“Volmageddon” is not a word in the dictionary.

It was a term coined by the derivatives industry that refers to the extreme market event that occurred on February 5, 2018.

As of this writing in early 2023, the next “volmageddon” has not happened yet.

People are speculating that it is not a matter of “if” but “when” it would happen.

“Volmageddon 2.0” is the next volatility event that will happen that is similar to (if not larger than) the event on February 5, 2018

I don’t know who specifically came up with the word, but I would admit that it is a catchy name.

Contents

Volmageddon

The word “Armageddon” is a word found in the dictionary.

It originates as a biblical reference to the location of the place where the last battle between good and evil will be fought.

The key word here is “last,” as in “last battle.”

The implication here is that this battle would destroy the world, and hence there would be no next battle afterward.

Armageddon has now come into popular usage to refer to any dramatic and catastrophic event likely to destroy the world or the human race.

Volmageddon is a play on that word where the prefix “vol” refers to volatility.

Options investors who employ “short volatility” strategies will know it well because they rather say “short vol” for brevity instead.

What Happened During Volmageddon?

On February 5, 2018, the Dow Jones Industrial Average lost more than 1,500 points during intraday trading.

source: TradingView.comThis is its biggest intraday point drop in history up to that time.

That is not to say that it could not make larger intraday swings in the future.

The DOW finally closed down by 1,175 points for the day.

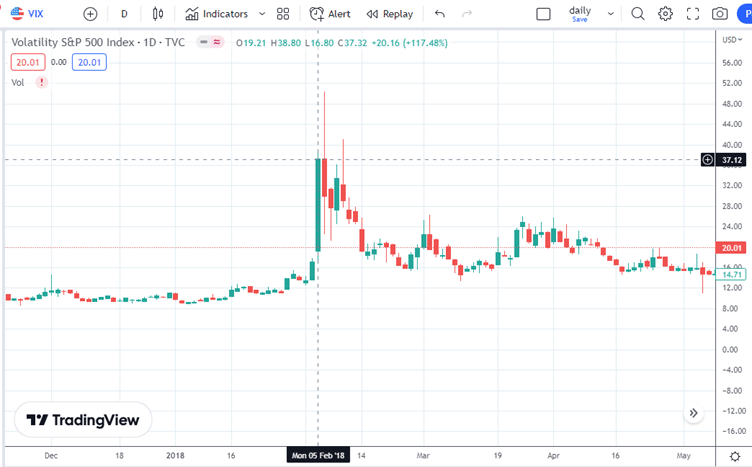

It is natural that when market indices drop, the VIX will rise. The VIX is the CBOE Volatility Index, often referred to as the “fear index” and used as a measure of market volatility.

That day was accompanied by an extreme spike in volatility, where the VIX rose from 17.16 to 37.32 (close to close), a spike of 117% — the largest VIX spike till then.

source: TradingView.com

What Happened To Short Volatility Strategies?

When VIX goes up by such a large amount, it financially damages certain exchange-traded products (ETPs).

Specifically, the “inverse volatility” products are hardest hit.

Inverse volatility products are funds that capitalize on falling volatility.

They are designed to profit when volatility falls and vice versa.

When volatility rises (as in the spike in the VIX), they lose value.

Prior to the event was the growing popularity of these inverse volatility products leading to an over-crowded “short vol” space.

Among products such as SVXY, UVXY, etc., one very popular inverse volatility product was XIV — an obvious play on the reverse spelling of VIX.

I used the word “was” because XIV no longer exists.

It was terminated when it lost 96% of its value during Volmageddon.

Somewhere in the legalese, there must have been a clause that mentioned that termination of the product is a possibility if the product loses 80% of its value, and if such an event occurred, investors would likely lose the entirety of their investment.

Many investors do not read such legalese, nor do they believe that such an event could happen. Unfortunately, it did.

Biggest Volatility Spike In Recorded History

What was unusual was why volatility increased so much when the S&P 500 dropped only about 4% that day.

I’m not saying that 4% is not a significant drop.

But one would think such a large volatility increase would only occur in a much larger market crash.

Many investors also did not understand how these inverse volatility products derived their value.

It is not based on supply and demand but rather on the end-of-day rebalancing of first and second-month VIX futures contracts.

Those ETPs that did not get terminated lost a significant amount of value.

Since I can no longer pull up the chart of the XIV after it got de-listed, here is the chart of the SVXY:

source: TradingView.com

Wow.

That’s quite a drop off a cliff.

This is rarely seen even in the most volatile of stocks.

Mainstream Media On Volmageddon 2.0

Can this type of event happen again? Sure, it can.

The mainstream media is calling it Volmageddon 2.0.

Just yesterday (February 17, 2023), CNBC titled their media piece “Volmageddon 2.0: How Options are Influencing Markets“, where it says that zero-DTE options are now estimated to make up about 50% of the daily volume of the S&P500 index options.

The Wall Street Journal is asking the question in its article, “Are 0DTE Options creating the next Volmageddon.”

In an article published in investing.com, J.P. Morgan’s chief global markets strategist, Marko Kolanovic, said that the rise of trading near-term U.S. equity options could trigger the next one.

FAQs

How is Volmageddon different from the Flash Crash?

The Flash Crash refers to May 6, 2010, when the DOW dropped almost a thousand points (or about 9%) intraday, only to recover most of that loss within minutes.

In this case, the blame was placed (rightfully or not rightfully) on high-frequency trading algorithms, which caused a cascade of selling.

Volmageddon is a more sustained market event that lasted several days.

How to protect against Volmageddon 2.0?

Always use defined-risk spreads or combinations thereof.

The worst thing that you can do is to short the VIX by selling a naked call option.

You get a small premium for doing it.

But if VIX skyrockets through the roof, the short call will be deep in the money, and you will be obligated to buy back the short call at expiration for a very high price.

If VIX is insanely high at that time, your net loss is theoretically unlimited — especially if your expiration is short and there is no time for the VIX to calm back down prior to the expiration of the option.

What other names has Volmageddon been referred to as?

Volmageddon has been referred to by other names such as “Volpocalypse” and “Volnado.”

But the name that stuck with mainstream media is “Volmageddon.”

Conclusion

Just remember that the VIX can go up dramatically and unexpectedly.

This is what makes shorting the VIX and other variants of that strategy a bit dangerous.

The use of defined-risk options structures would be wise.

We hope you enjoyed this article on Volmageddon 2.0.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.