One of the platforms which I have heard about from a few investors is Fast Graphs. Today we will be doing a fast graphs review.

This article will provide an overview of their platform and discuss the different features it offers investors.

We will then explore whether or not it is worth the subscription.

Let’s get started.

Contents

- What is Fast Graphs?

- Analyst Ratings

- Stock Screener

- Portfolios

- Pricing

- Is Fast Graphs Worth the Membership?

- Verdict

What is Fast Graphs?

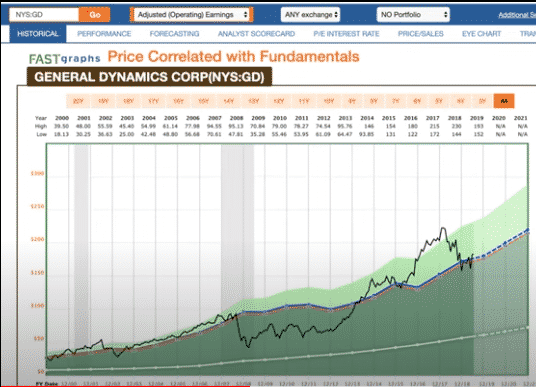

Fast Graphs is a software tool that analyzes fundamental data.

On their platform, you can plot historical fundamentals for stocks up to 20 years in the past.

Fast Graphs centers around charting features which allows you to chart how the fundamental data has changed over time, just like you would the price of the stock.

They claim it will enable an investor to conduct stock research on the fundamentals of companies deeper and faster than some other methods.

Admittedly seeing a price to earnings ratio or other fundamental data plotted on a graph over time is a lot easier than looking at a table as you can see more clearly how the values have varied.

Source: Fast Graphs

Analyst Ratings

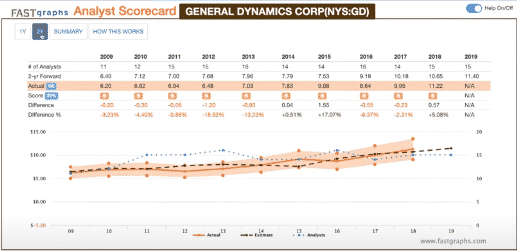

Fast Graphs offers a clear picture of different analysts’ fundamental views on a stock going forward.

It also shows how these analysts have done in their past estimates through an analyst scorecard.

For example, an all too common investor complaint is when their company “beats” their earnings but goes down in price.

This downturn happens frequently and can be seen through the scorecard if analysts constantly lowball their estimates.

In that case, an earnings beat would not mean the stock will go up unless it is by a much wider margin than what the market has factored in.

Source: Fast Graphs

Stock Screener

A key for fundamental investors is finding companies with attractive fundamentals in the first place.

By looking at stocks one at a time, an investor is prone to get stuck in and want to make a trade on that particular ticker.

After all, nobody wants to spend ten hours researching a company to find it is fairly priced.

The stock screener section allows investors to look at a whole plethora of stocks for certain fundamental characteristics.

By providing a database of over 18,000 stocks, there is no shortage of candidates to look for.

For the screener itself, there are over a hundred filters to choose from.

These are both backwards and forwards looking.

Using the screener, one can get a shortlist of potential stocks to look for, allowing them to dive deeper into analysis on each of them.

The stock screener section is very useful for a fundamental investor.

While some of the more basic fundamental screeners (such as P/E ratio and yield) that can be found on other free websites, these websites do not offer as many options as the Fast Graphs Screener.

Note: The screener section is only available to premium subscribers.

Portfolios

The portfolios section of Fast Graphs offers the ability to create multiple different portfolios.

By setting the metrics you view as important, you can then monitor the portfolio’s performance over time based on your chosen criteria.

As fundamentals constantly change, a stock you own today is not the same as that same stock tomorrow.

Therefore this is a valuable tool to have.

Pricing

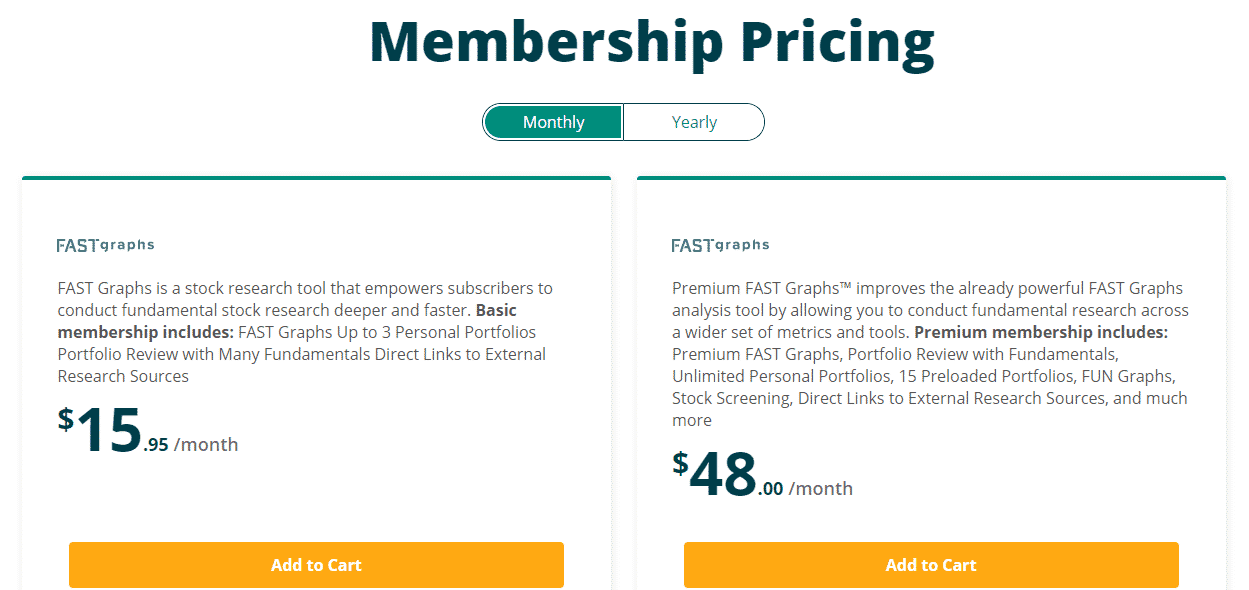

Fast Graphs offer both a basic and a premium version, as shown below.

Source: Fast Graphs

The basic version is $15.95, while the premium version runs $48.

While generally, the basic membership will suffice, it may be better to stick with the premium version since the scanner isn’t included.

If you love the software, there are yearly options of the basic and premium versions for around a 20% discount.

It may be a bit too expensive for smaller investors, but for anyone with larger accounts, the fee could be justifiable for the potential value added.

The good news for any investor is that if you scroll down on the pricing page, there is a free trial that allows you to try out the software for free.

This is definitely recommended to do first to get your own feelings of the platform before you shell out for a longer-term subscription.

Is Fast Graphs Worth The Membership?

Fast Graphs could be an extremely useful tool or a worthless membership that provides you with no value depending on what type of investor you are.

The site is for the fundamental value investor.

If that is not you, then the platform will provide little to help you.

Even for investors who do casual fundamental investing in addition to other techniques, a lot of the information could be available elsewhere for free, hence negating a lot of the value from the platform.

Despite this, Fast Graphs may be worth the shot if you want to dive into fundamentals on a deeper level.

Educational Material

They have some educational material (with a man who appropriately looks like a younger Warren Buffet).

I think this education would be very helpful for most investors who need a bit of aid in learning what fundamentals to look for.

After all, if you do not understand these fundamentals first, you cannot take advantage of Fast Graphs features.

It is important to note that simply being a value investor will not lead to easy riches.

For example, a company may have great fundamentals while also having some overhanging negative event that justifies valuation.

Or it may be the case that the market is undervalued or overvaluing a stock, but it will continue to do so, resulting in frustration and losses for value investors.

For example, many investors think Tesla’s stock has been overvalued.

The problem is, according to many of them, it has been overvalued since its IPO.

Remember, the market can be irrational longer than you can be solvent.

Despite this, to Fast Graph’s credit, they do not try to oversell you on what their platform can achieve like some other services.

They really attempt to provide the material in an unbiased way.

At the very least, with the screener and portfolio sections, you can make sure you do not bag holding stocks that are of poor quality in the long term.

This can lead to portfolios that should be able to at least match or slightly overperform index returns in the long run.

Verdict

For longer-term investors who love value investing and fundamentals, try the free trial of Fast Graphs to see if you like the platform enough to pay for it in the future.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.