Once upon a time, there were two double diagonal spreads on SPX.

Contents

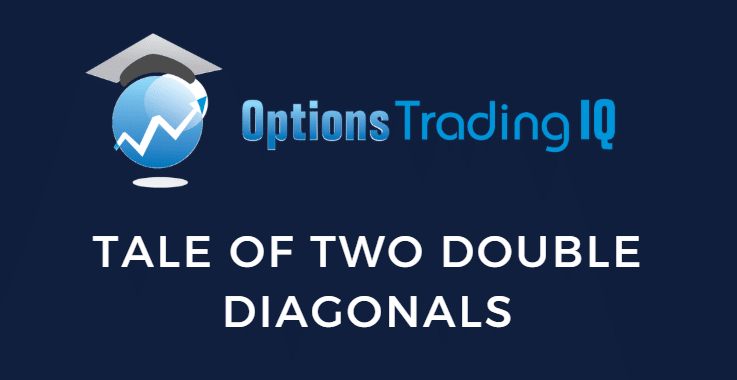

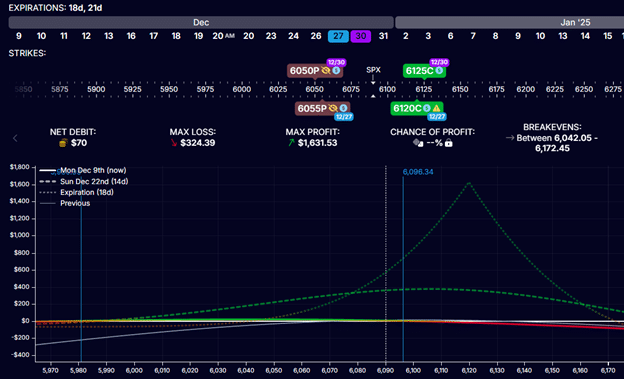

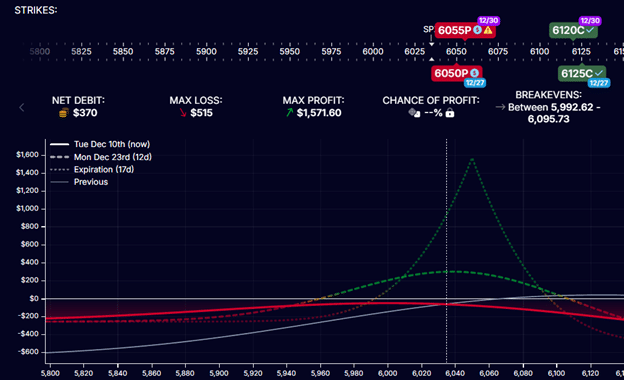

One looked like this:

Which was initiated on December 6, 2024, through this order:

Buy one December 30 SPX 6125 call @ $42.20

Sell one December 27 SPX 6120 call @ $41.50

Sell one December 27 SPX 6055 put @ $36.99

Buy one December 30 SPX 6050 put @ $37.80

Cost of call diag: -$70

Cost of put diag: -$81

Net debit: -$151

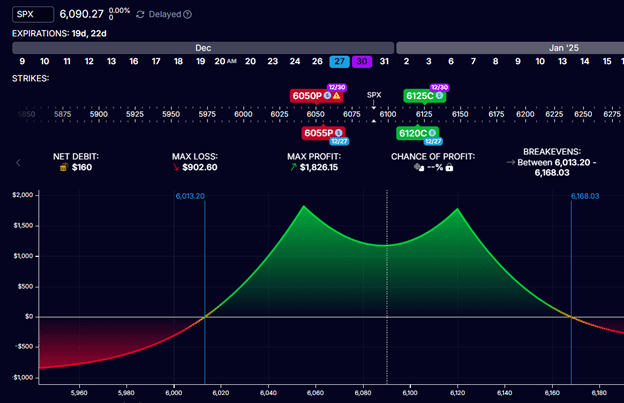

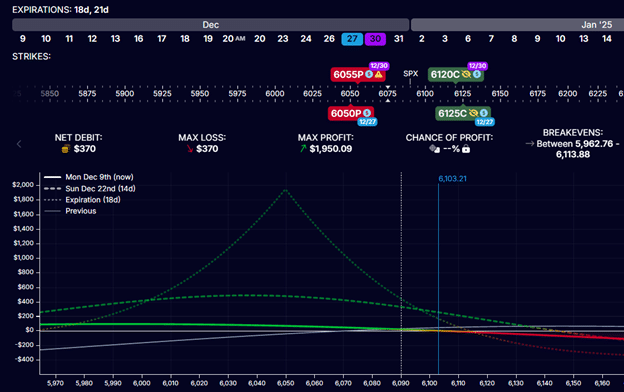

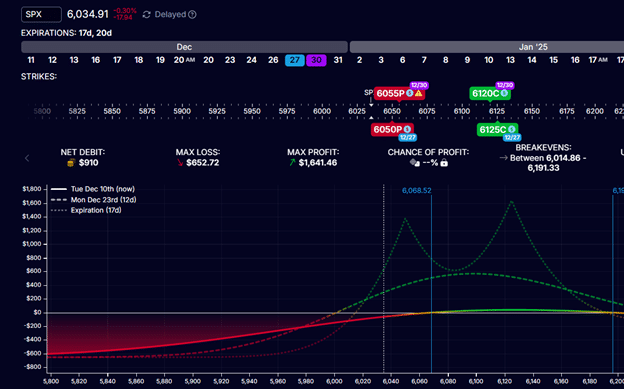

Another double diagonal looked like this:

Also created at the same time when SPX was at about 6090 (right at the center of the double diagonal).

Sell one December 27 SPX 6125 call @ $38.91

Buy one December 30 SPX 6120 call @ $44.31

Buy one December 30 SPX 6055 put @ $37.83

Sell one December 27 SPX 6050 put @ $34.03

Cost of call diag: -$540

Cost of put diag: -380

Net debit: -$920

On the surface, the two look very much the same in their curvy shape, which is indicative of time spreads consisting of different expiration dates.

The two expiration dates being used are December 27 and December 30.

In calendars, diagonals, and double diagonals, we always sell the shorter expiration option.

And we buy the option that has a further out expiration.

In the above, we always sell on December 27 and buy on December 30.

This is the only way we can get time decay to work in our favor, which is how, this time, the spreads generate income.

The shorter-dated expiration will decay faster than the longer-dated expiration.

Therefore, we sell the option that loses its value faster.

Buy the option that keeps its value longer.

There are differences between the two double diagonals if you look at them closely.

While the strike numbers look the same, the two trades never use the same options.

The first double diagonal buys the 6125 call.

The second double diagonal sells the 6125 call.

These are not the same options because they are on different expiry.

The way that OptionStrat displays the strikes is that it will display the strikes that are being bought above the ruler.

It will display the strikes that are being sold below the ruler.

The Traditional Double Diagonal

We call the first double diagonal the traditional double diagonal.

This is the double diagonal that we are more familiar with and is probably the one that we learned first.

It is like the cousin of the iron condor.

Like the iron condor, the short strikes are closer to the money (meaning closer to the current price of SPX) than the long strikes.

While the iron condor has all its strikes on the same expiry, the double diagonal does not.

You can think of the double diagonal as an iron condor but with the long options pushed out to a later expiration date.

The iron condor has a put spread and a call spread.

The double diagonal has a put diagonal that looks like this:

Like the put credit spread of the iron condor, this put diagonal would like the price of SPX to go up.

And it has a call diagonal that likes the price of SPX to go down:

Like the iron condor, the puts and the calls oppose each other, making the entire double diagonal directionally neutral.

These structures do not make money betting on a particular direction.

They make their money with time passing.

The Double Long Diagonal

For our second double diagonal, we call it the “double long diagonal.”

Its put diagonal looks like this:

Like the long put vertical spread, this put diagonal would like the price of SPX to go down.

This is why we call it the “double long diagonal.”

It has diagonalized long vertical spreads.

Its call diagonal would like the price of SPX to go up, just like a long call vertical.

Some Differences

The traditional double diagonal cost an initial debit of -$151.

The double-long diagonal cost -$920.

Another way to remember which is the “double long diagonal” is that it costs more.

When we go “long” an asset, we “buy” the asset and hence have to pay a debit.

It is natural that the double-long diagonal will cost more because the long options are closer to the money and hence cost more.

Because of this, the double-long diagonal tends to have more vega since long options carry positive vega.

This may be good in a low volatility environment where long options are less expensive and when there is a possibility of implied volatility increase.

On the other hand, the traditional double diagonal tends to have more theta because the two shorts are closer to the money.

Options closer to the money have faster decay.

Risk To Reward

What is more important than the cost of initiating the trade is the maximum potential loss of the trade.

Unlike the calendar, the max loss on a double diagonal is not the debit paid.

OptionStrat’s graph shows that the max loss on our traditional double diagonal is roughly around $900.

The max loss on the double-long diagonal is about $650.

The theoretical max potential profit on the traditional double diagonal is roughly $1800.

And it is $1500 for the double-long diagonal.

The risk-to-reward on each comes out to be roughly similar at two-to-one:

$1800 / $900 = 2.0

$1500 / $650 = 2.3

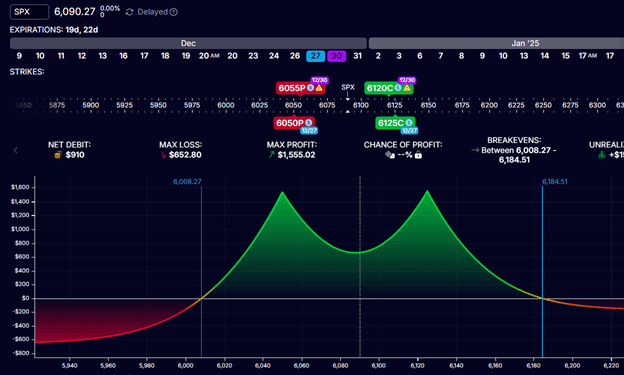

Adjustment For The Traditional Double Diagonal

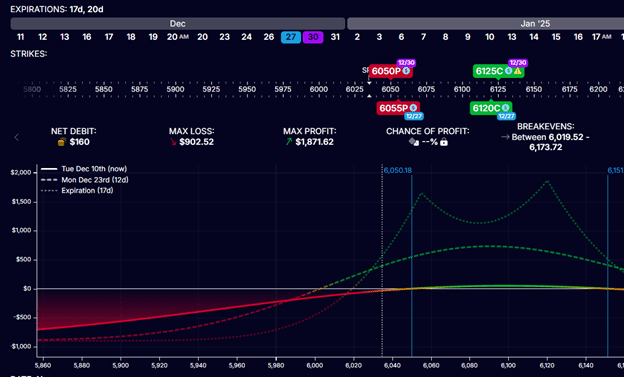

At the end of the day on December 10, we see that SPX has gone down to 6035, which is past the short strike of the lower diagonal.

The traditional double diagonal is down P&L -$31, with the call diagonal up $15 and the put diagonal down -$46.

It is time to adjust the trade.

One way is to close the losing diagonal and keep the winning diagonal open, especially if you feel the SPX will continue moving in the same direction.

In the case of the traditional double diagonal, the losing diagonal is the put diag.

We close the put diagonal to collect a credit of $35 back.

The winning diagonal is the call diagonal since it is the one that benefits when the price goes down.

The remaining call diagonal looks like this:

There is limited downside risk.

It still has positive theta, and hopefully, time can bring the trade back to breakeven.

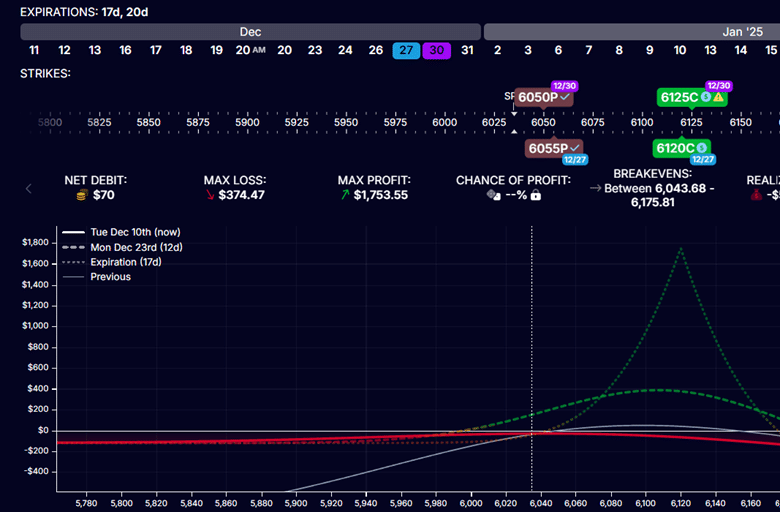

Adjustment For The Double-Long Diagonal

During that same time period, the double long diagonal is down P&L -$80 with the call diagonal down -$150 and the put diagonal up $70.

Why did the double-long diagonal suffer a greater loss than the traditional double diagonal?

Perhaps the traditional double diagonal had greater theta and had accumulated more gains during the four days before the SPX dropped.

Another way to adjust these diagonals is to close the diagonal that is further away from the price and keep the diagonal that is closer to the money for its greater theta.

In this case, we close the call diagonal, and the resulting put diagonal will be:

Final Thoughts

You might be wondering which of the double diagonals is better.

A survey of the YouTube landscape found the earliest mention of the double-long diagonal in December 2020 in this Sheridan Risk Management video.

Based on other subsequent videos, it can be surmised that Dan Sheridan is indifferent and feels both are about the same but tends to do more the traditional double diagonals from habit.

However, Mark Fenton of The Options Mentor says he prefers the double-long diagonal.

So you choose.

We hope you enjoyed this article on two double diagonal spreads.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.