Contents

Today, we’re discussing stop hunting and you will learn what it is and how to avoid it.

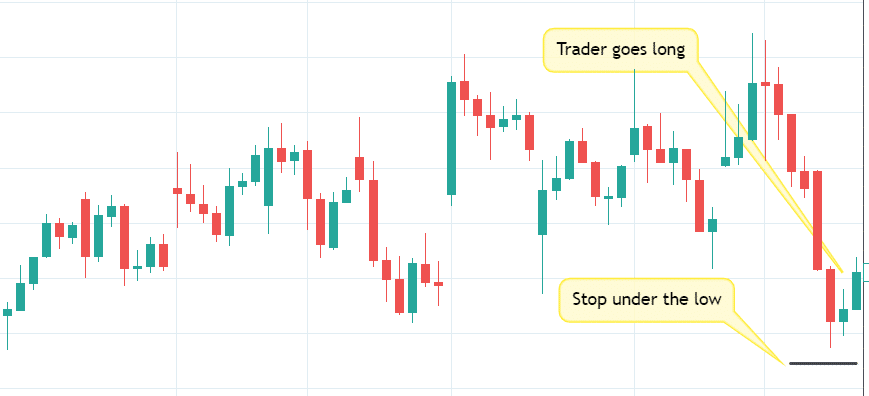

Consider this trader who decides to go long at the bottom of a range-bound stock after seeing two green candles come up from the low.

It is very reasonable to put a stop under the last swing low, which is the lowest point seen for a long time.

But guess what?

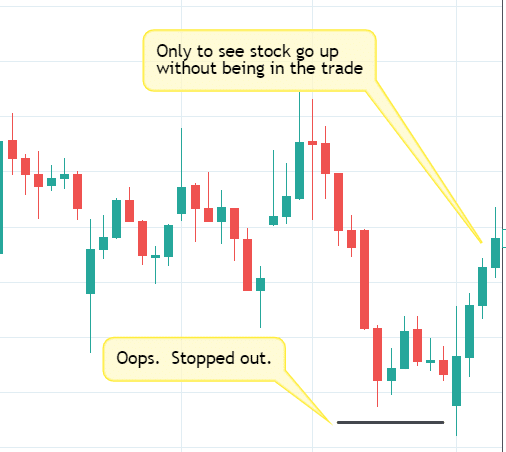

That stop was taken out a few candles later:

Anybody who has traded for any length of time would have seen this happen because this is quite a common occurrence.

It appears to happen more frequently than by chance.

Traders call this “stop hunting”.

Can the algorithms see my stops? Are they intentionally closing off our trades?

Could this be the reason why most retail traders are losing money?

Are stops being hunted?

This is a controversial question with good arguments from both sides.

This was what Peter Tuchman had to say about stop hunts:

“Ladies and gentlemen, if I teach you one thing in this interview, it is… I’ve been dealing with market makers for 137 years. I went to high school with George Washington and Alexander Hamilton.

I’ve known market makers for my whole trading career. And market makers don’t give a s*** about what the retail traders are doing. Not that you are any better than them or less than them. But they are way too busy trading billions of dollars for their customers and for their accounts to worry about a retail trader. When you are an unsuccessful trader, you must find someone to blame for losing money. And who do they blame?

They blame the market makers. I beg of you. The market makers don’t give a hoot about what you are doing, about your stop orders, or anything. … Market makers do not watch the stop orders, drag the price down, take you out on your stop, and let the thing run up. It’s absolutely insanity.”

Source: YouTube video

Peter Tuchman (also known as the “Einstein of Wall Street”) is funnier to watch in the above video. Because he does look like Einstein, and he can funnily say things.

The reporter (the “Humbled Trader”) couldn’t stop laughing.

The reporter asked Richie Naso, another New York Stock Exchange floor trader like Peter Tuchman, whether it is true that market makers can see your order flows and your stops and intentionally take you out and then swipe it back up.

Richie says:

“Correct. 100% percent. And that’s part of the thinking. Does anyone actually know whether this is the case? No. But can you see the reaction from these levels and know that it is true? Yes. And I’ll give you a real secret about this place down here. One of the most successful trades that has ever taken place in this building is when stop orders are touched off. … If the stop orders are touched off, and they have to sell down, you want to buy that every time. Or if the stop orders are on the way up, you want to sell that every time. You want to be on the other side of stop orders.”

Source: YouTube

In fact, they have proprietary charting software that makes a sound when it detects what appears to be stop orders being taken out.

Richie says that algorithms run the market.

They are both correct to some extent.

Richie is correct in that the big institutional algorithms are behaving so that they take out stops and reverse the price in the opposite direction.

Peter is also right in that they really don’t care about the solo retail traders.

It is nothing personal. After all, they are just computers.

They are not intentionally hunting your particular stop.

They are looking for liquidity.

The ah-ha moment is when you realize that liquidity coincides with where all the retail stops happen to be.

It is no big surprise.

All the retail traders are reading the same books, watching the same YouTube videos, and placing the stops in the same places.

Let’s Illustrate With An Example

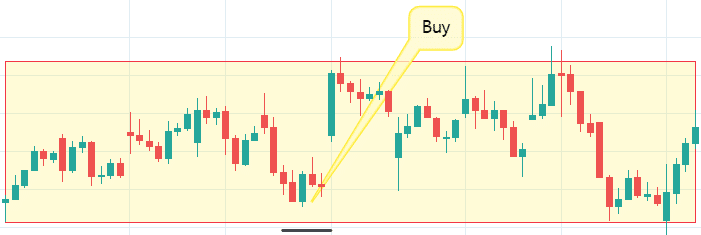

When the price is trading in a range, there are a lot of sell stops near and below the bottom of the range.

Some traders who bought the stock after a pin bar candle will put sell stops below the pin bar.

Mean-reversion traders buy when the price is near the bottom of the range, expecting the price to go up back to the middle of the range.

They also put stops below the range.

Big institutions and their machine algorithms know all this.

They are not dumb.

That’s why they are called the “smart money”.

The problem is that they have so much money that they need to allocate into stocks that they need to find sellers who can sell them stock (preferably at the lowest price possible).

Where are they going to find all these sellers?

What about all the sell stops sitting right below the range, waiting for buyers?

Perfect.

See that green candle with a wick poking out down below the trading range to trigger all the sell stops?

They just found a lot of sellers.

When the price gets near the bottom of the range, they and their algos will need to drive the price down a little more so that it gets outside the range enough to trigger all the sell orders to sell the stock they want to accumulate.

While it might be true that to drive the price down, they might need to sell some stock initially. But sacrificing those few stocks to get all that liquidity for them to buy a whole lot of stock at a low price is worth it.

Ultimately, that is what the big players are doing.

They are looking for liquidity.

Liquidity refers to the availability of a matching order on the other side of the market.

That candle with a wick poking below the range had an additional side effect.

As soon as the price goes outside and below the range, breakout and breakdown traders will start shorting the stock, expecting the price to continue down away from the range.

In other words, new sell orders are coming in.

In our example, the big players want to accumulate stock.

So they need to find sell orders.

Not only do they find these sell orders in the stops.

They find it from breakout and breakdown traders as well.

The major players want these shorts exactly.

They will buy all these until no more sellers are left, and the stock price can go up (as is the plan of the big players).

That is why Richie says to buy when you see this happen.

Buy just like what the big institutions are doing.

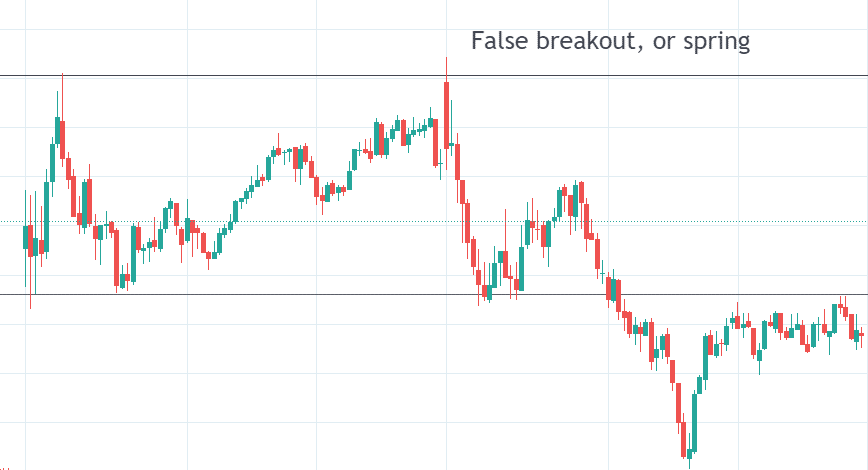

That wick that poked below the range and immediately came back up is also known as a “spring.”

It comes down only to spring back up.

It is also called a false breakdown.

False Breakout

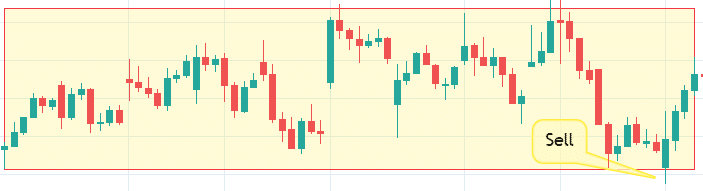

Similar arguments can be made for the other side.

See the wick poking outside the top of the range?

They are also called “springs” and “false breakouts”.

That is why many retail traders claim that there are more false breakouts than real breakouts.

That candle poked its wick above the trading range to trigger the buy stops, and then the price decreases.

And now you know why.

Conclusion

The big player, their algos, and market makers are not specifically hunting your stop.

But the act of going for the liquidity has the effect of triggering your stops.

Your stops are their liquidity. Incoming new traders provide liquidity for the big players.

This is why most new traders lose money.

Even if they are not doing it intentionally, the market is an efficient machine in doing its job.

Its job is to match buyers to sellers and sellers to buyers.

Your stops are being matched with willing buyers.

The market will naturally do this. It is its nature.

If you have sell stops, the market will find buyers to match (and trigger) your sell orders.

If you have buy stops, the market will find sellers to trigger them.

Think about it this way. You put in a stop order to sell to limit your loss.

How does the natural market know that you don’t want this order to be triggered?

Maybe the market thought you really wanted to sell, and it is doing you a favor by finding buyers for your sell order.

You should not think the market is “out to get you.”

That will do you no good in your trading psychology to become a successful trader.

You should not get angry that your stops are “hunted.”

It’s nothing personal.

Just like you should not get angry at the weather for raining on your plan, all you need to do is to bring an umbrella.

We hope you enjoyed this article on stop hunting.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.