Contents

Continuing in the fundamental analysis series, we are now going to take a look at the Quick Ratio, what it is, and how it might be helpful in evaluating an investment.

What is the Quick Ratio?

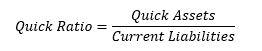

The Quick Ratio is very similar to the Current Ratio in that it measures a company’s ability to cover its liabilities with its current assets.

However, it differs from the Current Ratio in one important regard: it is focused only on those assets that are considered highly liquid, whereas the Current Ratio includes all assets, liquid or not.

Hence the term “quick” refers to the liquidity of the assets rather than the speed at which the calculation can be made.

It is for this reason that the Quick Ratio is also sometimes called the Acid Test Ratio.

The Quick Ratio is more conservative than the Current Ratio.

It excludes certain assets, which could otherwise inflate the ratio.

It is calculated as follows:

“Quick” Assets are again, those assets that are highly liquid. There are two primary ways of calculating Quick Assets:

![]()

Or

![]()

Note that while Prepaid Expenses are an asset, they cannot be liquidated to pay for current liabilities; therefore, they are excluded from Quick Assets.

Also, if using the second formula, Accounts Receivable are only considered an asset if their term is 90 days or less.

With Accounts Receivable, the quicker the payment terms, generally the better liquidity position that company is in.

Other Considerations

It may be helpful to look not only at the terms for Accounts Receivable, but at the terms for Accounts Payable, as well.

If a company has longer to pay its suppliers than it does to get paid by its customers, it can be considered in a healthy liquidity position so long as receivables are greater than or equal to the payables.

A Quick Ratio of 1 is considered normal.

This means that a company has enough assets that can be immediately/quickly liquidated to pay for its current liabilities.

The key is that the asset being liquidated can be done so with minimal impact to its price on the open market.

A company’s inventory includes not just the finished product, but any raw materials and components as well.

While it is possible to liquidate inventory quickly in most cases, it is often required that the inventory be steeply discounted to do so.

That is why inventory is most often excluded from the Quick Ratio.

Ratios of less than 1 indicate that even an otherwise healthy company may experience a liquidity crisis.

Such was the case in the global credit crunch of 2007-2009.

Many companies were unable to secure short-term financing and were unable to pay their immediate obligations.

In such cases, companies are left with trying to liquidate assets in a fire sale and/or seeking bankruptcy protection.

Conclusion

The Quick Ratio is a more conservative measure of a company’s ability to cover its current liabilities.

While not an immediate crisis, per se, a ratio of less than 1 does indicate the potential of a problem should short-term financing be unavailable or hard to acquire.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.