Today, we are looking at the victory spreads option strategy. We will look at what they are and how to trade them.

Enjoy!

Contents

- What is a Victory Spread?

- Visualizing the Victory Spread

- What Is My Exposure To Volatility When I Put On A Victory Spread?

- When Should I Use Victory Spreads?

- Victory Spreads vs. Ratio Spreads

- Concluding Remarks

There is no shortage of different options combinations.

One such combination is called a Victory Spread.

This article will take an unbiased look at the victory spread.

We will talk about the advantages and disadvantages of this type of trade.

We will then determine when the best time may be to place a Victory Spread on a stock.

What is a Victory Spread?

A victory spread is similar to a call ratio backspread.

In this case one option is sold near the money and multiple options are bought out of the money.

What separates the Victory Spread is that the options traded are on different expiries, similar to a diagonal.

This gives a similar but slightly unique payoff complex.

Due to this structure a victory spread could also be called a ratio diagonal spread.

Visualizing the Victory Spread

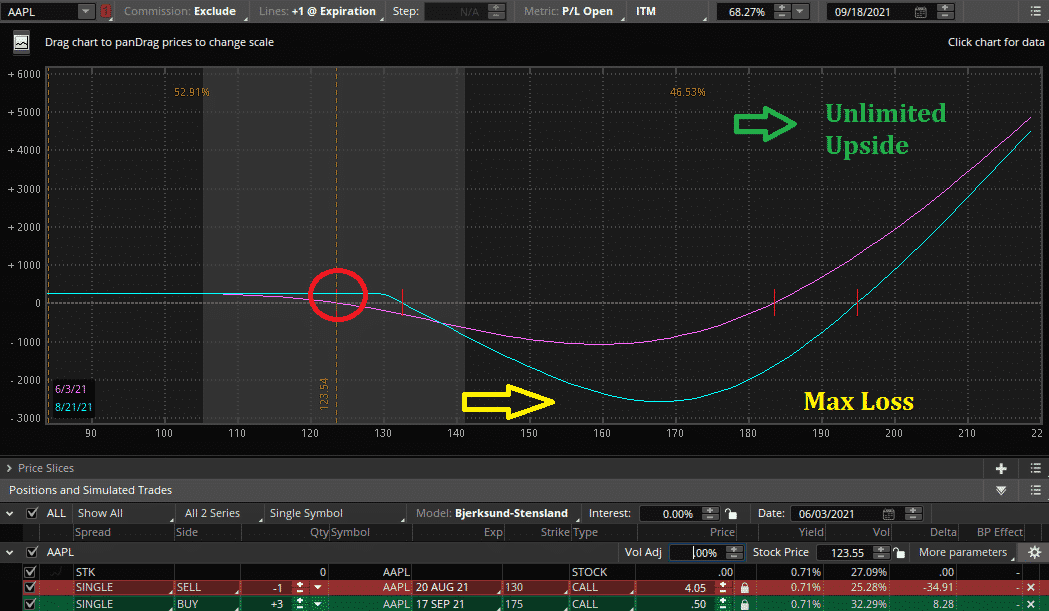

Below is an example of a victory spread.

In this case I have sold one Apple 130 call expiring in August while buying four 175 calls expiring in September.

At inception Apple is trading at the red circle.

The corresponding structure will make a small credit if Apple moves down.

If Apple moves up slowly the position will start to incur losses.

The loss on this trade is capped, but still substantial.

Despite this if we have a large move in the underlying past our long call options, we have unlimited profit potential.

This is because we have bought four of the 175 calls but only sold one 130 call.

What Is My Exposure To Volatility When I Put On A Victory Spread?

One may be tempted to say that they are short volatility on a victory spread as if the price doesn’t move at expiry they will make a small credit.

Others would say that the potential of a large move would make it long volatility. Both could be right.

Depending where you set the strikes your victory spread will take on different volatility characteristics.

Then as the trade evolves these characteristics will evolve too.

When Should I Use Victory Spreads?

One of the most important questions is when someone should use a spread like this.

Victory spreads like any other spread are not a free lunch.

When someone expresses a trade like this, they are expressing the view that the stock has the ability for an explosive move to the upside and if this move does not occur will likely drift lower.

A question to ask yourself is in what type of situation will this occur?

One clear example is biotechs. Imagine a small biotech trying to find a cure for cancer.

Most likely it will slowly bleed cash and decline out of existence but imagine their drug trial is all of a sudden successful.

The stock could sky-rocket.

Now before you go out and buy all the victory spreads in small biotechs you can there is a caveat.

The market is not stupid. It prices this risk as call skew.

This means the far OTM options you buy will cost more (in implied volatility terms) than the ones closer to the money that you sell.

This makes the payoff less attractive.

The key for Victory Spreads is having situations like that small biotech but specifically where you think the market is underpricing the potential for a massive upside move.

This could be either due to a binary event or a potential upcoming catalyst.

In the above example we used a call victory spread, but we can do the same structure with puts.

This would express the view that an investor feels as though there is a chance of a large swift down move but if that does not happen the stock will drift higher.

We can see this from a Put victory spread shown below.

Victory Spreads vs. Ratio Spreads

Victory spreads are incredibly similar to ratio spreads, in both the payoffs and the view they express. Despite this there is one difference.

The long leg is on a different expiry to the short leg.

By trading a victory spread, the investor is also taking a view on the term structure saying that they think the further dated volatility is underpriced.

They are trading more Vega instead of Gamma.

So why would one want to express this view?

Let’s say you believe there will be a large event that could cause a move in the stock, but you also think that because of this move the stock will become more volatile in the future.

For example, Bidu moving into the EV space caused a large move up in the stock while also increasing longer dated implied volatility.

The company pivoted and became a company with higher volatility.

Another reason is you could simply think that by viewing the volatility itself that the short-term volatility is looking pricey compared to the longer term volatility.

Moral of the story if you don’t have a view on the volatility term structure of the underlying you are most likely better expressing your view by just trading a ratio spread.

Trade the exposures you want, not the exposures you don’t.

Concluding Remarks

Victory spreads can be useful in certain situations.

Specifically, if an investor feels like there is a possibility for a large up or down move and that the market is not pricing in the potential for that move.

Despite this they are not a fool safe options strategy.

No strategy is. Forget about what some of the marketing online about victory spreads suggests.

Yet understand when it is advantageous to choose a structure like a Victory Spread.

This will enhance your long-term profitability as a trader.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.