Contents

The PCE is the Personal Consumption Expenditures index released by the Bureau of Economic Analysis (BEA), typically monthly.

It measures inflation in the United States and is closely watched by investors, traders, and policymakers as it reflects changes in consumer spending patterns and price levels.

The report itself can be found on the BEA government website.

For example, the PCE report was released at 8:30 a.m. EDT on Friday, April 26, 2024 (just one hour before the market opened).

While the report comes out in April, the numbers are personal income and outlays for March 2024. Compiling all these numbers takes time.

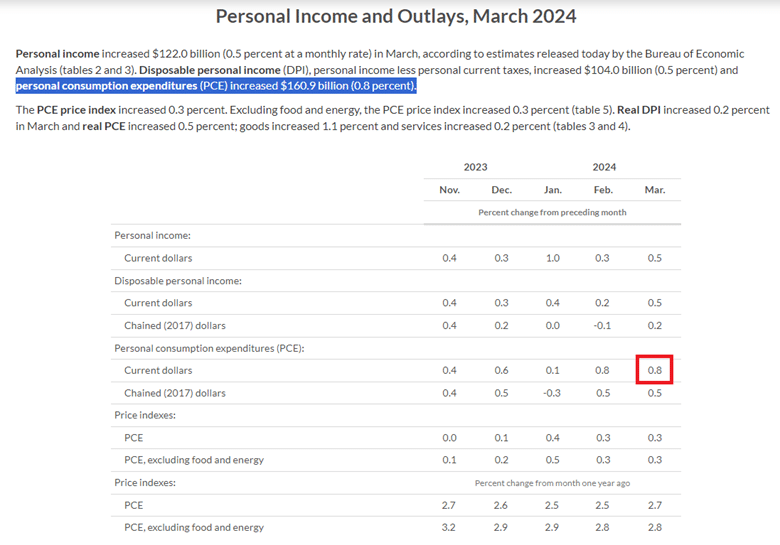

Here is an excerpt of the report:

The report says that personal consumption expenditures increased by $160.9 billion from the month before.

Assuming that people buy the same things from month to month on average, an increase in expenditures means the same things cost more than before.

This is what is known as inflation.

Hence, these numbers measure the rate of inflation.

Current Dollars Versus Chained Dollars

This 0.8% increase is the “current dollars” number highlighted in the above table.

The number is also reported as “chained dollars.”

These are just two different ways that economic analysts like to calculate numbers.

Current dollars refer to the nominal value, whereas chained dollars adjust for changes in price levels (inflation) over time, allowing for a more accurate comparison of economic values across different periods.

The PCE Index

Consumer expenditures are also reported as a PCE index.

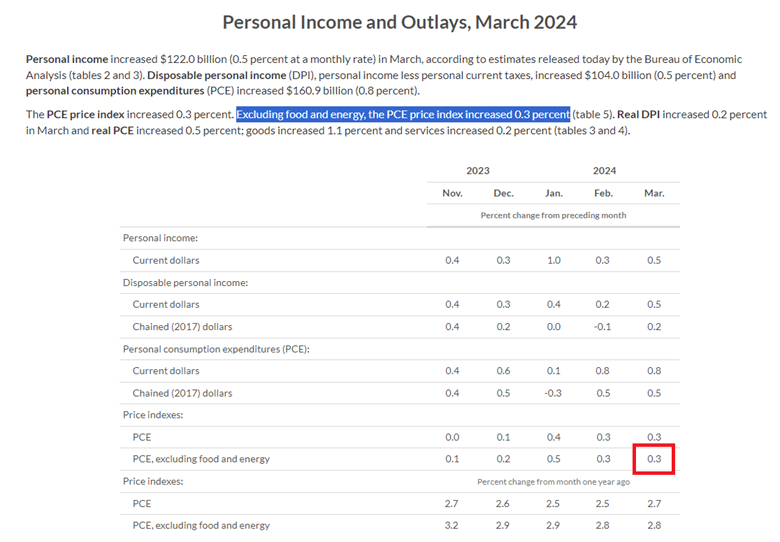

This is the number that is most often reported in the media:

It excludes food and energy expenditures.

This is the “Core PCE Index,” and the box is highlighted in the above table.

The line above it (sometimes called “headline PCE”) includes all items in the index, including volatile components like food and energy prices, which fluctuate significantly.

The core PCE excludes these volatile components to provide a more stable measure of underlying inflation trends.

It excludes food and energy prices, which can be affected by many other factors not related to inflation (such as seasonal and geo-political factors).

The PCE index is often reported relative to a base year, which is assigned the value of 100. Price changes are then reflected as a percentage of this base year’s value.

For example, if the index is 110, it means prices have increased by 10% since the base year.

We are less concerned with the value of the index itself and more concerned with the percent change of this index.

This report says the Core PCE price index increased by 0.3 percent from the previous month.

How Does The PCE Affect The Markets?

Financial markets closely monitor PCE index releases for insights into potential monetary policy actions by the Federal Reserve.

Higher-than-expected inflation readings may lead to speculation of tighter monetary policy, such as interest rate hikes, which can impact asset prices and market sentiment.

Analysts also assess whether actual inflation is consistent with the inflation target the Federal Reserve aims to achieve over the medium term.

Does The PCE Affect The Price Of The S&P 500?

Sometimes it does, and sometimes it doesn’t.

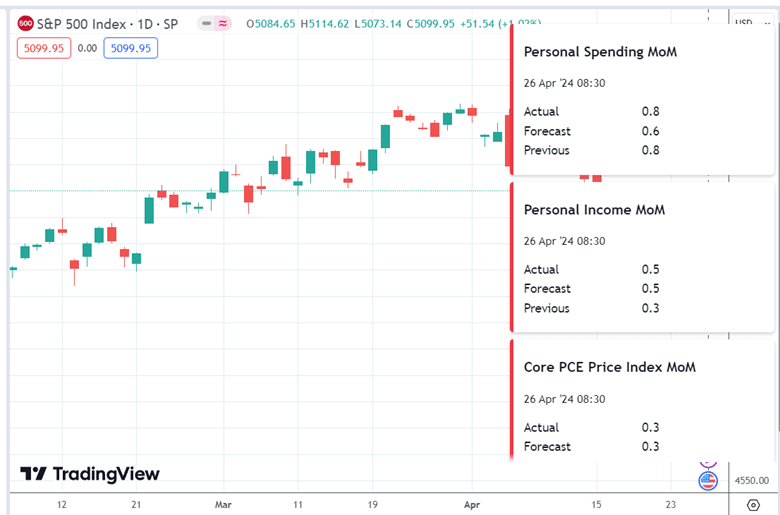

This report is significant enough that it is included in the economic calendar news event on some charting software.

Below is an example from TradingView:

In this case, the March PCE index came out as forecasted.

The ” Actual ” and “Forecasted” numbers showed a 0.3% increase.

So, did this move the markets?

The Friday on which the report came out, the SPX did gap up and continued to close higher that day…

It is difficult to say whether that was due to the PCE report, other news, or just normal market movement.

Final Thoughts

Many traders who routinely monitor the economic calendar are aware of the potential that the PCE report can trigger a large move in the S&P 500 in one direction or the other.

Whether it will or not is unknown.

The key word here is “potential”.

We hope you enjoyed this article on the PCE report.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.