Contents

- The Risks of Selling Short Strangles

- Delta Hedging With Shares

- Delta Hedging With Options

- Rolling the Position

- Closing Out A Position

- How Often Should You Adjust Short Strangles?

- Concluding Remarks

Today we’ll talk about short strangle adjustments, an important topic for those who trade strategies with undefined risk.

A short strangle is a trade made by selling an out-of-the-money put and call, usually of a similar delta.

This selection makes the trade, on inception, a directionless view.

The strategy of selling strangles, in the long run, is profitable as it takes advantage of the variance risk premia.

Or in other terms that implied volatility is usually overpriced against future realized volatility.

This, along with income generation, makes selling strangles a very desirable strategy through the premiums received.

Yet, selling strangles is not without significant risk.

In fact, arguably, they can be one of the riskiest options strategies if executed and managed incorrectly.

This article will break down the risk of short strangles and discuss different ways to adjust and manage them to reduce risk.

The Risks of Selling Short Strangles

Unfortunately, in the investing world, there is no such thing as a free lunch.

Being an options seller, as an insurance seller, is profitable in the long term.

Usually, you collect a premium, yet you are on the hook for when things go astray.

Selling insurance is profitable but risky.

A short strangle aims to reduce the risk of options selling through selling two equivalent distance options, thus making the position delta neutral.

This removes a significant amount of risk from the trade.

As the underlying moves in one direction, one option will gain while the other loses.

So how does this directionless, seemingly conservative income structure become so risky?

To understand why we need to look at the structure of the strangle itself.

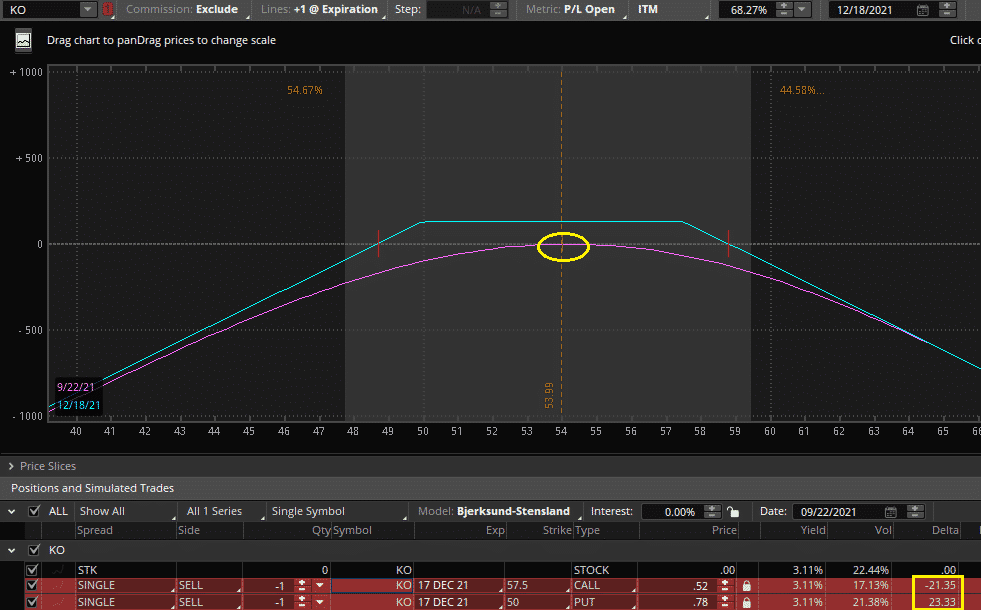

Here is an example of a short 50/57.5 strangle on Coke which we placed for a credit of $130.

At the bottom, we can see that our short call has a delta of -21 while our short put has a delta of 23, making the position virtually delta neutral.

Hence aside from our vega risk, we have relatively low other risks on inception.

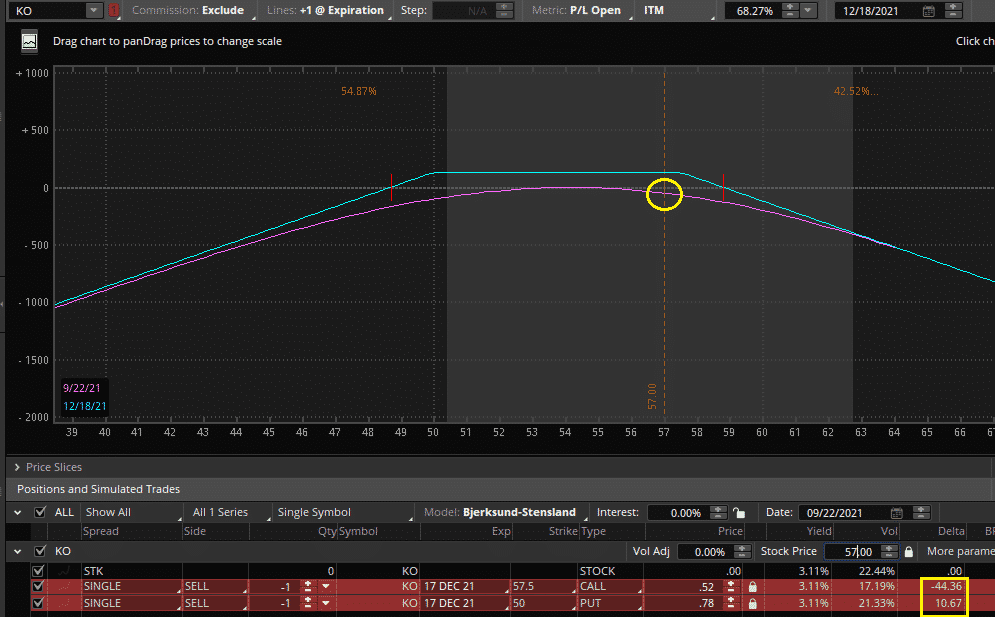

Now let’s imagine that the price of Coke moves moderately up to $57.

If Coke ends at this price at expiration, we still make a full profit.

However, look carefully at our delta values in the yellow box.

We now have a negative delta of -34.

We put on this trade with no opinion on the price of Coke.

Now we want Coke to go back down and will lose money if it continues to go up.

The risk of a short strangle comes from gamma, which is this change in the value of delta.

If Coke continues to go up from here, we will continue to take on more delta until we reach a delta of -100.

At this point, we are essentially not short volatility at all and simply short Coke stock.

We can see this gamma risk from the concavity of the purple instantaneous P&L line.

Remember, a short strangle, unhedged, has an unlimited risk potential.

There are only a few reasons we should not adjust the position, which are:

- A now negative view on the price of Coke, perhaps you feel that the price will come back.

2. You are not concerned about the new delta risk, and it is very small, almost insignificant to your portfolio.

There is a special caveat to the second point.

Many traders will not hedge a small position while still having multiple other short strangles in other stocks.

While these positions may be diversified in market turmoil in the best of times, they will likely all start to move in the same direction.

Not hedging these positions can lead to significant losses and tail risk.

Simply hoping these positions recover when market turmoil happens is not a good strategy.

Odds are these exceptions do not apply to you.

So how does one remove or reduce this delta component and take less risk on the trade?

Thankfully there are multiple ways to do it.

Delta Hedging With Shares

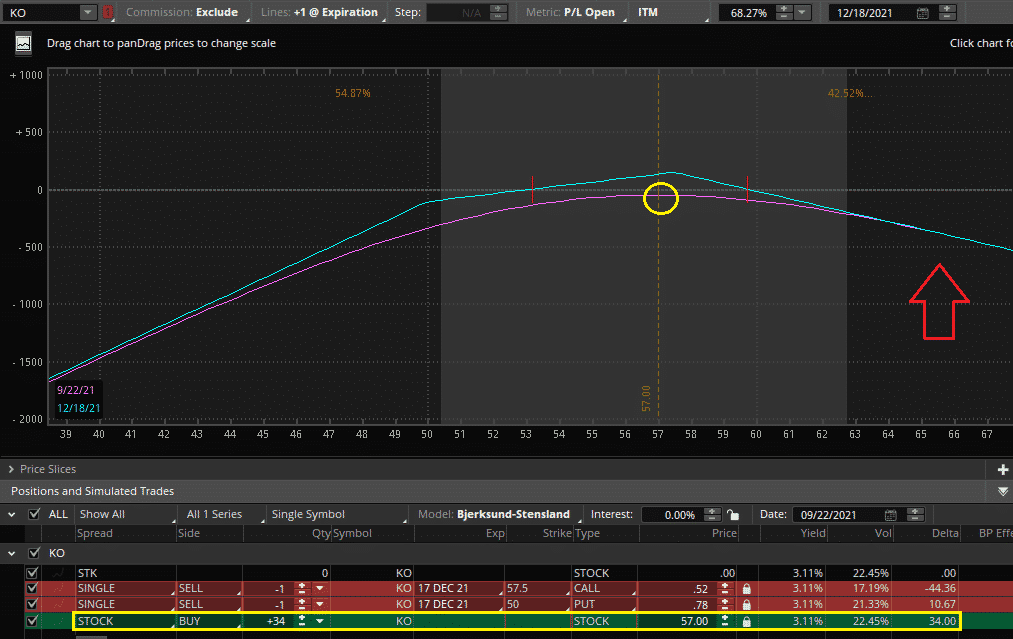

Delta hedging is the process of buying or selling shares of the underlying stock to remove or reduce the delta component on an options position.

After the move to $57, we have a -34 delta in Coke in the example above.

That means that if Coke moves up another $1, we will lose .34 cents.

At this point, as gamma will increase further, and subsequent dollar move will lose even more.

To hedge our delta, we buy the number of shares of our short delta.

In this case, we buy 34 shares of Coke, here is our new position.

We can see that our structure has altered, and we are now unconcerned about whether the stock rises or falls.

We have also decreased our loss potential to the upside.

We are back to being delta neutral and simply short volatility.

Delta hedging allows you to take the risks you want to take (short volatility) and remove the risk you do not want (directional view on Coke).

Delta hedging with shares is easy and cheap because you are hedging with more liquid shares instead of options.

There are some downsides to delta hedging with shares.

It does lock in small losses, but certainly, this is justified for the risk reduction.

Additionally, delta hedging with shares, while cheap, is not free.

Every time you buy or sell shares, there is a small transaction cost.

This reduces the positive expectancy of a trade.

If you want to maintain a position perfectly delta-neutral, you will be hedging a lot; hence these small transaction costs can add up.

This can get to the point where a profitable short strangle strategy can become unprofitable.

Therefore while constantly delta hedging is feasible for a market maker, it is not for a retail trader.

A solution is to set a bound of delta you are willing to take on the position before hedging.

This is known as a hysteria band.

A theoretical example of using a hysteria band for the example above:

“I am short a strangle in Coke. I want to be directionally neutral but do not want to spend too much money hedging. I am comfortable with up to 30 deltas, Long or Short in Coke. Thus, I will delta hedge when I have greater than 30 deltas in either direction.”

Delta Hedging With Options

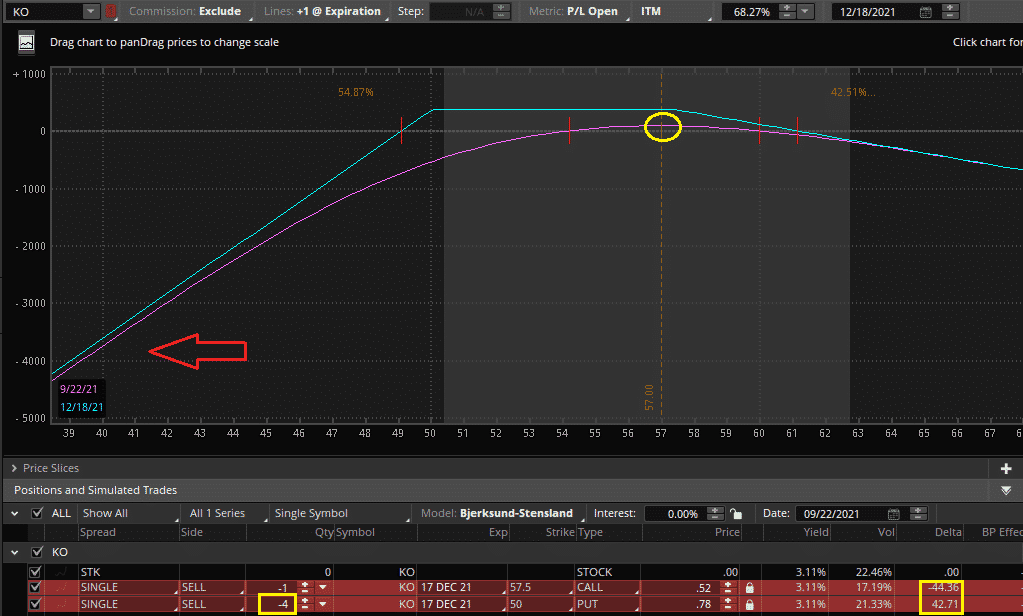

We can also remove delta risk by buying or selling an option that will give us the delta we need to return to being delta neutral.

Returning to the Coke example, we can buy or sell options that will give us 34 deltas.

Here I have sold three more 50 puts to get back to delta-neutral.

Does anyone see a problem with this?

We can see that despite our delta being equal, we have way more risk to the downside than before.

By selling these options, we have added a lot more short volatility.

If we are now more confident in the trade taking action like this makes sense.

Though continually adding options, positions can get dangerous, or at the least, very messy.

Tip*** If you are a retail trader and have 30 different options in one stock due to hedging, you need to simplify your trading.

What about buying an option?

This is a fair choice but remember that we sold the options because we thought they were overpriced.

Now, do we think they are fairly priced?

Buying options or making a trade into an iron condor could be a reasonable decision risk-wise, though closing out the trade should also be considered if we are at this point.

Rolling the Position

Rolling the position is done by closing out the current position then reestablishing a new position that is delta-neutral.

This trade can be done in the same expiry or rolled over to the next expiry.

Rolling a position helps because we can reset our position.

We also have less gamma risk (the risk of our delta changing) as we go out further in time by rolling a position out.

This can be crucial as options approach expiry continually adds more and more gamma.

The result can be dramatic P&L swings if the options are at the money going into expiration.

Rolling the position reduces this variance and avoids any assignment risk.

Furthermore, rolling out the position to a further expiry will usually also involve collecting a higher premium.

There are, of course, a few downsides.

The higher premium results from adding more time to our short positions, thus giving the stock more time to move outside of our new strikes.

Also, rolling does sometimes involve significant transaction costs.

Closing a strangle and opening a new one consists of 4 options trades.

While this is not a bad thing to do periodically as options approach expiration doing it constantly to delta-hedge is not a smart choice.

Closing Out A Position

If you can’t find a way to adjust the strangle to your liking, or if you feel differently about the position than you originally created, it’s vital to remember that you may always close the position.

While this will most likely happen when the underlying has moved, and the position is at a loss, accepting you were wrong or simply unlucky and moving on is a crucial asset as a trader.

Take pride that you have been able to take some small losses, and loss aversion has not gotten the best of you.

While selling options and strangles have a positive expected value, sizing too large and then avoiding action when turmoil happens is the quickest way to turn a very profitable strategy to visits at the soup kitchen.

Feeling a little bit stressed on positions happens, but if the risk gets to the point you do not want to tolerate, take pre-emptive action by either adjusting to reduce risk or closing the position and moving on.

How Often Should You Adjust Short Strangles?

Generally speaking, adjusting a short strangle based on a delta threshold is recommended.

This may result in hedging multiple times a day or not hedging for a few weeks, depending on the movement of the stock.

Investors who do not wish to examine their portfolios frequently can trade smaller positions with lower risk or trade options for a longer duration until expiration.

These options will have less gamma resulting in smaller changes in a strangles delta.

Alternatively, these investors can choose another short volatility structure with defined risk, such as an Iron Condor.

Defined risk structures reduce the need for adjustments so long as the maximum loss on the position is acceptable for the investor.

Concluding Remarks

Short strangles are great options structures to take a neutral view on price while collecting a premium for doing so.

While selling strangles is a profitable strategy, by not adjusting positions, an investor can end up taking multiples of risk and directional views they do not want to have.

There are many ways to adjust short strangles to help reduce this risk.

These include delta hedging with shares, delta hedging with options, and rolling positions.

All of these actions serve to reduce unwanted delta exposure and decrease directional risk.

By periodically adjusting a position, risk can be reduced dramatically.

This can allow traders to benefit from selling options without experiencing massive tail risk and losses, putting them out of business.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Nice article. A not often talked about topic. Seemingly very complex but for those who understand the delta and gamma greeks, it is as easy as addition and subtraction.

I delta hedged for my single short put position in FB.

At inception, delta was just 10. After the massive recent drop in price following earnings, it shot up to 100!

I rolled the put out twice (way out) & then down later (when share price rose a bit) and picked up some credits along the way. Delta dropped to a more reasonable 50. I am still LT bullish on FB and would probably maintain a positive delta bias of 30.

I would probably short 20 shares to achieve that. The interesting thing is there is no need to put up additional collateral for the short position. I am not sure whether that’s the case because of my short put position or maybe its just my broker who operates that way. I can of course convert it to a strangle by selling calls but it would now mean I have unlimited upside risk. Also my broker does not support multiple legs and selling a call would require additional collateral. Thus my preferred way to acquire short delta is still by shorting the underlying.

I am not sure how everything would eventually pan out. Hoping for the best. But like I always tell people, unlike the stock world, in the options world, you can point your weapon in the wrong direction but if the enemy happens to creep up from that direction, you can still score a kill. cheerio!

That’s a good plan. Keep us posted on how the trade works out.

Hi Raymond, thanks for sharing. The massive drop in facebook is a surprise. What would happen to the short stock should facebook go up in price? would the short put expire worthless but the short stock would have some losses? thanks