The Fear and Greed Index may be one of the unique metrics that you can use to analyze the stock market from a different perspective.

The metric is designed to try and calculate the level of fear that investors may be feeling during a specific period.

This metric is also capable of calculating the amount of greed that they may be showing as well.

We will take a closer look at how the ‘Fear & Greed Index’ works and why it might be helpful to you as an investor.

Contents

- Introduction

- Stock Price Momentum

- Stock Market Volatility

- Why does the ‘Fear & Greed Index’ matter?

- Final Thoughts

Introduction

The Fear & Greed Index is pretty straightforward.

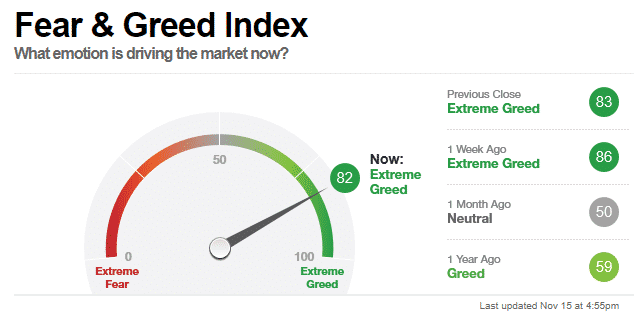

The calculation outputs a number between 0 and 100.

Lower numbers mean that the stock investors appear to be fearful about the stock market’s prospects.

In contrast, a number closer to 100 would mean that greed is becoming very common among investors.

The calculations that go into the ‘Fear & Greed Index’ actually come from other metrics pieced together and averaged out.

These metrics include the stock market’s momentum, trading volume, and market volatility compared to several different moving averages.

Stock Price Momentum

Calculating the stock market’s price momentum is extremely important for analyzing the ‘Fear & Greed Index’.

The calculation uses the 125-Day Moving Average for the S&P-500 Index as a major factor for calculating this metric.

In addition, the calculation looks at the percentage of stocks that are closer to their annual high points rather than their low points.

A higher percentage means there is more greed in the market.

A lower percentage would imply that there is more fear.

Stock Market Volatility

Volatility usually scares investors and can often lead to bearish movements in the stock market.

You are much more likely to see ‘fear’ in the stock market when market conditions are extremely volatile.

Volatility can equate to risk in the stock market. Investors don’t like to take unnecessary risks with their finances.

Fear can skyrocket during periods where uncertainty dominates the market sentiment.

Why does the ‘Fear & Greed Index’ matter?

Not all investors believe that the ‘Fear & Greed Index’ is a good way of analyzing the stock market.

Some investors believe that it is inaccurate, while others think it doesn’t provide useful information about the stock market.

In general, it is designed to provide a different perspective to try and detect the possible emotions that investors might be feeling.

One of the reasons it can matter to investors is that it can provide strong indications towards a future price movement in the stock market.

Just like any other piece of information relating to the stock market, some investors may want to build this metric into their trading strategy.

Final Thoughts

Some investors really love taking a look at the ‘Fear & Greed Index’ because they believe it provides valuable information about the stock market.

Other investors are more reluctant to use this metric because they don’t believe in the formula or methodology used to calculate the ‘Fear & Greed Index’.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.