Today, we are looking at day trading options. How do you do it and what are the best strategies.

Let’s get started.

Contents

- What is the Benefit of Day Trading Options?;

- What is the Downside of Day Trading Options?

- So, Who is My Competition?

- Day Trading Options Strategies

- Holding Overnight is Alright

- Concluding Remarks

Many new investors have at least considered day trading options.

Like stocks it is very possible to day trade options.

This article will take an unbiased look at options day trading.

We will talk about the benefits and costs and discuss whether day trading makes sense.

What is the Benefit of Day Trading Options?

The biggest benefit to day trading strategies is frequency.

This allows strategies with a positive but low expected value to generate immense amounts of wealth.

Let’s imagine we have two slot machines. When they win, both pay $1 for every $1 bet.

Slot machine 1 has a 99% chance of winning though it is limited to one play a year.

Slot machine 2 has a 51% chance of winning but you can play as many times as you want.

Which one would you pick?

Source: Painting Valley

The answer with any math and risk management is slot machine 2.

In fact, with unlimited plays, we could generate immense amounts of wealth with only a small advantage.

This is in the same way that casinos generate large profits with only a small house edge.

They have mastered the frequency game.

The good news for day trading is that only a marginal positive expected value is needed.

This is due to our high frequency.

We don’t need a huge edge, just one that allows us to profit after our costs of doing business.

What is the Downside of Day Trading Options?

So, if the benefit of day trading is frequency the downside is the cost.

Every time a trade is placed, a price is paid to execute the trade.

This cost of business is small but substantial. Specifically for options it can make day trading more costly than stocks as spreads and commission costs are often higher.

The cost of trading can also leave thousands of strategies that are profitable on paper unprofitable in real life. Small edges can easily be wiped out by small transaction costs.

Some retail traders will argue that they have commission free trades.

Often unaware that because of that their order flow is being sold their corresponding fill prices will suffer as a result.

If you are not paying for the product, you are the product.

The reality is that large edges rarely exist in the high frequency space, even small edges are often quickly arbitraged out.

Remember our slot machine example.

After playing thousands of times on machine two and betting more each time the machine will run out of money.

At that point, the game is over.

Or perhaps when you step away to go to the washroom someone who saw your success will have stolen your spot at the machine.

Competition is everywhere.

So, Who is My Competition?

Day trading in options will mean you are commonly interacting with a market maker. Most likely a machine at Citadel, Susquehanna, or Virtu to name a few.

They are in the business of scraping pennies of edge, however they can in each trade.

As they are doing this millions of times a day this is still extremely profitable.

Despite this they are forced to spend a lot of profits trying to stay constantly ahead of their competition.

This includes hiring the best talent, fanciest models, best data and most having the cushiest relations with exchanges.

So, if you think you can compete with them from your basement, they would be glad to play with you.

Hopefully, this has discouraged you from trying out the high frequency space.

Despite this we don’t need to trade 1000 times a day. After all, a day trader could trade a few options contracts in the morning and close them out in the afternoon.

This is ultimately more realistic although transaction costs still need to be factored into the profitability of a strategy.

Placing a few trades and a few dollars in commission may not seem like much.

Despite this it can expand very quickly over the course of a year.

Day Trading Options Strategies

Systematic strategies for day trading options are challenging.

This is because markets will usually adapt.

There are some people who have developed systematic day trading options strategies.

One such person, Tammy Chambers developed a 0 DTE SPX options strategy.

Though a word of caution.

When evaluating the performance of a systematic options strategy it is important to take it with a brick of salt.

Anyone advertising more than a slight edge in an options day trading strategy is a guaranteed right off.

If you have an edge, why would you advertise it to the world?

Sometimes I have found the best options day trades are opportunistic.

This can result in a certain mispricing occurring for a short period of time, sometimes only minutes then disappearing.

These are challenging to trade as they happen infrequently and in unique circumstances.

Yet that is the reason why they sometimes exist.

Knowing when an opportunistic situation could potentially happen can make for some profitable day trades.

Despite this, because of the nature of these opportunities a lot of the time a trader will be left doing nothing.

Losing on the opportunity cost of their time.

Holding Overnight is Alright

A strict day trader will not hold positions overnight.

This is because there is overnight risk that cannot be hedged, as the market is closed.

Despite this, the whole reason traders get paid is to take on risk, so holding overnight and taking on that risk has a premium associated with it.

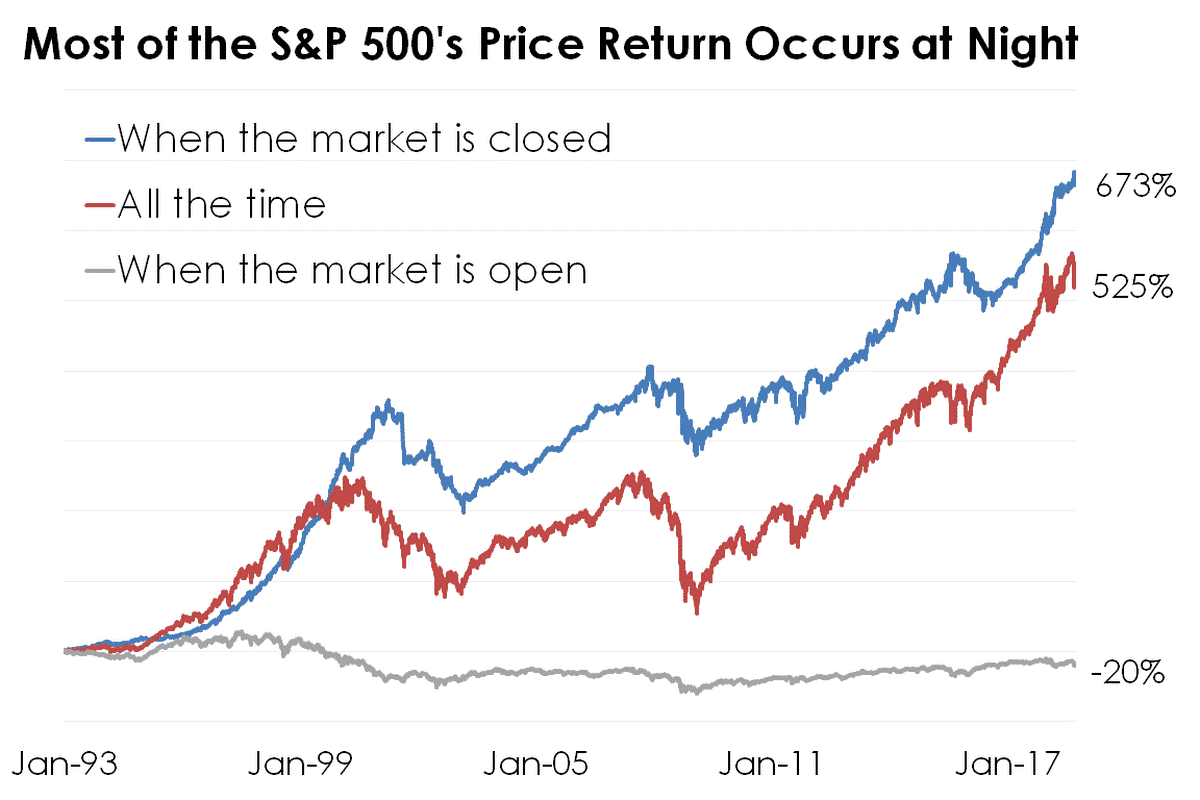

For example, the stock market makes almost all its gains overnight vs. intraday as shown below.

Source: Seeking Alpha

One major option strategy involves selling a short straddle the afternoon before a company’s earnings event and closing it the following morning once the news is out.

This exposes an investor to jump risk that cannot be hedged.

Therefore, it is a reason why a structural premium should exist.

While this is not technically a day trade, we can trade thousands of earnings events a year.

Running a back test, I came up with an edge of 2.6% of the staddle price, which is substantial.

Despite this with execution and transaction costs the profitability will be substantially lower.

Concluding Remarks

Day Trading Options is not for the faint of heart. For those who have the complex infrastructure to compete in the high frequency space it can be very lucrative.

For people without fiber optic cables and a team of quants, day trading can still be profitable, but it requires finding edges large enough to overcome transaction costs.

These can be infrequent or involve holding some other type of risk.

For most retail investors the lure of options day trading should be avoided though if a strategy is found with enough of an edge it can become highly profitable.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.