WallStreetBets AMC traders were jumping for joy yesterday as the stock closed 95% higher.

What was even more impressive, however, was some of the action in the options market.

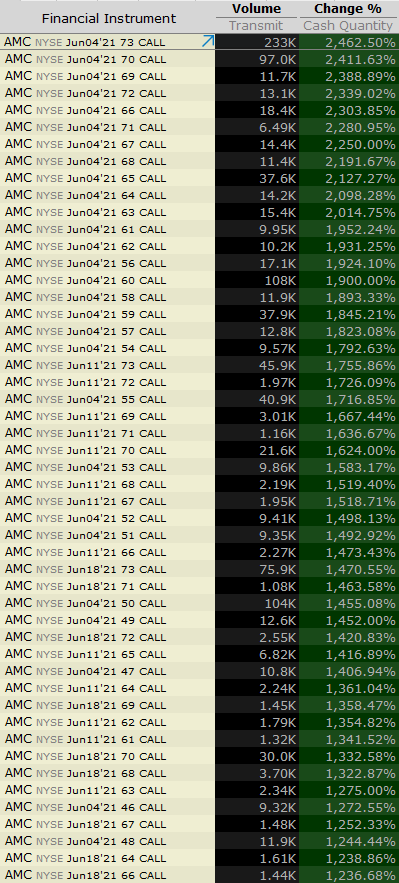

The most actively traded contract yesterday was the June 4th calls with a strike price of 73. These traded 233,000 contracts and were up a staggering 2,462.50.

Below you can see some of the other impressive moves during the WallStreetBets AMC short squeeze.

Total volume for AMC stock was 4.5 million of which 60% were calls and 40% were puts.

SPY typically holds the most actively traded options on most days, but yesterday, AMC took with prize with SPY only trading 3.3 million contracts.

The average option volume for AMC is around 650,000 so we saw a seven-fold jump in volume yesterday.

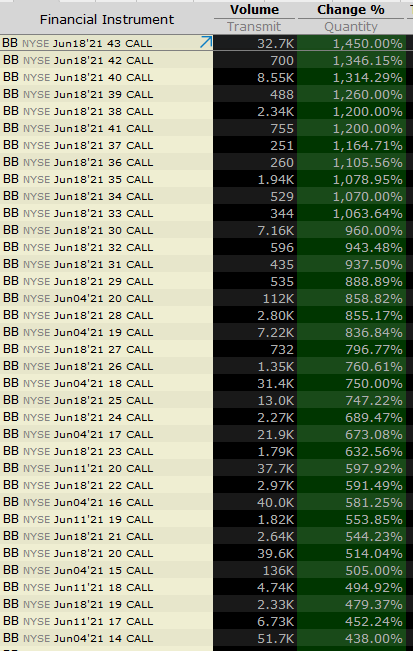

Blackberry (BB) was another WallStreetBets stock to go through the roof yesterday as the stock jumped 32%.

Option volume was 8.68 times higher than normal and most of the volume was in the call options.

Here is a snapshot of some of the action in Blackberry yesterday.

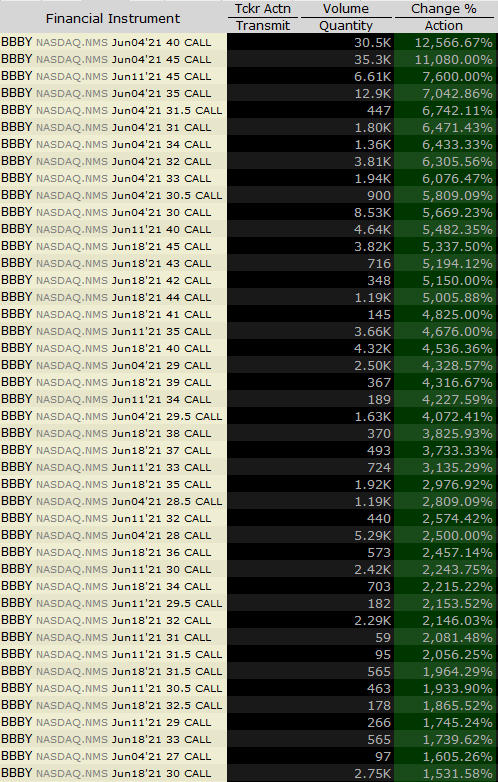

AMC and BB may have won the volume game, but by gar it was Bed, Bath & Beyond (BBBY) that took the cake in terms of percentage gains.

BBBY stock was up 62% yesterday and some call option contracts gained more than 11,000%. Absolutely nuts and well done if you were able to ride the Reddit / WallStreetBets coattails.

BBBY saw 35,000 contracts traded in the June 4 calls at the 45 strike. Those calls were up 11,080% on the day. Truly amazing.

What’s clear is that some Reddit wsb traders made a killing on AMC, BB and BBBY call options yesterday.

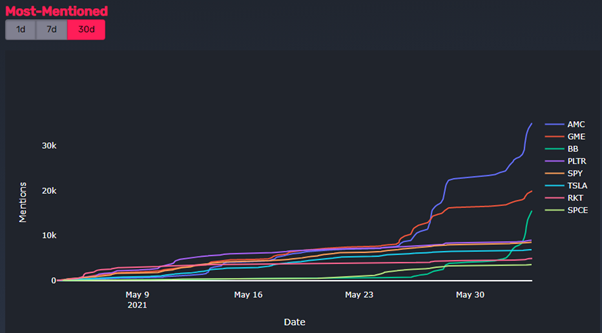

One interesting site I recently discovered is QuiverQuant which tracks the number of mentioned of certain stock tickers over 1, 7 and 30 day periods.

Take a look below:

The last time we had a WallStreetBets AMC short squeeze was back in late Jan. Below you can see that prices pretty quickly came back down to earth, but never dropped back to pre-short squeeze levels.

Below you will see the most actively trades option tickers from yesterday with some key data points highlighted.

We don’t know how long the short squeeze will last, but it sure is interesting watching it develop.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Interesting view on trading. It seems that amateur forum is worth following.