A synthetic stock strategy is created by using a combination of options.

In this article, we will look at how this is created, why one would use this, and the nuance difference between the two.

Contents

How Is This Created?

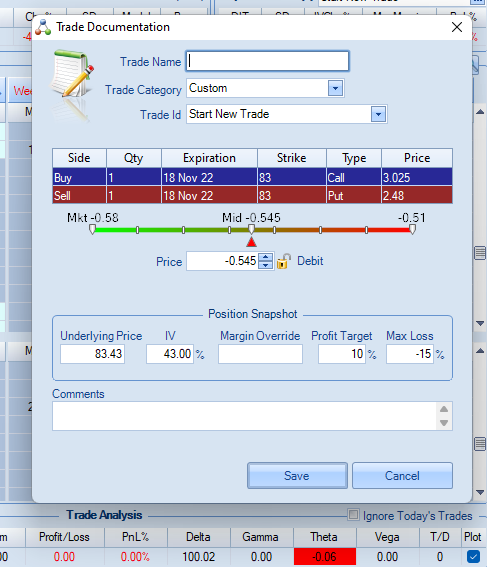

Let’s see what happens if we buy an at-the-money call option and an at-the-money put option on GOOGL, the company Alphabet (commonly referred to as Google).

On November 3rd, 2022, GOOGL closed at $83.43.

Suppose we buy the $83 call and sell the $83 put with 15 days till expiration on November 18th.

source: OptionNet Explorer

The call option is priced at $3.03 per share.

The value of the put is $2.48.

Hence we need to pay a debit of $0.55 per share for this option combination.

Since one options contract equates to 100 shares, we pay a net of $55 to buy one call option contract and sell one put option contract.

Believe it or not.

This option’s position, which costs $55 to enter, is the same as if you had owned 100 shares of GOOGL stock (which would cost $8343).

Take a look at the Greeks in the above screenshot.

It shows a Delta of 100, which means that it is equivalent to 100 shares of the underlying.

The option position’s gamma, theta, and vega are essentially zero.

Confirm for yourself in the above screenshot.

This is expected since a pure long stock position would have zero gamma, theta, and vega.

In other words, we are saying that the synthetic stock strategy has the same Greeks as the actual stock.

Payoff Diagram

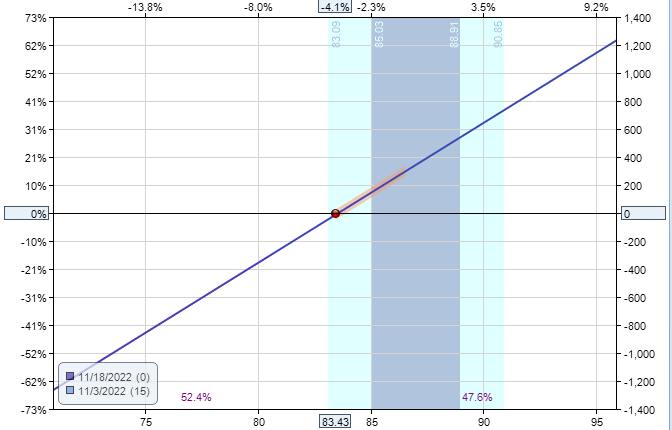

The payoff diagram of the synthetic long stock position is

It is a straight line, just like a stock position.

Its T+0 line coincides with the expiration graph.

That means that the risk graph does not change with the passage of time (as other options strategies normally would).

Comparison To Stock Investor

How would this be different for a stock investor who owns 100 shares of GOOGL at $83.43? Well, let’s see.

The stock closed at $86.58 the next day.

So the stock investor would profit $315, which is a return of 3.8% on the initial capital of $8343 invested.

How much would the options investor profit?

According to OptionNet Explorer, the call option would be worth $4.88, and the put option would be worth $1.16.

We are long the call and short the put.

So, if we were to close the position by selling the call and buying the put, we would get a credit of $372 (from $488 minus $116).

Since we paid $55 for the options initially, that leaves us with a profit of $317.

The profit is essentially the same as the stock investor — as it should be since these two are equivalent positions.

Leverage

One might think that a profit of $317 on an initial debit of $55 is quite a handsome return of 5 times one’s money. However, that would be misleading.

Unlike buying a stock, the $55 is not the maximum risk of the position.

The maximum risk of the options position is when the stock goes to zero, in which case the long call becomes worthless, and the investor is obligated to buy 100 shares of GOOGL at $83/share due to the short put.

Hence, the net debit (if that were to happen) would be $8355, which would be the max loss.

The max loss for the stock investor is about the same at $8343.

However, certain brokers and account types will assume that a stock price will not go to zero. So, they will not margin the max potential loss of the options position.

Based on OptionNet Explorer’s calculations, the maximum margin is $1928 for the options position, resulting in a P&L (profit and loss) return of 16.5%.

This is the power of leverage in the options position.

For the same stock move, you get a larger percentage return.

Therefore, the use of options is a more efficient use of capital.

While you get leveraged returns when you are right, you also get leveraged losses when you are wrong. Please keep that in mind.

FAQs

Is a synthetic stock strategy better than owning stocks?

For some investors, yes.

Due to leverage, they can capitalize on more stock moves because each position requires less capital than owning the stock.

But there are some trade-offs, as discussed below.

Do synthetic stock positions get dividends?

No, synthetic stock positions do not get dividends.

Investors need to own the actual stock at a certain date in order to receive dividends of the stock.

This is one of the drawbacks of the synthetic stock position.

What are the other drawbacks of the synthetic stock position?

The synthetic stock position consists of two options.

Options have wider bid-ask spreads than stock positions.

Therefore, the investor may lose a little trying to enter into the two options.

It is much easier to enter the stock position from a fill perspective.

It is easier to set good-to-cancel orders to exit the stock position for a stop loss or a take profit.

Getting filled on two options at the same time is more difficult.

Conclusion

Now you can see how to use options to mimic owning a stock.

It has the advantage of leverage and lower capital requirements, which gives better percentage yields if you are correct in the price direction.

While some may consider it advantageous to control 100 shares of stock with one contract of an option, there are a few drawbacks, as discussed.

We hope you enjoyed this article on the synthetic stock strategy.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.