The short put butterfly is not your typical butterfly strategy.

If you are trying to learn butterflies for the first time, learn the more commonly used long put butterfly first.

When people simply say “butterfly,” they are referring to the long butterfly.

But for today, we will look at the short put butterfly and why one might use it.

Contents

- Introduction

- How Is The Short Put Butterfly Constructed?

- How Is Short Put Butterfly Max Loss Calculated?

- How Is The Short Put Butterfly Different From The Inverse Iron Butterfly?

- How Is The Short Put Butterfly Different From Buying A Straddle?

- How Do The Greeks Of The Short Put Butterfly Behave?

- How Does The Short Butterfly Compare With The Ratio Backspread?

- What Other Possible Use Is There For The Short Put Butterfly?

- Conclusion

Introduction

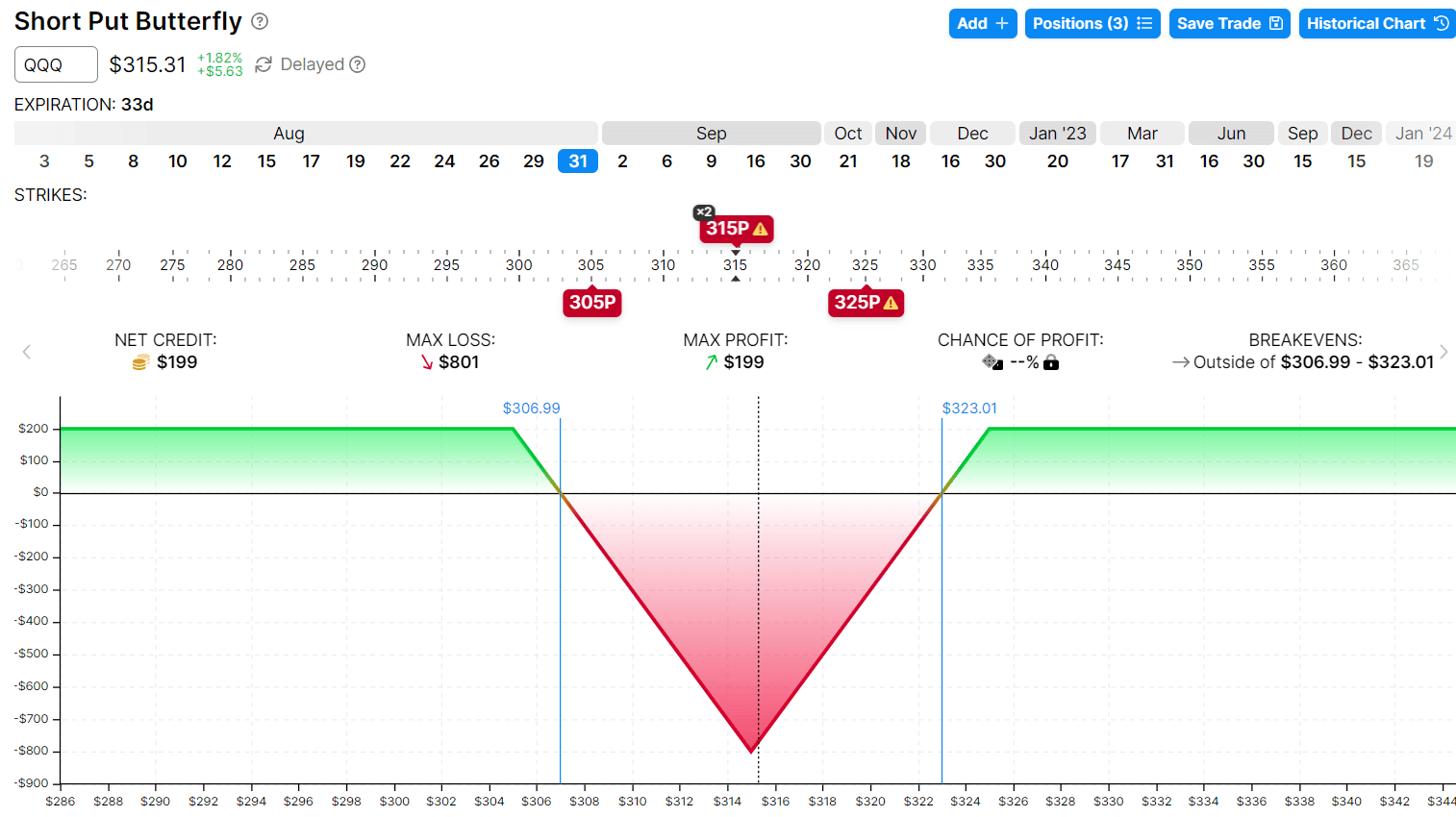

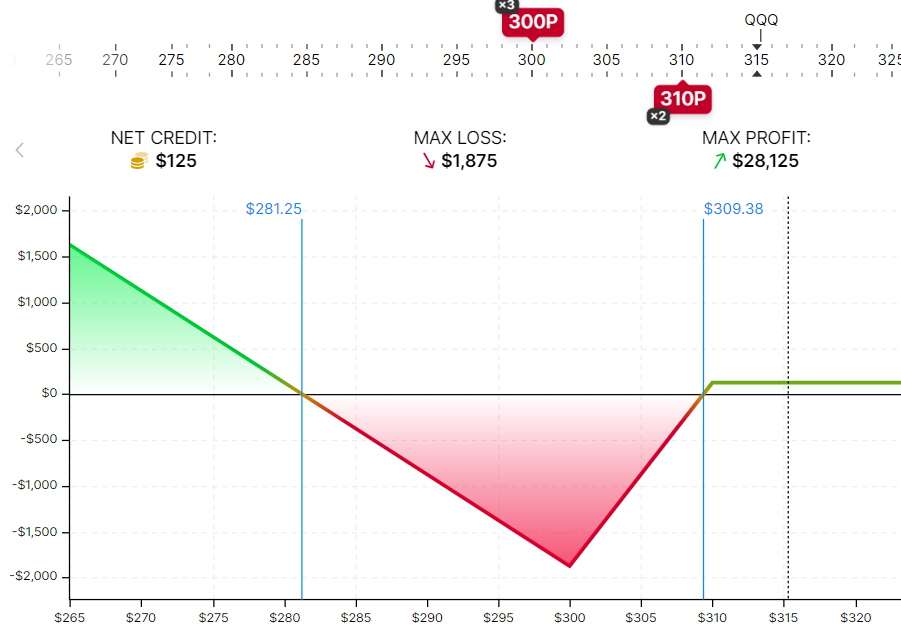

The first thing we want to see is the payoff graph.

Selecting “Short Put Butterfly” from OptionStrat’s build menu, we get the following…

source: OptionStrat.com

This is the graph of a short put butterfly on QQQ (Nasdaq ETF) with expiration one month out.

It might be something that an investor might want to do if they think that the QQQ is going to make a big move during, say, earnings season.

However, they don’t know which direction it will move, so they trade it in both directions.

QQQ is currently trading at $315, and we want the price to move above $323 or below $307 into the profitable green zone at expiration.

If QQQ doesn’t move and stays at or ends up back at $315 on expiration day, August 31, then we can lose up to $801, which is the max loss for this trade.

This is the “sea of death” marked by the red area in the graph.

This only will happen if we hold the trade all the way to expiration.

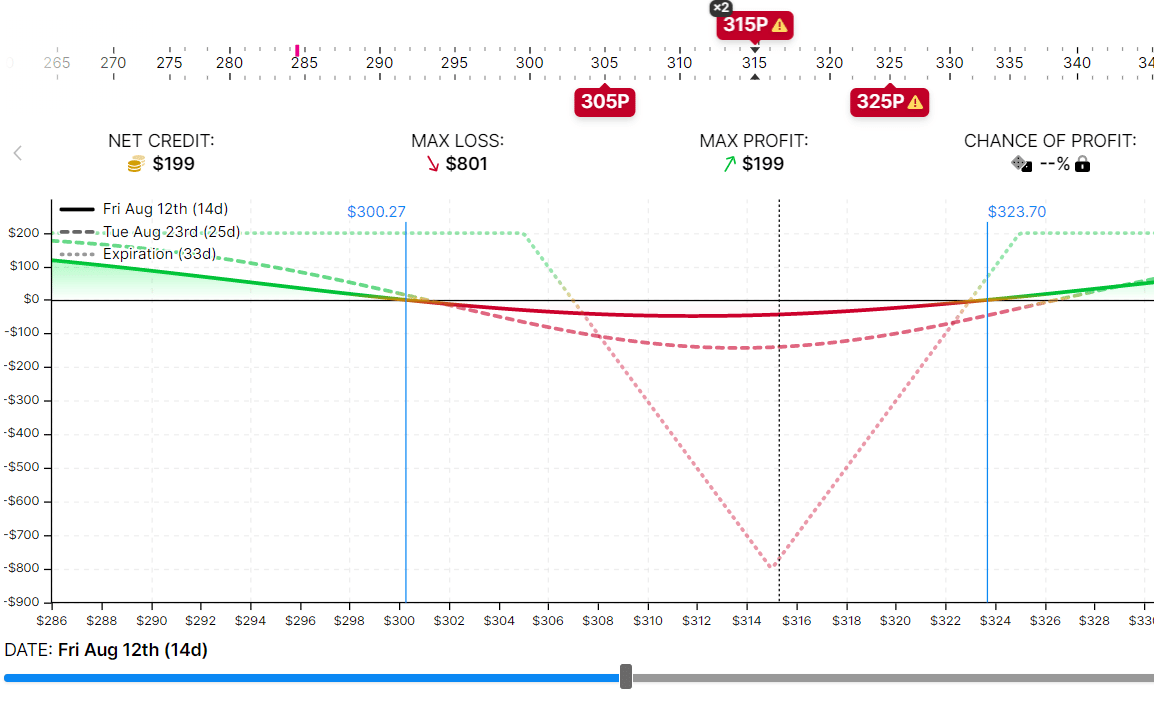

If we exit the trade after two weeks, the payoff graph will look like the following: the max loss at $50.

source: OptionStrat.com

This also means the profit would be less as well.

How Is The Short Put Butterfly Constructed?

This short put butterfly is constructed by buying two at-the-money (ATM) puts.

To help finance the cost of these puts, the investor sells two other puts — one further in the money and one further out of the money.

Date: July 29, 2022

Sell one Aug 31 QQQ 305 put @ $5.59

Buy two Aug 31 QQQ 315 put @ $9.07

Sell one Aug 31 QQQ 325 put @ $14.54

Net Credit: $199

You get a credit for selling a butterfly. Hence the name “short butterfly.”

When you short, you sell. When you sell, you receive money.

The short put butterfly can be thought of as being constructed by a put credit spread joined by a put debit spread.

The put credit spread is the short 325 put with the long 315 put.

The put debit spread is the long 315 put with the short 305 put.

A put credit spread is bullish and would benefit if the price goes up.

A put debit spread is bearish and would benefit if the price goes down.

It is a tug-of-war, and if neither gives and the price does not move, they both lose — dying in the sea of death.

The trade becomes profitable if the price makes a large move in one direction or the other.

How Is Short Put Butterfly Max Loss Calculated?

The max loss is calculated by assuming what would happen if QQQ stays at $315 at expiration.

In this case, the put credit spread will be at its max loss having to pay out $1000 at expiration (because the width of the spread is 10).

Short the $325 means we buy at $325. Long the $315 means sell at $315.

We are buying at $10 more than we are selling at.

That’s a loss of $10 per share or a loss of $1000 for the 100 shares in the one contract.

The put debit spread will also be at a max loss.

But its loss is already accounted for in the initial debit.

So, we don’t pay anything out at expiration.

Considering that we received $199 at the start, the max loss would be:

$1000 – $199 = $801

How Is The Short Put Butterfly Different From The Inverse Iron Butterfly?

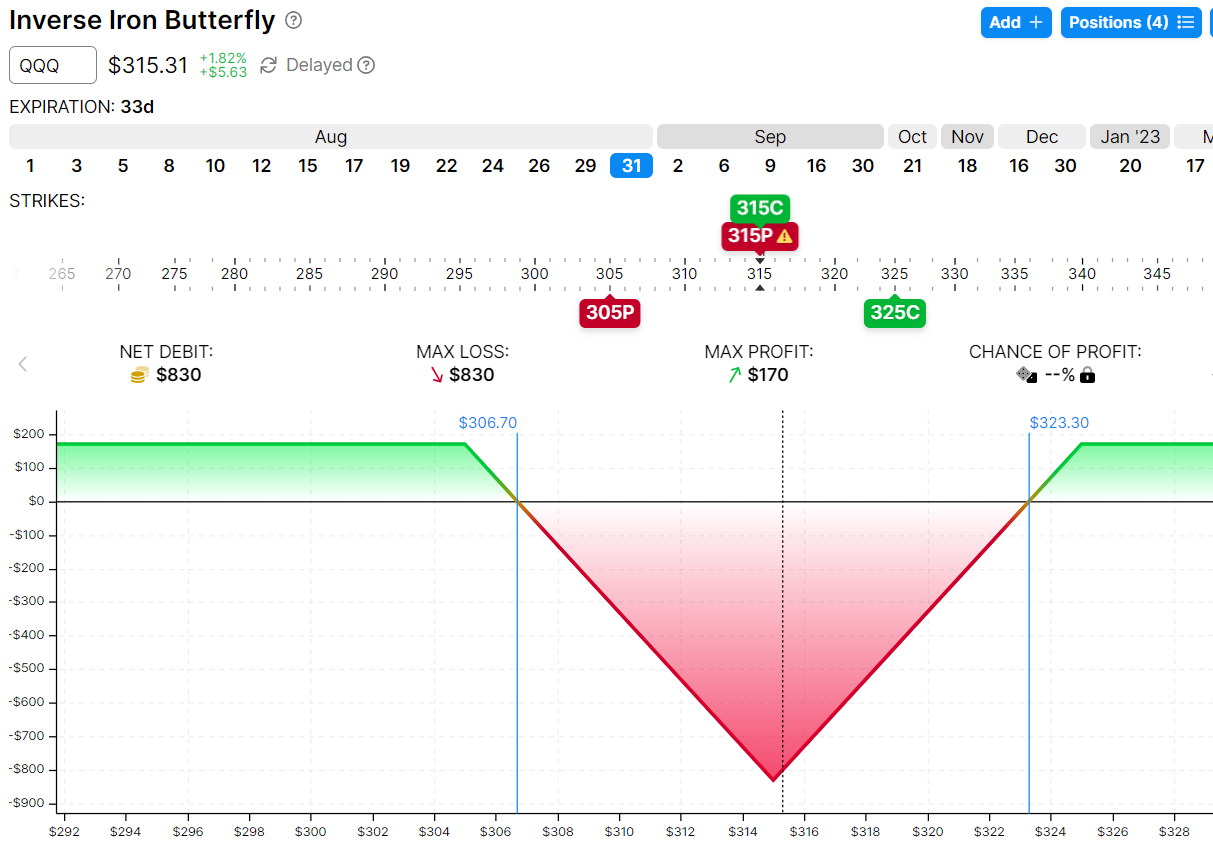

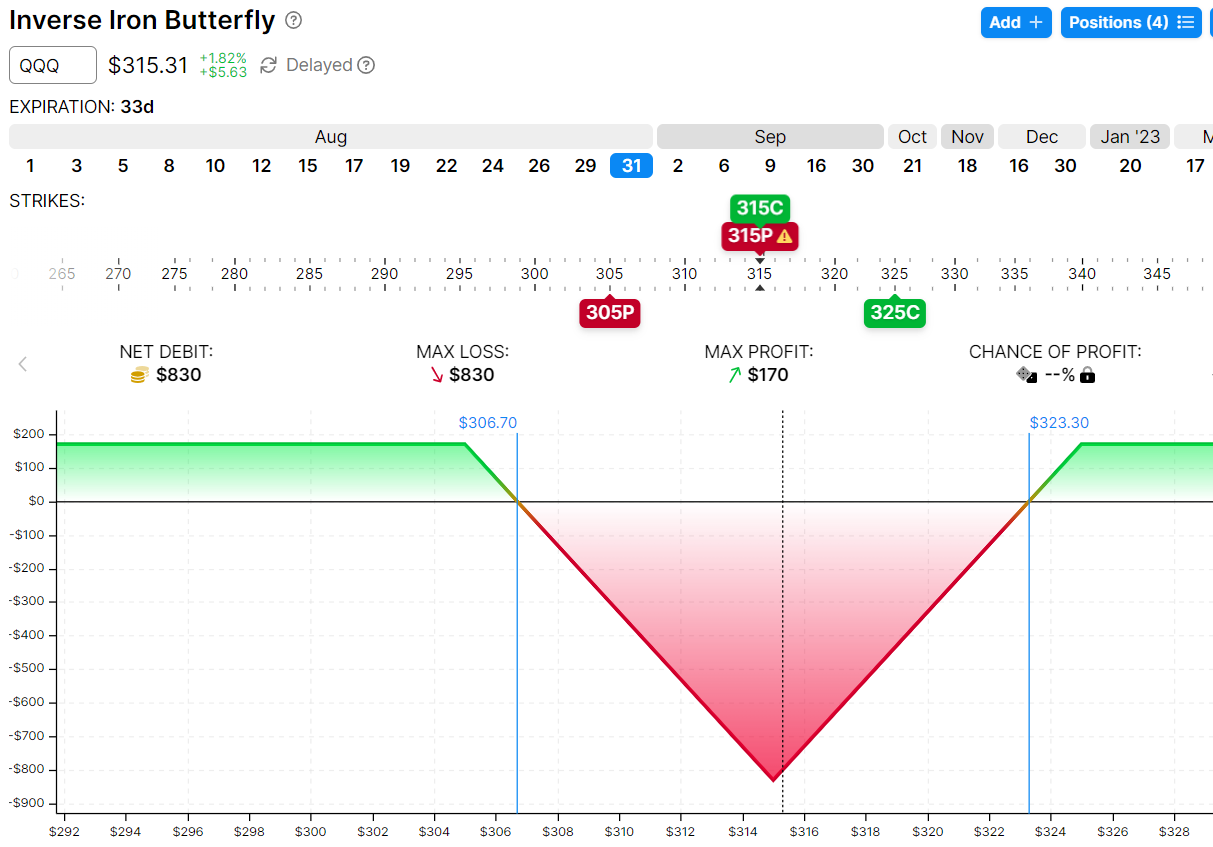

The inverse iron butterfly has the same put debit spread as the short put butterfly.

But instead of the put credit spread, the inverse iron butterfly has a bull call debit spread.

As can be seen from the payoff graph of the inverse iron butterfly, the max loss and max profit are (nearly) the same as those in the short put butterfly.

source: OptionStrat.com

We consider the two positions to be equivalent.

The Greeks and expiration breakeven points are the same.

They both have one bullish spread and one bearish spread.

How Is The Short Put Butterfly Different From Buying A Straddle?

For comparison, here is a QQQ long straddle which consists of buying the 315 at-the-money call option and buying the 315 put option:

Some investors may find the max loss of this straddle of $1900 to be too large, and the expiration breakevens at $296 and $334 to be too far apart.

Hence, they may buy a call debit spread and buy a put debit spread instead.

This reduces the max loss to $830 and makes the expiration breakeven closer to the current price so that price does not have to move as much to be profitable.

The result is the inverse iron butterfly, which is equivalent to the short put butterfly.

So, to answer the question, a short put butterfly is a more conservative version of a long straddle.

It caps the max profit.

And by doing so, it increases the probability of profit.

The foundational concept of the short put butterfly and the long straddle is the same.

They both have half their options position bullish and half their options position bearish.

The two halves are equal in strength, so the trade does not assume a particular direction in the price movement.

They both just need the price to make a big move in either direction.

The move needs to be larger for the straddle to be profitable.

The move does not need to be as large for the short put butterfly to be profitable.

How Do The Greeks Of The Short Put Butterfly Behave?

The short put butterfly has similar Greeks to the long straddle.

It is delta-neutral to start. It has negative theta, which means time decay is not on our side.

With each passing day, it loses money, and the price does not move.

It is positive vega, which means that it benefits if volatility increases.

Selling butterflies are good when you think volatility is going to increase.

How Does The Short Butterfly Compare With The Ratio Backspread?

The ratio backspread is also good when you think volatility will increase and that price will make a big move.

The only difference is that the ratio backspread is biased in one direction.

For comparison, here is the graph of the put ratio backspread on QQQ:

It is very similar to that of the short put butterfly, except that it is biased in the bearish direction where it has unlimited gains.

On the upside, it gains less.

What Other Possible Use Is There For The Short Put Butterfly?

There is one other obscure use case.

Suppose an investor had just placed a regular at-the-money long call butterfly on the QQQ:

And suppose, within the same day, the trade is going against the investor who now wants to exit the trade.

To exit the trade the same day would be considered a “day trade.”

For accounts of less than $25,000, there is a limited number of day trades available — known as the pattern day trade rule.

So instead of exiting, the trader can neutralize the trade by initiating a short put butterfly.

The short put butterfly is the exact reverse of the long call butterfly.

But be careful. By doing so, you have created two box spreads, which is not allowed by certain brokerages.

Also, box spreads can be broken and expose investors to risk if one of the legs is exercised early.

This hack can be used to temporarily neutralize the trade until the following day when both butterflies can be taken off without it being considered a day trade.

For most investors, this is not going to be applicable.

This is just an example to show that a short put butterfly is the exact reverse of a long call butterfly.

Conclusion

You get a credit for selling a short put butterfly.

However, the potential loss is greater than the potential gain.

Time decay is working against you.

And price needs to make a large move to be profitable.

Long butterflies are butterflies that you buy by paying a debit to initiate.

Their potential gain is larger than their potential loss.

Hence a better reward-to-risk ratio.

They make money if the price does not move much because they benefit from time decay.

For this reason, the long butterfly is far more commonly used and is referred to when an investor simply says “butterfly.”

We hope you enjoyed this article on the short put butterfly.

If you have any questions, please leave a comment or send an email.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.