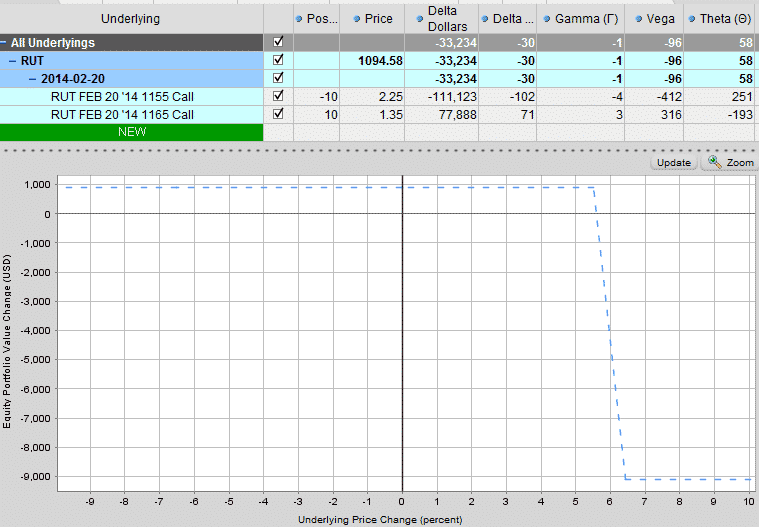

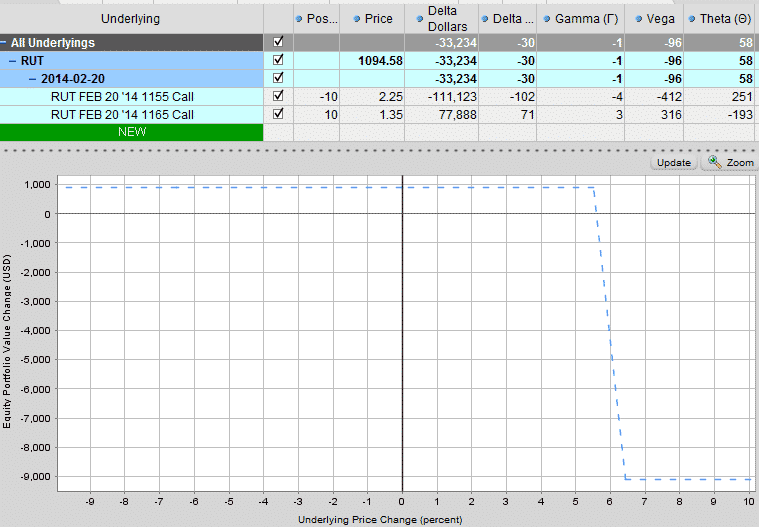

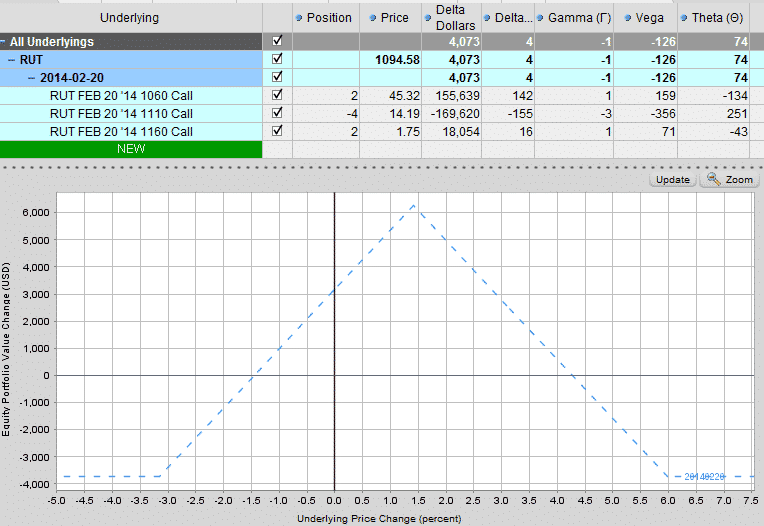

Call Credit Spreads

With less than 3 weeks to expiry, the Feb options are pretty short-term but also provide excellent Theta decay. Usually, I like to have my short deltas around 0.10, but if you’re a bit more aggressive you could use 0.15.

You could also look at going further out and use the March expiry. Here’s how a 0.10 delta March call credit spread looks:

BULLISH STRATEGIES

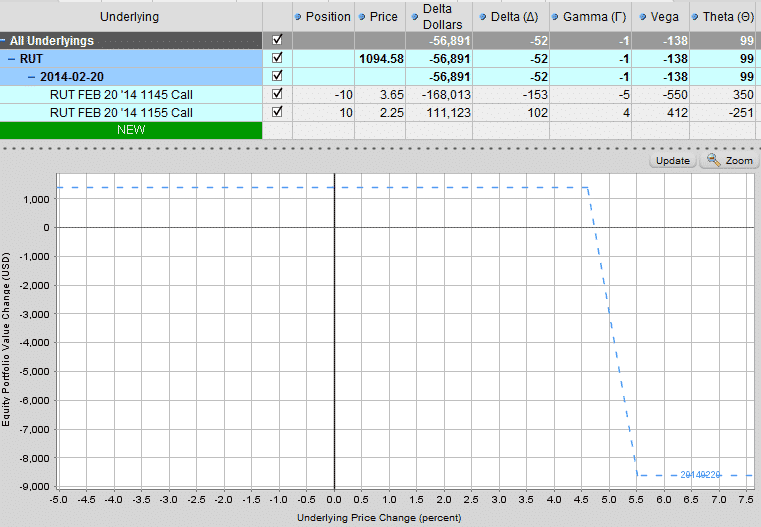

If you think the markets are due for a bounce, you could try some bull put spreads. With volatility spiking over the last few days, you can get so much further away from the current price with your bull put spreads than you were able to even just two weeks ago. This gives you a MUCH greater margin for error.

Here’s how a 0.10 delta Feb bull put spread looks:

Another way to play a bounce is with a bullish butterfly. This has the added benefit of being short Vega.

NEUTRAL STRATEGIES

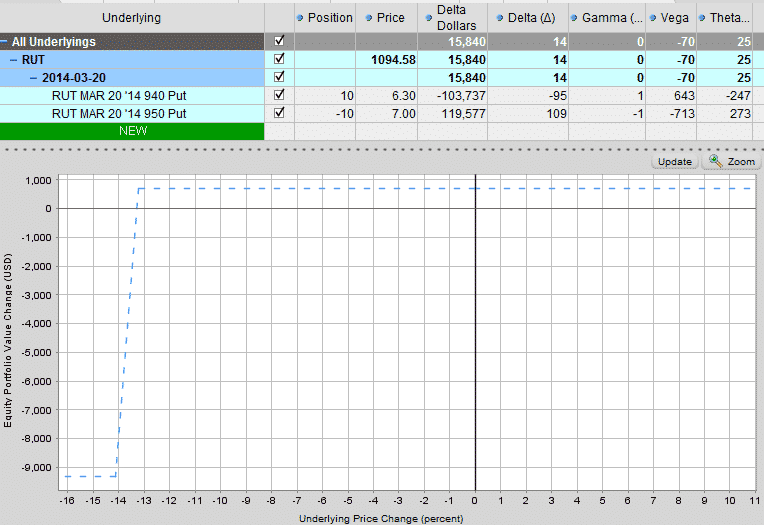

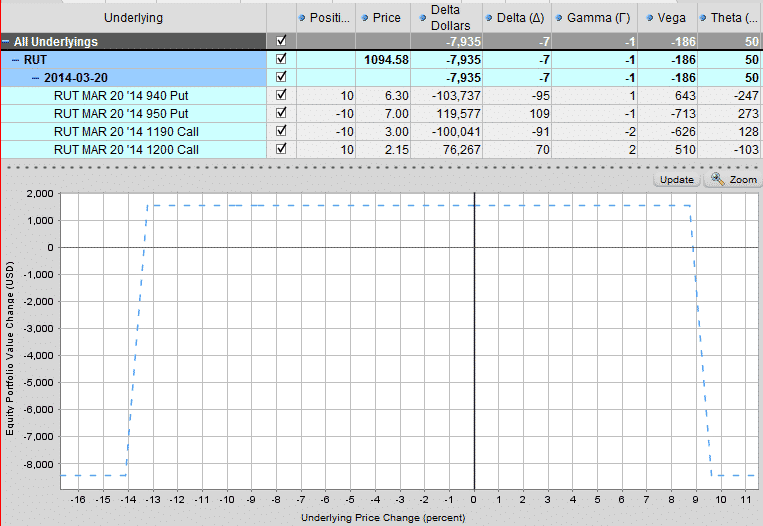

Perhaps the best way to take advantage of the rise in volatility is to be direction agnostic and just put on an iron condor. Let’s take a look at a 0.10 delta March iron condor. You can see that your short puts are a massive 13% away from the current price, and the short calls are almost 9% away.

COMBINATION STRATEGIES

Here are a couple of outside the box strategies that you may want to take a look at.

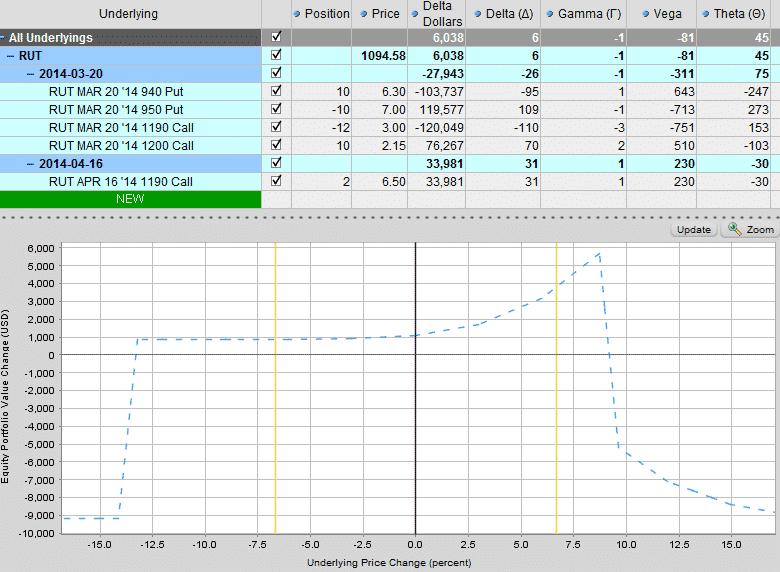

Iron Condor with Call Calendar

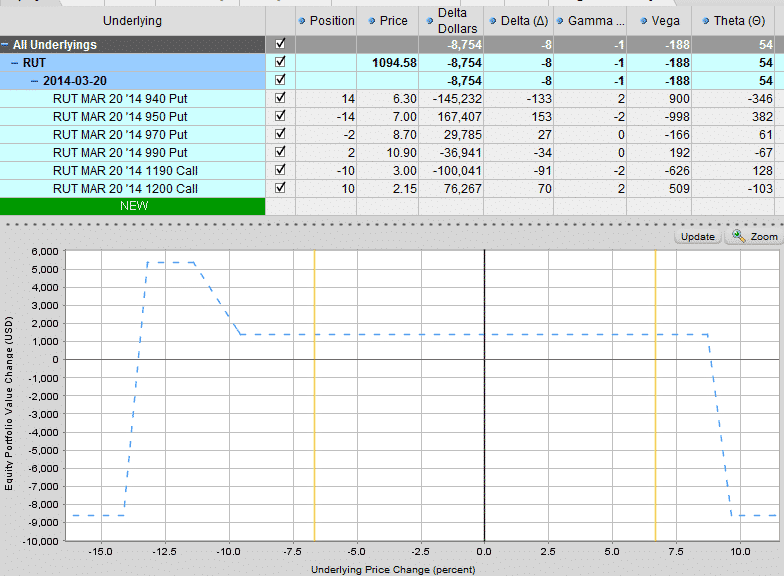

Iron Condor with Put Protection

While volatility can painful for any open positions that were short Vega, it provides MASSIVE opportunities for new trades. There are so many ways to trade this type of selloff, let me know in the comments below what trades you are looking at.

The markets had been so dull over the last 6 months, but this is what it’s all about, this is what we have been waiting for, so get out there and get amongst it!

with the volatility so high yesterday, just put on a weekly 1000/1020 PUT RUT spread yesterday for 0.75 credit, which is pretty good for something that expires in 3 days. But one question Gavin, if you put a March trade like you had above and the volatility keeps spiking like it has the last few days, you could see the loss on your position mount pretty quick correct? And that would force you to roll down or higher depending on which direction its going.

Hi

Chandran,

Nice trade from yesterday. Yes, if the spike continues it would hurt the march

trades due to the high Vega exposure. But, longer dated trades tend to move a bit slower than the shorter ones and you have more time to think through your adjustment strategy.

Thanks for your question.