Volatility spike tend to happen every few months, so they are nothing to be scared about and sometimes they are even welcome.

When volatility gets quite low as it did in mid-January, a trade I like to put on is one that I learned from a Whale Trader.

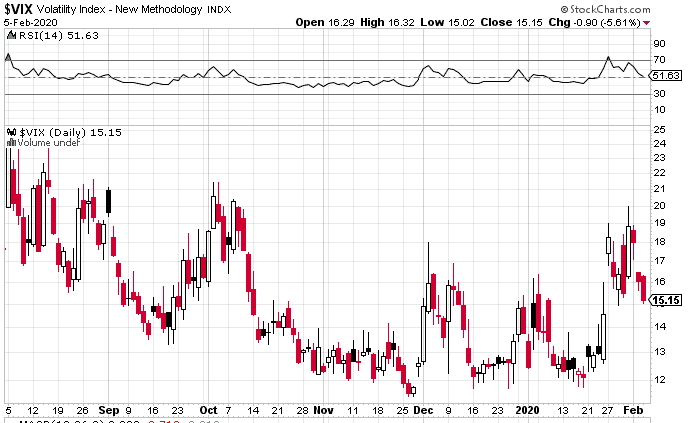

Taking a look at VIX, you can see that volatility was down around 12 for a lot of November, December and early January.

I had a feeling the next spike might be just around the corner and this is the trade I placed:

Date: January 15th, 2020

Current Price: 12.42

Trade Set Up:

Sell 1 VIX February 18th, 2020 12.50 Put @ $0.19

Buy 1 VIX February 18th, 2020 15 Call @ $1.58

Sell 2 VIX February 18th, 2020 20 Calls @ $0.66

Premium: –$7

Max Profit: $493

Max Loss: Unlimited

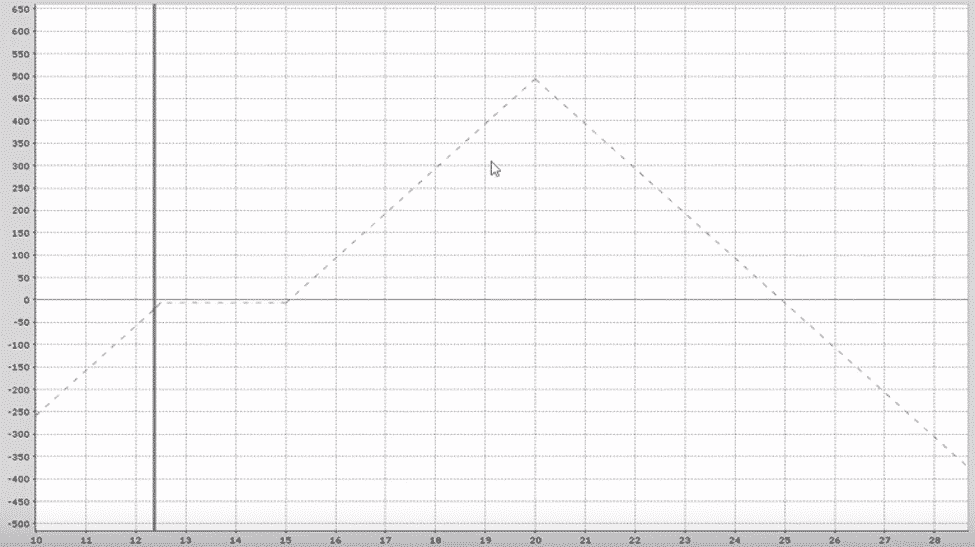

That set up resulted in a trade that looked like this.

Now you may be thinking, and I completely agree, that this isn’t a perfect hedge against a volatility spike, because if we get a huge spike, the trade ends up losing money with VIX above 25.

It only really protects against a mild run of the mill vol spike. But still, it’s an interesting trade and worth discussing.

One good thing about the trade is you have very little risk on the downside. Yes there is risk on the graph, but VIX very rarely closes below 12 on expiration day.

The $12.50 put only sold for $0.19 so potentially wasn’t even worth it. I usually try and sell that put for at least $0.50.

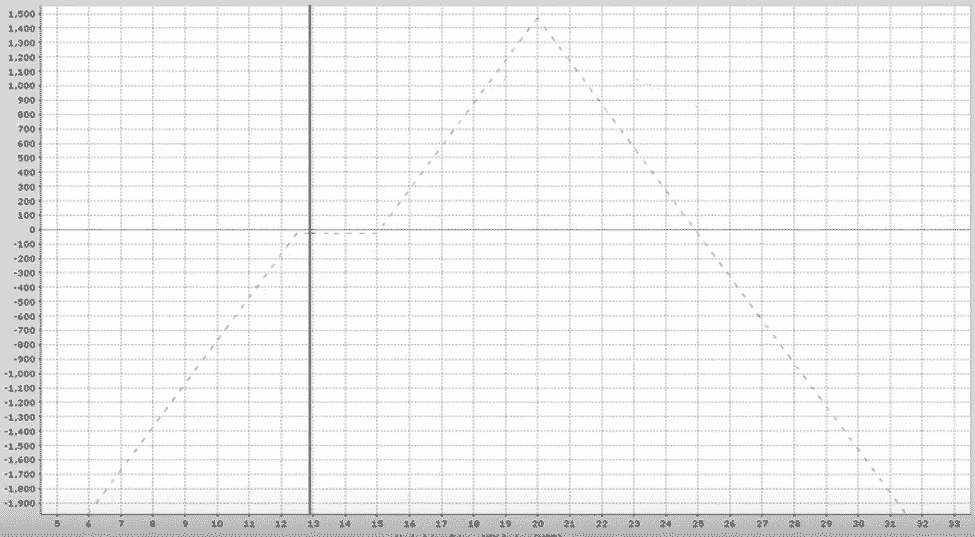

A week later, the trade was basically flat, but I felt confident in it and ended up tripling the position size to 3-3-6.

As of February 4th, the trade was +$229 with VIX closing at 16.05.

What do you think about this trade? Is it something you would try?

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.