Today’s trade review is a losing Iron Condor trade from the November expiration period.

I thought this was a great trade to review, because even though it was a losing trade, I still view it as a good trade.

When reviewing trades, it’s important to evaluate your decision-making process rather than the dollar outcome.

Solely focusing on the dollars is not a good way to trade.

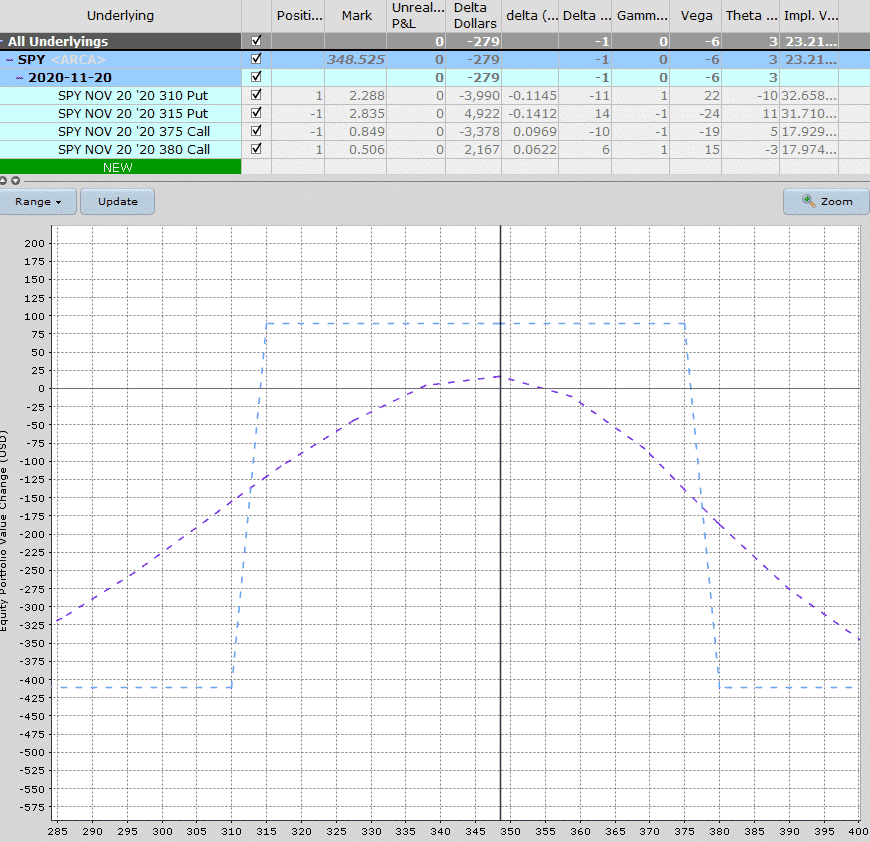

Here are the trade details:

Trade Date: October 15th, 2020

Underlying Price: 348.53

Details:

Buy 1 SPY November 20th $310 put @ $2.29

Sell 1 SPY November 20th $315 put @ $2.84

Sell 1 SPY November 20th $375 put @ $0.85

Buy 1 SPY November 20th $380 put @ $0.51

Premium: $89 Net credit

Max Loss: $411

Return Potential: 21.65%

Stop Loss: 1.5x premium received ($133)

Adjustment Points: If either short strike delta hits 25

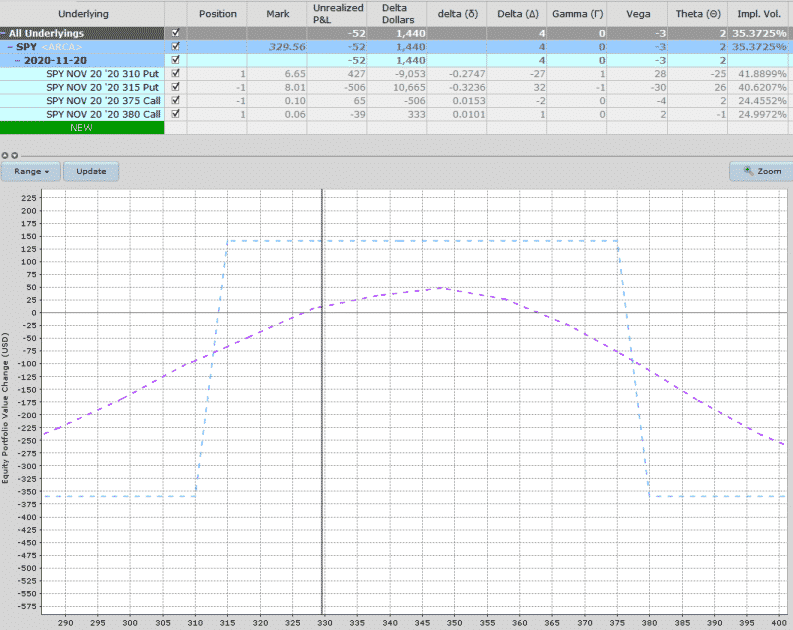

On October 28th, SPY had dropped to 329.56 and the short 315 put delta had blown out to 32.

Delta dollars was also 3x capital at risk.

It was time to adjust.

You can see the condor is skewed with more risk on the downside.

The adjustment involved repositioning the entire condor by rolling the puts spreads down from 315-310 to 295-290 and the call spreads from 375-380 to 355-360.

I also added another contract on the put side, similar to the recent PYPL example, I shared.

This adjustment got the condor back to delta neutral. In hindsight, rolling the untested side closer was my only mistake, but looking back, I’m still ok with that decision.

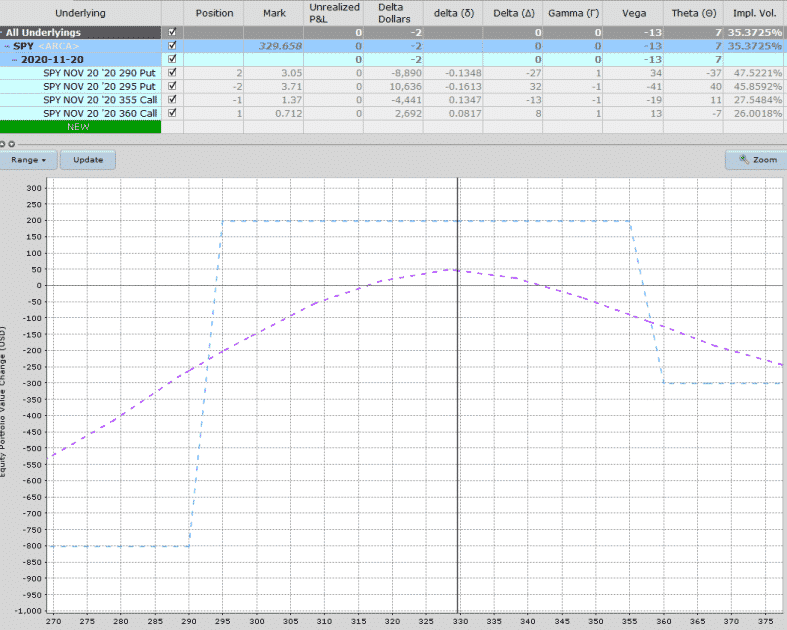

By November 5th, SPY had rallied back strongly and now the call side was getting tested.

The trade was only down $70 which was no big deal, but I looked at a couple of adjustment ideas but they were all a bit messy and I hate fighting losing trades so the best course of action was to close for a loss.

I view this as a good trade even though it lost money, because I stuck to my rules.

In hindsight, rolling the calls in cost me a winning trade, but I tend to try and stay pretty delta with my condors and if I had my time again, I would probably make a similar move.

Such is life. You can’t win every trade.

Cutting losses early proved to be the right move with SPY rallying up to 365 prior to expiration.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.