Contents

ORATS (Options Research and Technology Services) is a trading, backtesting, and research platform for stock and options that has been around since 2001.

The platform is entirely web-based, which is a huge perk, and has a lot of tools and features that both experienced and novice traders will find useful.

The main features of this software are their proprietary backtesters, scanners, formulas, and indicators.

As with all tools, though, there are tradeoffs.

Let’s dive into the ORATS platform and see if it’s worth the hype and the cost.

Tools of the Trade

When you first log into ORATS, you are met with the dashboard.

One of the nicer features of this dashboard compared to other products is that the first thing you see is the “Getting Started” guide.

This will walk you through getting started and setting up scans, backtests, your broker (if supported), and several other items to familiarize you with the platform.

This has no bearing on actual functionality but is a nice touch for a new user.

Moving on to the actual tools of the platform, they are broken out into several categories: Trade, Analyzer, Research, and Resources.

Below, we will review each section and some of the tools and settings they contain.

Trade

First up is the Trade section, and as the name suggests, this is where you can monitor your actual trades, look for trade ideas, and see some market stats about individual tickers and sectors.

The Positions monitor is a standard one you see on many other platforms.

The other two tools, trade ideas, and market intelligence, are very interesting.

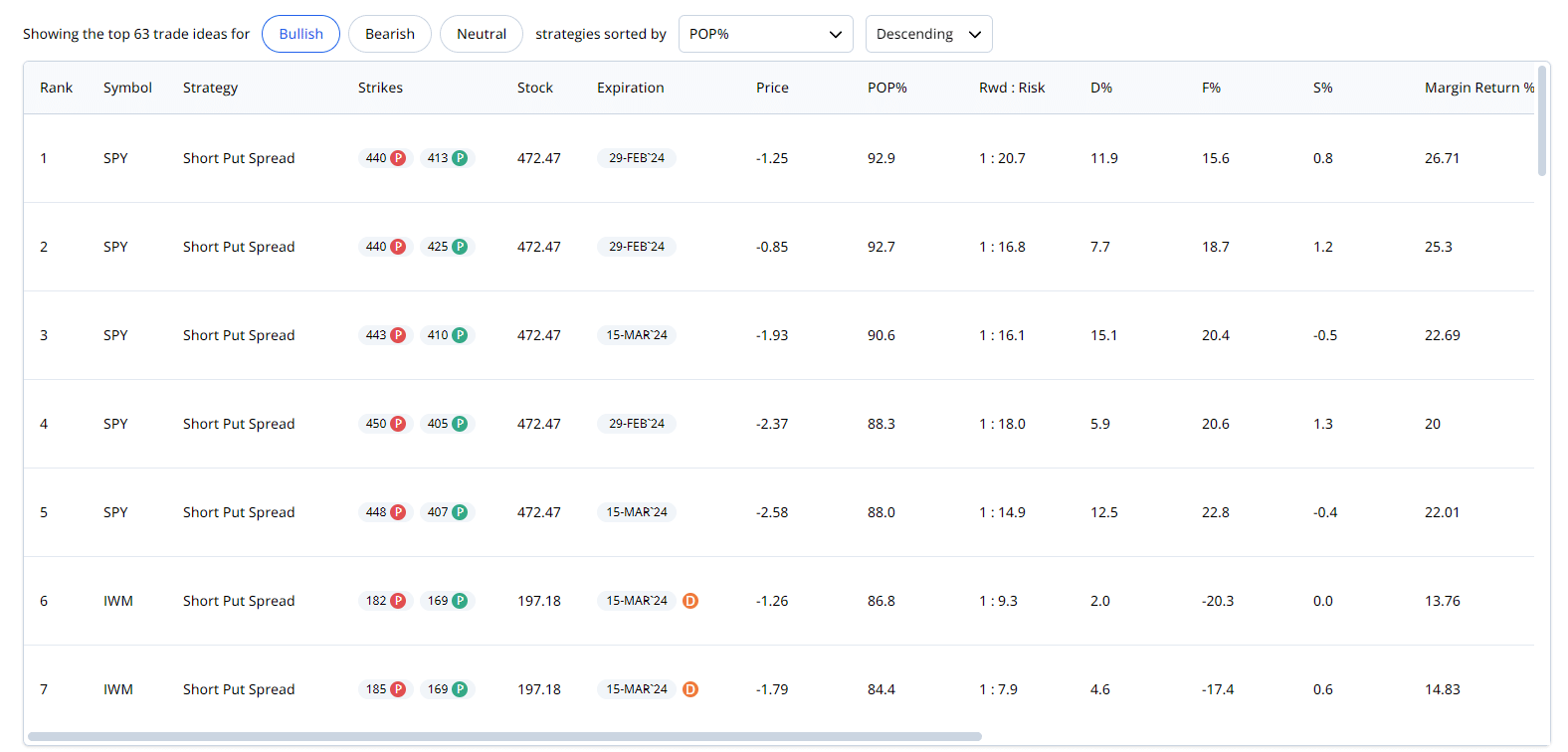

The Trade Ideas (pictured to the left) show Bullish, Bearish, or Neutral spread trades that can be sorted using various methods such as Probability of Profit, Sharpe Ratio, and Risk Reward ratio.

This could be one of the more useful tools on the platform.

Finally, the Market Intelligence tool provides information such as the largest trades, top movers, unusual volume, and other key intraday metrics.

Like the Positions tool, this is pretty standard across scanning and market tools, but the visualizations here are very clean and easy to read.

Analyzer (Ticker Analyzer)

The second set of tools falls under the Analyzer tab.

These tools are all linked together and meant for some deeper research into individual tickers.

There are six total tools here, all linked by ticker: Outlook, Earnings and News, Trade Builder, Options Chain, Trade History, and Time and Sales.

Below is a quick rundown on each one:

Outlook – This is a general overview of the ticker and includes metrics like IV Term Structure, Stock price, Slope, Skew, and Similar Tickers. One of the outlook tab’s cooler aspects is ORATS predictive analytics, which gives an outlook on the stock over the next few trading days based on their own formulas. You can select the number of days you want Outlook for as well.

Earnings and News – This is pretty self-explanatory. This is where anything important related to the ticker will be displayed.

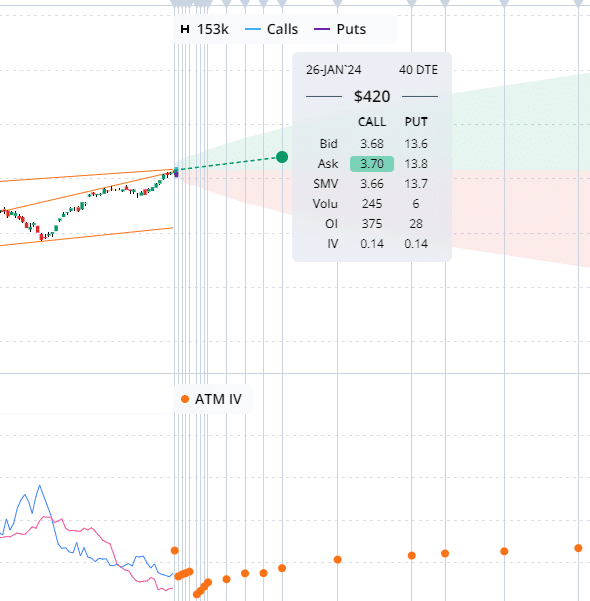

Trade Builder – This is like a price chart with a hidden secret; in addition to showing you the price and any indicators you decide to add, you can also see insider transactions, open interest, IV, and IV range for future price movement. What sets this chart apart is your ability to select a trade from the chart. You click and drag from the current candle to a future expiration and buy or sell an option right from here. (See the screenshot to the right)

Options Chain – This section visualizes the Volume, Open Interest, and IV for each available date. The visualizations make viewing relevant information about each date and chain much easier, but the actual information is also available to most brokers.

Trade History – This lets you visualize how an option’s price has traded over time. This could be incredibly helpful if you need to visualize or backtest a strategy on options prices for specific tickers.

Time and Sales – This scans for the largest options trades on the day for the ticker you have selected. It has the strike, expirations, number of contracts, type of strategy, and more. This is one of the more useful tools on the site because it gives the end user a real window into how the options are trading under the hood.

Research

The Research section is where ORATS differentiates itself from some of the other platforms.

There are four sections: Backtester, Options Scanner, Stock Scanner, and Signal Builder.

The Stock and Options scanners are pretty standard scanners.

The options scanner allows you to add specific symbols, strategies, and other criteria to find spreads and options that meet your needs.

The Stock scanner is very similar but obviously scans for the stocks instead of the options contracts.

Both are very well built, but as stated above, they are pretty standard for most trading software.

The Signal Builder allows you to create and backtest custom strategies on indicators using ORATS’ vast library of custom indicators.

Just a note on the Signal builder: there is a bit of a learning curve to it, but once you get it, you will see how powerful it can be.

The last tool, the Backtester, is reviewed in more detail below.

Backtester

The Backtester is one of the most powerful tools on the platform.

Anyone who has tried to backtest options knows how difficult it can be to build a strategy and find good data.

This allows you to select a stock, a strategy, and some options metrics, and it will show you backtests that you can look at to see how they do over time.

You then can view the metrics, the results, and how the returns track compared to the underlying stock.

You can also download the results if you want to run your own analysis on it.

The image below shows how a Put Spread Backtest on Microsoft went.

This tool will allow traders to level up their strategies as they can view how they would do against some of the largest stocks in the market.

The one downside to this tool is its limited scope to the strategies and tickers that ORATS provides.

Even with that, though, almost all of the major options strategies are covered, and most of the highest volume tickers are present, so unless it’s a very niche strategy, you should not have an issue finding it on ORATS.

Resources and Customizations

This final section will focus on the Resources section of the platform and all of the custom tools it provides therein.

The Resources section includes API access, Indicator explanations, and Blog access. While all the other sections and tools have a lot of functionality, this is the section you should spend the most time in when you get started.

First, their documentation is fantastic if you have API access or use the API for custom tools.

The API console will give you samples and documentation for each endpoint they offer.

The Indicators section is where you should spend the bulk of your initial few days; it has detailed explanations of all ORATS custom indicators and is a goldmine of information.

This section shows what makes ORATS unique in the options space.

Take the below, for example, that is their contango indicator.

By clicking on it, you will get an instant overview of what it is, how it works, related indicators, an example of a stock, and a sample scan that shows it in action.

This is also an example; they have over 800 indicators to explore and learn to use in your options trading.

The blog is the ORATS version of the documentation. It is easily set up with categories, so if you have questions about the platform, this would be a great place to start.

Not linked to their blog, but also worth mentioning here is YouTube.

Their YouTube channel has many videos and interviews to help you learn and utilize the platform.

Pricing and Connections

So, now that you have seen all of the tools this platform provides, let’s look at brokerage connections and pricing.

Currently, ORATS can only connect to Tradier Brokerage for live data or their own paper trading account for the delayed data.

However, they plan to add access to TD Ameritrade, TradeStation, and Interactive Brokers in the future.

Once connected, you can use all the abovementioned tools and find trades in real time.

Finally, the price: something that everyone wants to know.

There are two price points currently: for Individual Traders, it is $99/month, and for Professional Traders, it is $299/Month.

Professional and individual accounts can try ORATS for 14 days for $29, which is a steal for the ability to see everything they offer.

The Verdict

So what’s the final verdict? Is ORATS worth the monthly membership fee?

The short answer is Yes, but it has a pretty big caveat.

They have built a very solid platform with more features than we could cover in a review like this, but it is geared towards options trades that make data-based decisions.

While the Backtester alone is worth the price, if you aren’t looking to see what the IV skew on expiration is or find an edge hidden in other options data, you may not find it useful.

Overall, the ORATS platform is one of a kind and would be an incredible addition to any options trader who needs or wants better data to make better decisions.

We hope you enjoyed this comprehensive ORATS review.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Gavin,

Wow, a very interesting article. I would like to thank you very much for this. I spent a few hours on the orats website today and still can’t believe all the interesting data and tools they offer. It looks like they combine a lot of what I’ve been getting from various websites and tools and offer a lot more that I haven’t seen anywhere else. On top of that, the price seems acceptable for private traders like me – especially if it means that I no longer have to subscribe to other paid resources.

I used Orats for a month. It was quite expensive and had some issues. First, the sample code they provide does not work. I used the python code and it simple created an error. So you cannot rely on their online sample code to understand how to make the API calls appropriately. You’ll need to be ready to play around and figure it out yourself. Second, they don’t have nearly as much data as they claim. About 20% of the ETFs I requested options data for, all of which they indicated they have options data for, had no options data. I made the requests in January 2024 for options expiring through the end of 2023 so it wasn’t an issue of requesting old data. Third, they do not provide the expiration dates for any ticker. Generally this is fine as most options expire on the last trading day of the week, but at some point options actually expired on Saturdays. If you don’t know this, your requests for Friday expirations will come back blank. Another 25% of my calls came up empty from 2008 to 2015 for this reason. Fourth, their data before 2014 is quite sparse. They claim options were not traded as frequently prior to this date, but I was disappointed to get so little data for this period given that is not disclosed in their advertisement. I was expecting robust data as far back as 2008 based on the statements on their site. Finally, customer support is not particularly nice. Emails were terse. Small thing, but in a customer service business having a customer oriented approach is always positive; that is a growth point for them.

Overall, I paid quite a bit of money and only got about 60% of the data I was expecting to get from them. I would suggest looking around, and only pull the trigger if you are willing to deal with the above issues.

Thanks for sharing your experience with ORATS Nikhil.