Learning to Read Your Emotions is the Key to Reaching Peak Performance

“Learning’s a gift, even when pain is your teacher.”

– Michael Jordan

When the topic of emotions is discussed within the context of trading, it’s usually with regard to how they interfere with performance.

When the topic of emotions is discussed within the context of trading, it’s usually with regard to how they interfere with performance.

And indeed, if you’ve ever experienced any of the following, you might be tempted to view emotions as evil:

- Moving your profit target out of a greedy attempt to make a killing

- Chasing the market from a fear of missing out

- Overtrading out of anger to make up for losses or mistakes

- Thinking you can outsmart the market because of overconfidence

- Sticking with a losing trade too long because your confidence can’t handle another loss

But viewing your emotions as inherently bad doesn’t make any sense.

Realistically, emotions are unavoidable – as a human being, it’s simply not possible (or even desirable) to eradicate them completely.

What’s more, when managed correctly, emotions are an essential source of energy to fuel performance.

Anger, for example, can be a phenomenal source of energy.

Michael Jordan used anger as motivation, most notably from being cut from his high school basketball team, to become one of the greatest basketball players of all time.

Some traders are at their best when they’re pissed off.

Others reach peak performance only when their back is against the wall and they are under a ton of pressure.

But the downside of using anger or fear to fuel optimal performance is that most people lack the ability to control their emotions.

In the hands of a novice, anger and fear can be extremely volatile.

Jordan, and other elite performers like him, have attained a mastery of their emotions.

They have figured out how to maintain the right mixture of emotion, energy, or fuel to consistently perform at the top of their game.

Part of this is achieving the right mixture of emotion.

Another key aspect is stability. Imagine being on a small boat in choppy seas and trying to board another boat that has pulled alongside.

The unpredictable nature of the waves makes it difficult, if not impossible, to correctly anticipate when you should jump from one boat to the other

That’s what it’s like trying to get into the zone when your emotions are volatile. You can do it, but the odds are low and big mistakes are likely.

On the other hand, when the seas are calm, or your emotions are stable, reaching the zone consistently is much easier.

MAPPING YOUR PERFORMANCE RANGE

When it comes to execution, everyone has their own performance range, both mentally and tactically.

You’re likely aware, intuitively, that you have one too.

It’s easy to tell the difference between when you’re trading at your absolute best from when you’re trading at your absolute worst.

But have you ever stopped to think deeply about the different levels of your performance in a precise way?

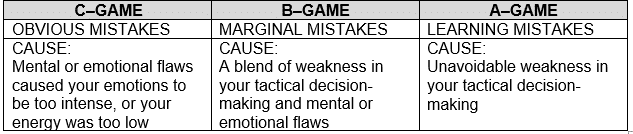

Most haven’t. For simplicity in discussing the concept here, I’ll stick with calling these levels your A-, B-, and C-games

When performing at an A-game level, your emotions are clear and stable.

You’re in the zone, or close to it, so you make high quality decisions because there’s no negative emotional interference with your process.

Any mistakes you make at this level are caused by something technical—for example, knowledge you haven’t yet gained or a recent change in the market you haven’t identified yet.

Frankly, to even call these “mistakes” is a bit of stretch.

You wouldn’t say a toddler was making a mistake when they fall soon after taking their first steps.

Your attempts to take your A-game higher are no different.

These “learning mistakes” can’t be prevented.

They’re an inherent part of the process.

On the flip side, your C-game is chock full of emotional volatility, and that’s the primary cause of your poor performance.

You make mistakes that are so obviously wrong, you know it seconds afterward. At this level, there’s nothing new for you to learn tactically.

You know what you should have done, and it’s why you’re so quick to recognize it was a mistake.

In that moment, you lacked access to the knowledge and skills you typically rely on, either because excess emotion caused your mind to malfunction, or you lacked sufficient energy to think properly.

Some traders don’t make big, obvious mistakes.

Their mental game has advanced to a point where their C-game consists of more subtle mistakes.

For example, you might have a tendency to read too much into price action, and force trades that lack a strong indication of edge within your strategy.

Whether the mistakes are big or small, C-game is where your performance flaws live.

Those flaws create emotional chaos, cause your perspective to be out of sync, and result in mistakes that are basic, relative to your range

The nature of your B-game is more complicated.

In your B-game you’re likely making some marginal tactical errors—things that you need to improve but aren’t super obvious.

If it were obvious, that would make it a C-game error.

You’ll find some emotions holding you back from being in your A-game, but not enough to pull you down into your C-game.

From a mental and emotional standpoint, one of the biggest differentiators between B- and C-game is that, in B-game, you have the impulse or thought to make a C-game mistake, like forcing a trade or closing one too early, but instead you retain the presence of mind, mental energy, and emotional control to avoid it.

In C-game, your emotions are too strong, and you can’t stop yourself from forcing or getting out too early.

While in A-game, the impulse or thought doesn’t happen, or it’s so small you barely notice.

The key to unlocking the backend of your game and eliminating your most common errors in execution is correcting the performance flaws that cause your C-game.

Even if you’re a seasoned trader with 20-plus years of experience, some performance flaws still cause your worst mistakes.

This is true regardless of whether your mistakes are significantly less awful than the mistakes junior traders make.

Every trader has performance flaws, no matter how experienced or skilled.

You can’t escape the gravitational force of your C-game by focusing solely on improving your trading knowledge and skill.

If you improve only on the technical mistakes that exist in your C-game, your performance flaws will continue to generate the same level of excess emotion. You’ll make different, but still obvious, mistakes.

That strategy isn’t wrong; it’s just inefficient.

You’ll continue to go through unnecessary ups and down in your execution, and your performance will continue to lag.

To move your entire game forward, you must move your C-game forward.

And to do that, you must prioritize fixing the flaws causing your C-game.

3 STEPS TOWARD IMPROVING YOUR MENTAL GAME

As humans, we’ll never achieve lasting perfection, especially in an industry as competitive and dynamic as trading.

But by working on your mental game in a systematic way, you can steadily improve your performance while remaining energized, confident, focused, and motivated.

Here are three steps to help you get started:

- Acknowledge the important role emotions play. Emotions provide data on how we operate, for better or worse, at an unconscious level. They provide information on a host of things, including our underlying belief systems, biases, goals, perspectives, flaws, ingrained habits, wishes, and illusions. This is important, because what happens at the unconscious level has a direct impact on your thoughts, actions, and trading decisions.

- Treat your emotions as signals. Rather than fighting your emotional state, get curious about what your emotions are trying to tell you. As a trader, you use signals all the time and, based on your level of expertise, you are more or less skilled in leveraging those signals to deploy your edge. Think of your emotions like the indicators you follow in the market.

- Develop a system. By developing a system to read your emotions, you’ll learn how to clear out the mental and emotional volatility caused by your underlying performance flaws. What automatically emerges is an intense drive, but with greater stability. You get the benefit of the Jordan-like anger without the turmoil. The process to reach the zone becomes easier and more straightforward. And in the long term, you will enjoy your work more, reduce the odds of burnout, and strengthen your ability to produce higher returns.

To learn more, check out my newest book, The Mental Game of Trading:

A system for solving problems with greed, fear, anger, confidence and discipline.

About the Author

Jared Tendler, MS, LMHC, is a leading expert in how your mental game impacts performance.

His roster of clients spans 45 countries and includes esports athletes, financial traders, some of the top poker players in the world, a top ranked pool player, and several PGA Tour players.

The author of two highly acclaimed books, The Mental Game of Poker, and The Mental Game of Poker 2, Jared is currently writing a book on The Mental Game of Trading and is the host of the popular podcast, The Mental Game.

In addition to his writing and 1:1 coaching, Jared also previously served as the Head of Sport Psychology for the esport organization Team Liquid.

He was a key driver of their success as they won multiple championships, including The International 2017 (DOTA2), the Intel Grand Slam (Counter-Strike) and four League of Legends Championship Series (LCS) titles.

Jared’s straightforward and practical approach to coaching has helped numerous clients solve their mental game problems and perform at their highest levels.

After earning a Master’s Degree in Counseling Psychology (MS) and becoming a Licensed Mental Health Counselor (LMHC), Jared began his coaching career in 2005.