Is there an optimal wing width for iron condors?

Yes, there is, according to the research team at Tastylive, which backtested over 1000 trials of iron condors from 2013 to 2024.

Contents

The wing width size depends on the underlying assets’ price.

The larger the asset, the larger the wing width needs to be.

So, the Tastylive study used five different underlyings of various prices ranging from $100 to $500 to ensure that the underlyings have similar implied volatilities (IVs).

The typical iron condor used in the study had short strikes at the 16 delta and started out at 45 days till expiration (DTE) and was taken off when it reached 21 DTE.

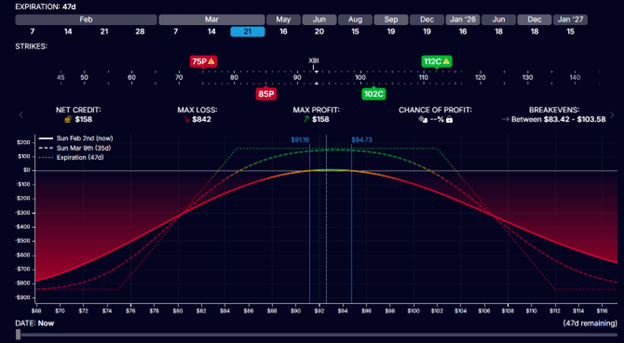

For example, an iron condor on XBI (biotech ETF) with a stock price of $93 may look like this:

Buying the long put at the strike price of $75

Selling the short put at the strike price of $85

Selling the short call at the strike price of $102

Buy the long call at the strike price of $112

This condor would have collected about $158 of credit with $842 of max risk.

So, a risk to reward of 5.3.

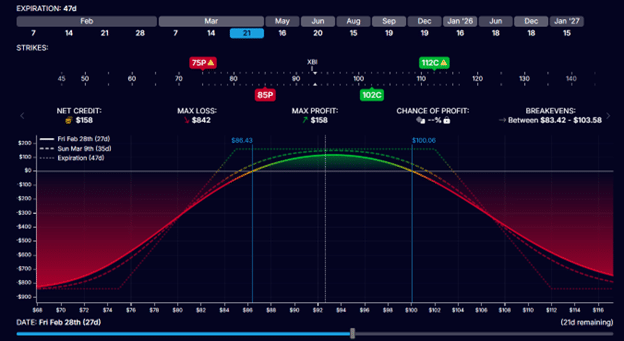

The iron condor would have been taken off when it reached 21 days left in the trade when the P&L graph might look like this:

According to the modeling, if XBI stayed at the same price, the potential gain at this point would be $115.

Based on the capital at risk of $842, that would be about a 13% max potential return.

$10 Wings On $100 Stocks

In the above example, we used $10 wide wings.

The 75/85 put spread is 10 points wide, as is the 102/112 call spread.

This is because the Tastylive study found that $10 wide wings on $100 priced underlyings were the most optimal.

When they tested the $5 wide wings, the average P&L was negative.

When they tested wider wings, the average P&L was more in dollar amounts, but the percentage return on capital was less.

$15 Wings On $200 Stocks

When the underlying size is larger at $200 per share, the wing widths had to increase.

The $15 wide wings worked best with an average P&L of $14.50 and a return on capital of 27%.

When tested on the IWM ETF, this was the average P&L they found:

$5 wing: -$12.79

$10 wing: $1.02

$15 wing: $14.52

$20 wing: $20.78

$25 wing: $24.39

$30 wing: $26.92

While the dollar profit increased as the wing was widened, the return on capital showed a U-shape curve, where the $15 wing gave the best return on capital:

$5 wing: -5.83%

$10 wing: 14.65%

$15 wing: 26.97%

$20 wing: 23.87%

$25 wing: 21.78%

$30 wing: 18.94%

$20 Wings On $300 Stocks

For a stock like Visa (V) used in the study, which is priced around $300, they found that $20 wide wings worked best.

The average P&L was $25, with a 27% return on capital.

$25 Wings On $400 Stocks

As the underlying price increases, the average dollar profits increase because more capital has to be used.

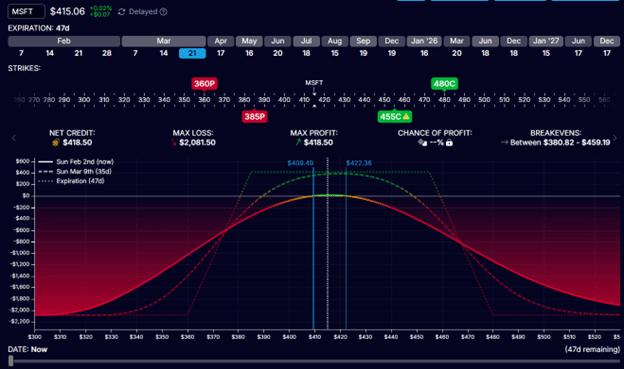

For Microsoft’s (MSFT) stock, they found that the $25 wide wings worked best with an average return of $35, which is a 20% yield on capital used.

An example condor on MSFT may look like this:

Remember that the yield percentage and the look of the condor will change in different IV environments.

The above screenshots were in a low VIX environment of 16.

Higher IVs would typically give better yields and better risk-to-reward.

The Tastylive study spanned 12 years and would have covered a greater range of IVs.

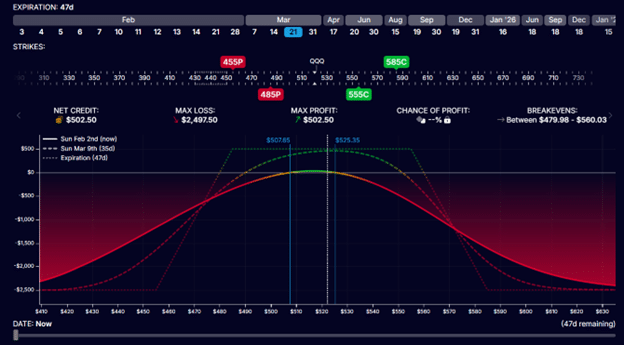

$30 Wings On $500 Stocks

An iron condor on QQQ (at slightly over $500 per share) would require a capital usage of $2500 for one contract if using the optimal wing width of $30.

This may be too large for smaller accounts.

So, the size of the account needs to be taken into account when selecting the size of the underlying account.

Smaller or newer traders may want to reduce the wing width to decrease risk and reduce capital usage per trade.

While decreasing wing widths may be sub-optimal, it was still profitable – except when you decrease the wing width too much.

The study found that decreasing the wing width to 5-point wide may be decreasing it too much.

The results showed that the $5 wing had negative P&Ls and was not profitable over the long run for any underlyings priced at $100 or above.

Problems With Narrow Wings

In our previous XBI condor example with the optimal $10 wide wings, we had a theta of 3.3.

If we narrow the wings of that condor to $5 wide wings, we only have a theta of 2.1.

This decrease in theta may be the reason why the condor is not able to generate income.

When you widen the wings, you increase theta.

Theta is the income-generating engine of the iron condor.

The condor becomes more efficient in generating money when the long and short options of the spread are further apart.

When the short legs and the long legs are too close to each other, their opposing directions cause friction, which decreases efficiency.

Think of two metal plates going in opposite directions.

When placed too close, they cause friction.

Increased friction decreases the efficiency of the machine.

Some experienced traders would trade strangles, which are iron condors, without the long options.

This way, they let the short options generate their full theta potential like a well-oiled machine, unencumbered by any long protective options.

But it comes at a greater risk.

Conclusion

Increasing the wing widths of the iron condor increases their ability to generate income via larger theta.

However, increasing the wing width also increases risk.

Narrow wings have small risks but are unable to generate income well.

Wide wings have a better ability to generate income, but they come with greater risk and potentially larger drawdowns.

There is an optimal where you risk enough but not too much.

The Tastylive study found that for $100 underlyings, the optimal wing width is $10 wide.

For every $100 increase in the underlying size, increase the wing width by $5.

We hope you enjoyed this article on the optimal wing width for iron condors.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.