Today, we’re looking at how to credit spread adjustments. We hope you enjoy this article.

Contents

If the price goes through your credit spread and you do nothing, it will be a max loss, which can be multiple times the amount typically won.

If the market goes against the spread, we need to cut risk fast.

But how?

Here are a few ideas.

Example Of Hedging With Stock

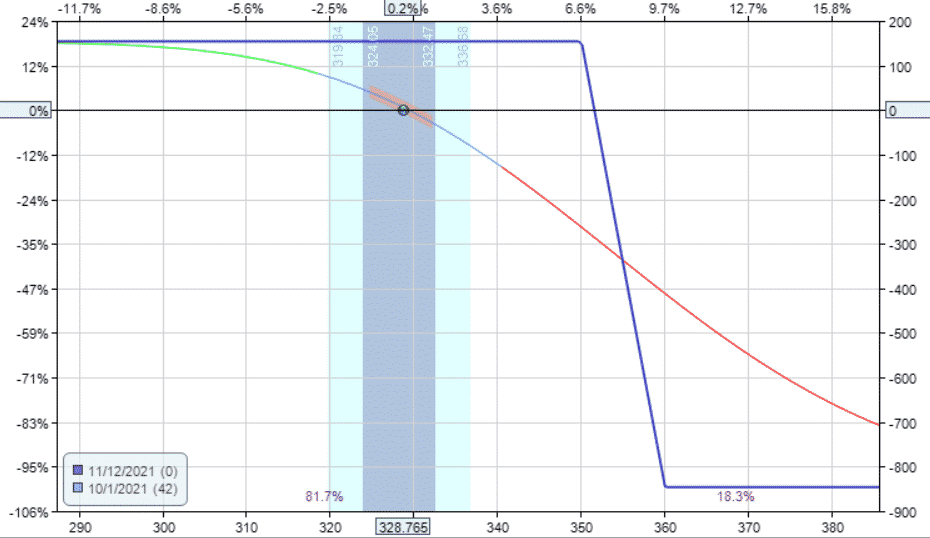

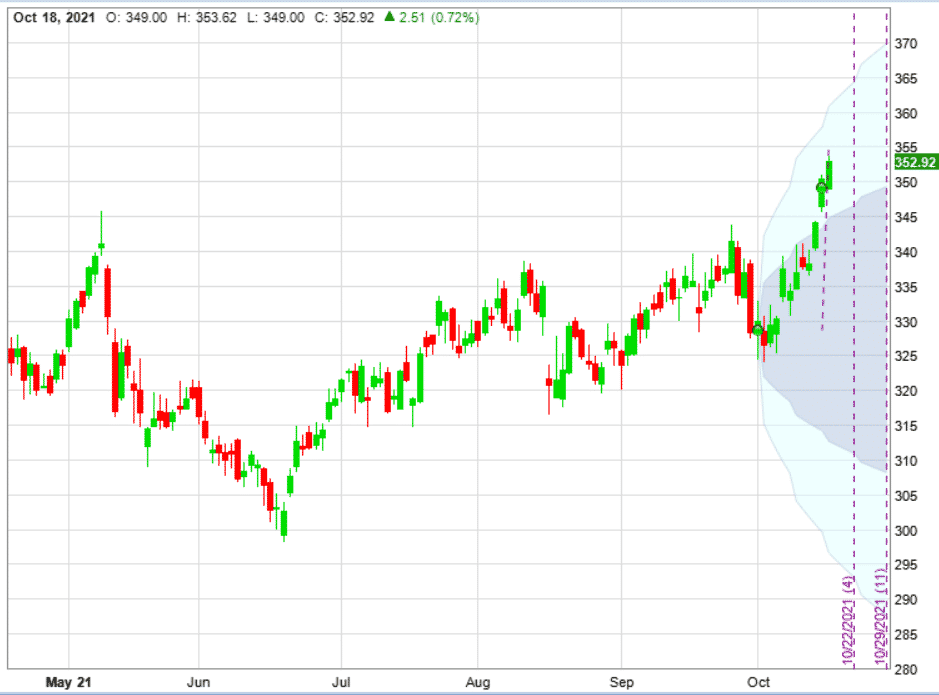

Suppose on October 1, 2021; an investor initiates the following bear call spread on Home Depot (HD) for a credit of $154:

Sell one November 12 HD $350 call

Buy one November 12 HD $360 call

The payoff diagram shows a risk-to-reward of about 5.5 = $846/$154.

source: OptionNet Explorer

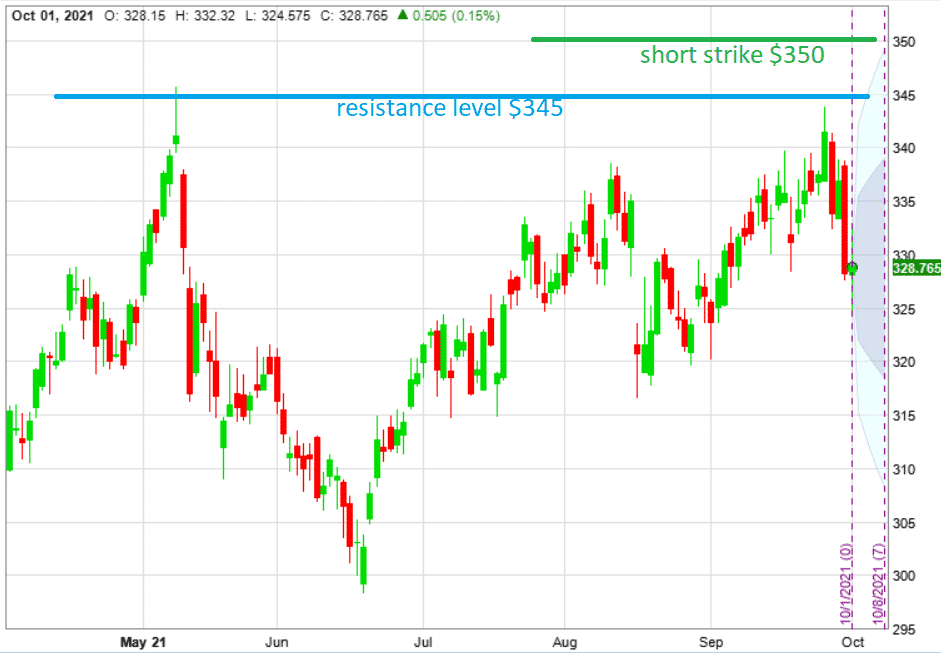

With the short strike at the 21 delta, with 42 days to expiration, it is quite a good trade considering that there is a resistance level at $345 where the price is expected to not be able to go above.

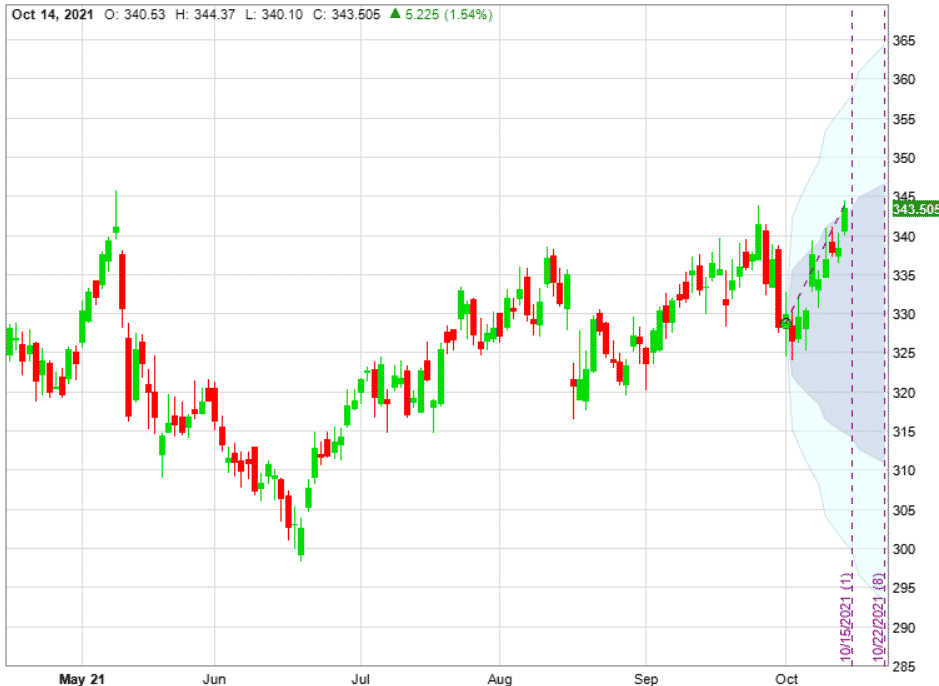

On October 14, the price did get up to the resistance zone at $343.50

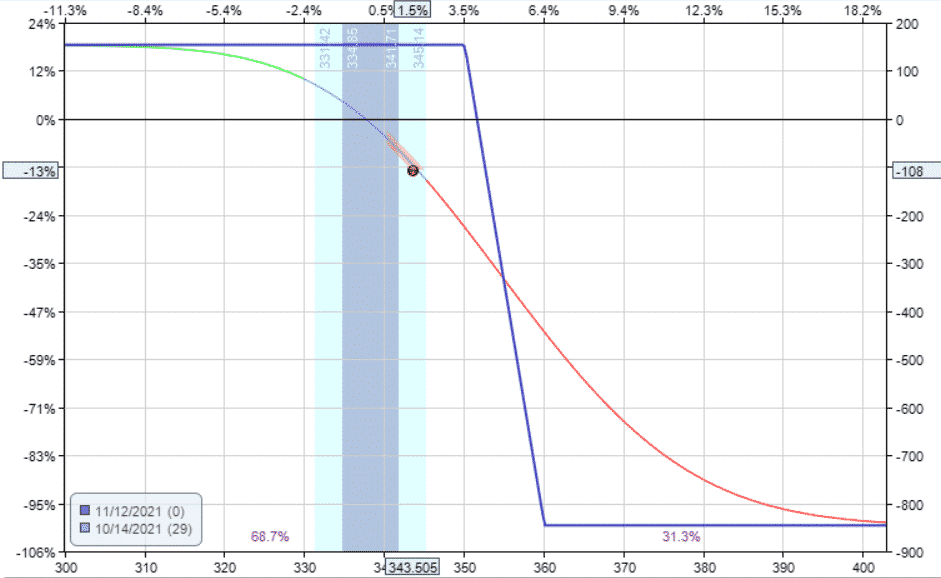

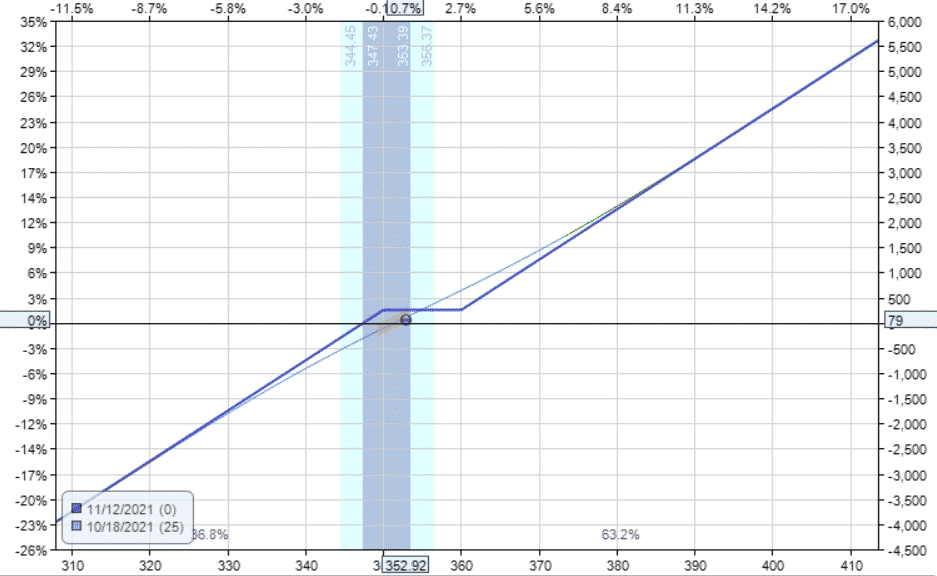

The payoff diagram now looks like this:

If the price goes past $360 at expiration, the investor may incur the maximum risk of $846.

If the trade is closed now, the investor will lose $107.50, or 13% of the maximum capital at risk.

If the resistance level holds and the price bounces down from there, the trade can still be a winner.

Decisions, decisions, decisions.

The investor continues with the trade but takes a proactive risk management approach to account for the possibility that the price will go completely through the bear call spread.

The investor places a standing buy stop order to buy 100 shares of HD if the price goes above $349 (one dollar before reaching the short strike of $350).

The next day October 15, the order did trigger because the price of HD did go above $349.

Since Home Depot is a liquid stock that traded through $349 (as opposed to gapping above it), let’s assume it got filled at a market price near $349 at the time.

The next trading day, October 18, the price breached the short strike and is at $352.92 two hours after the open.

Clearly, the resistance level did not hold, and the price went in the wrong direction of the bear call spread.

However, the combined position is up a positive $78.50 because the 100 shares of stock had gained $392.

If the stock were not purchased, the position would be down $313.50.

Note also how the shares of stock completely changed the risk graph.

At this point, the investor could close the bear call spread and sell the stock, and walk away unscathed.

The 100 shares ensure that the investor will still come out positive even if the price goes completely through the bear call spread.

If we continued the trade to October 21, this is what happened, and P&L (profit and loss) is up to $662.50 due to the appreciation in the stock.

If you own 100 shares of stock, it will always pay for the max loss of a one-contract bear call credit spread, even if the price goes completely through the spread.

Understandably, purchasing 100 shares is quite capital intensive.

Depending on how close to expiration you are and how high the stock goes, it might still be possible to come out positive with a lower amount for the stock purchase.

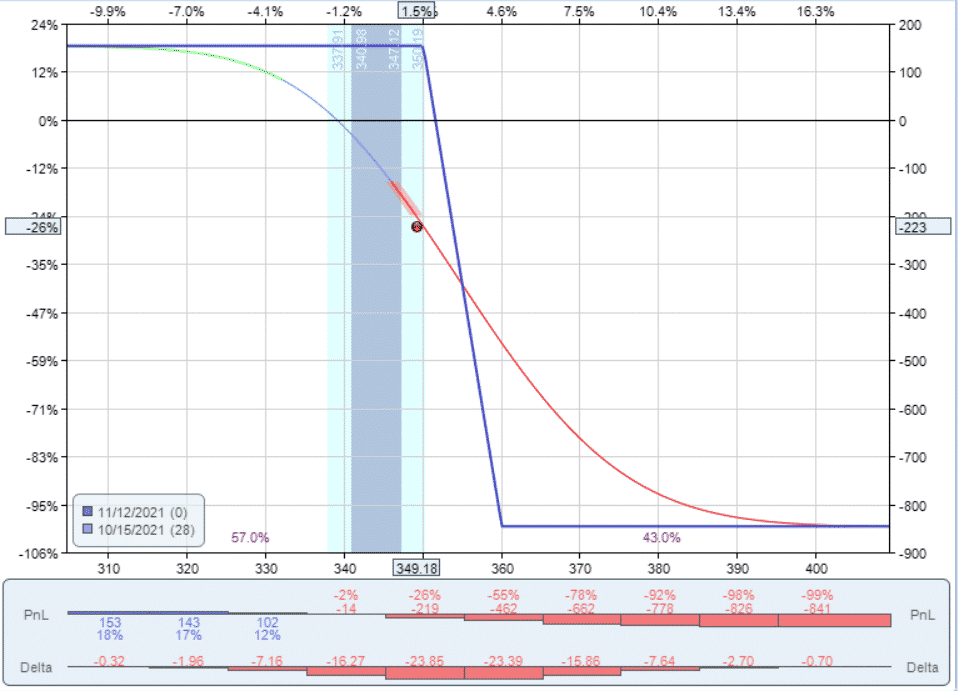

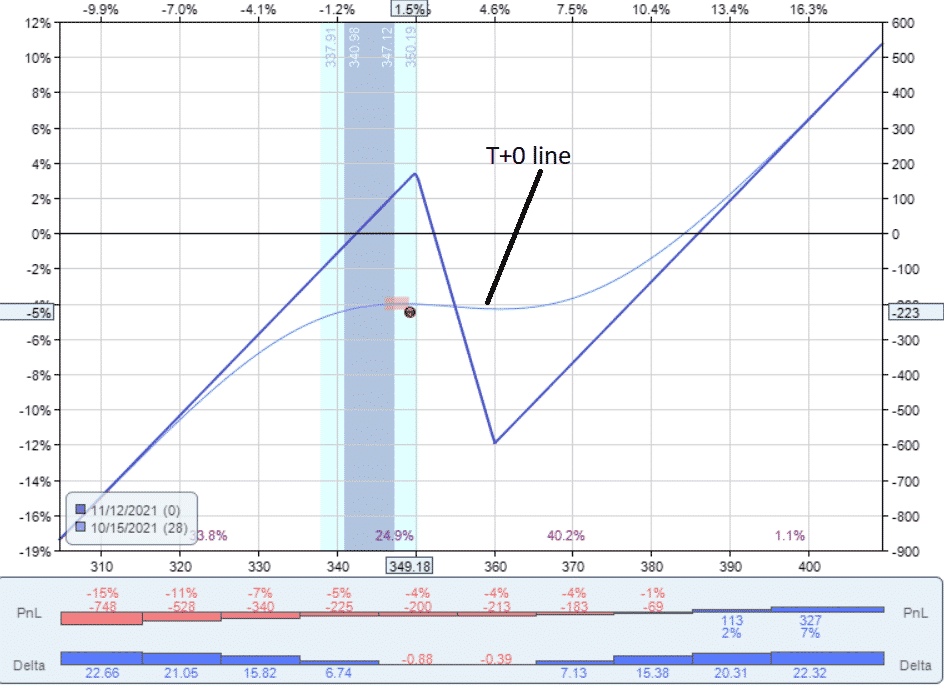

What will happen if, instead of purchasing 100 shares, the investor buys only enough stock to hedge the delta.

On October 15, the bear call spread showed a delta of -23.

If we buy only 23 shares of stock, we flatten our T+0 line, and our delta drops to -0.5.

However, note that we have already lost $222.50 in the position.

These 23 shares will only help prevent further loss.

It will not be enough to take the investor back to positive unless stock takes off and goes to $385.

Example Bull Put Spread

In the next example, we have a bull put spread on Netflix.

source: tradingview.com

Date: December 21, 2021

Buy one January 28 NFLX $540 put

Sell one January 28 NFLX $550 put

Credit: $235

Max Potential Profit: $235

Max Loss: $765

Risk-to-reward: 3.25

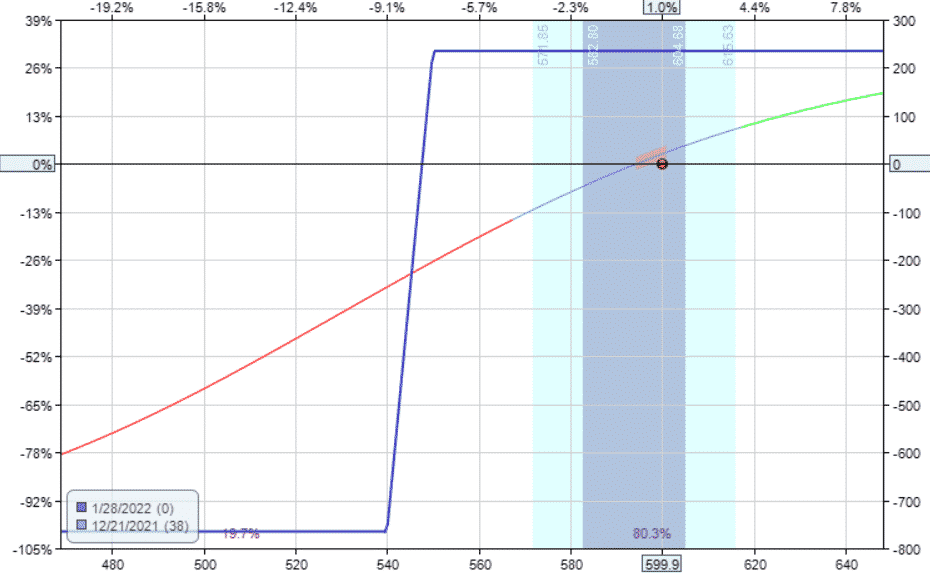

This is what the payoff diagram looked like at the start:

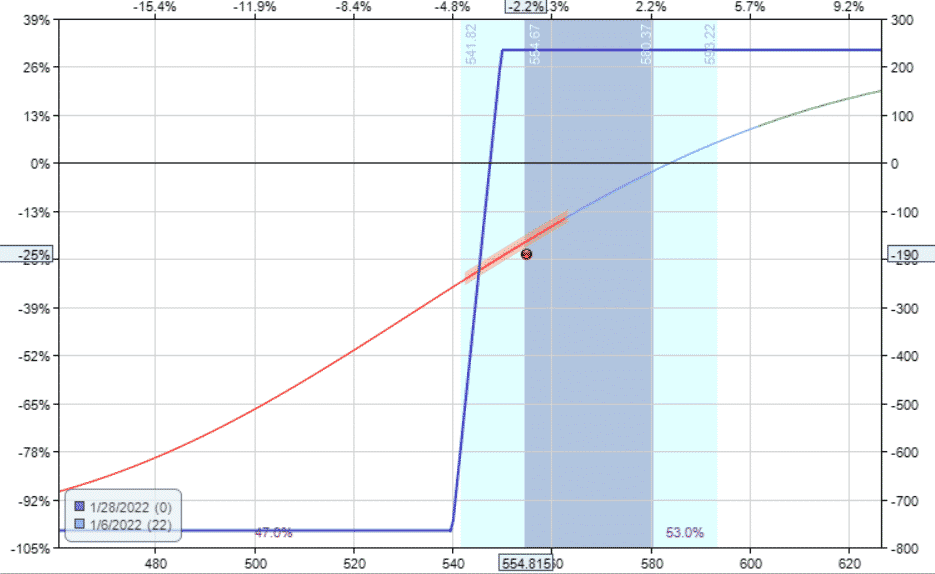

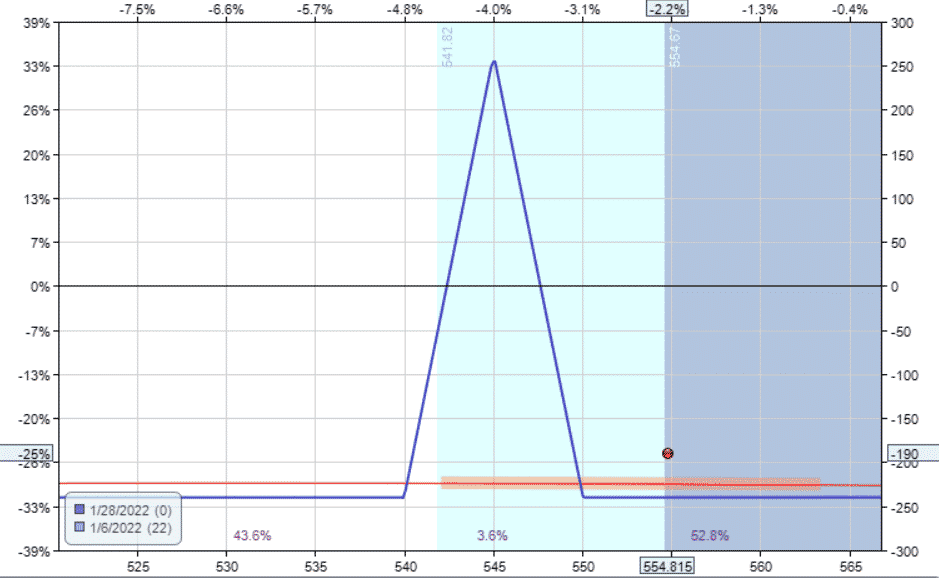

And this is what it looked like on January 6 with current P&L at –$190:

Ideally, the position should have been adjusted earlier.

But in this hypothetical trade, suppose the investor had not noticed the position earlier, or it could be the stock just gap down to that level overnight.

What can we do now to reduce the potential risk of losing the max loss of $765 if the price continues to go down?

With 22 days left in the trade, we could just close the trade and take the $190 loss.

Alternatively, we can roll down the short put from $550 to $545, narrowing the width of the spread.

Buy to close one January 28 NFLX $550 put

Sell to open one January 28 NFLX $545 put

Debit: –$232.50

This adjustment will cost us $232.50.

Essentially, we took the $235 initial credit received to pay for this adjustment.

If Netflix stays above $545 at the expiration, we will come out at break even.

If Netflix goes down past the entire spread, then we have to pay out about $500 at expiration — since we would be obligated to purchase 100 shares at $550 and then can sell it back at $545.

$500 becomes our new max loss instead of the original max loss of $765.

The max loss was reduced because we had reduced the width between the strikes.

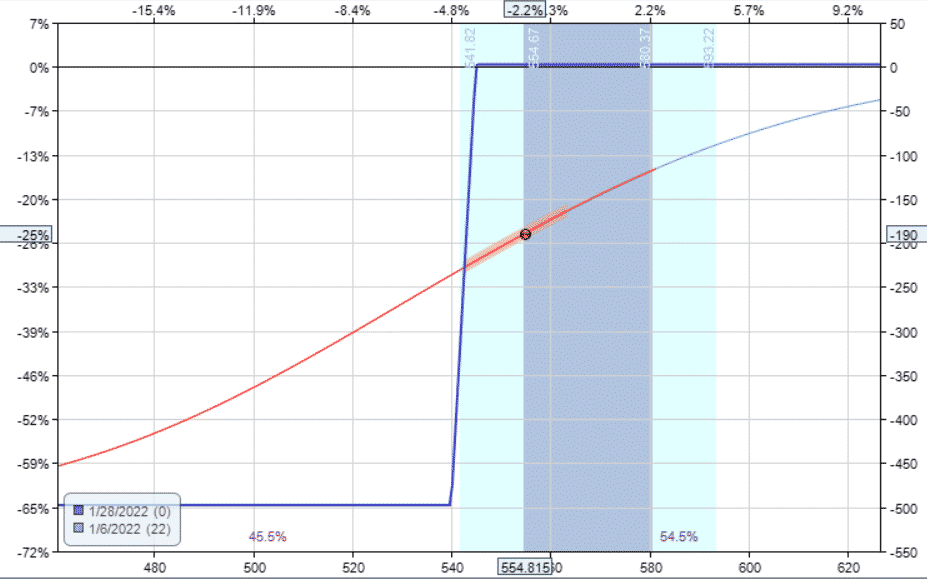

Can the risk be reduced further?

Yes, it can. But there are trade-offs.

We can sell a bear call spread, turning the trade into an iron condor.

Sell one January 28 NFLX $600 call

Buy one January 28 NFLX $605 call

Credit: $102.50

The $100 credit we received reduces our risk by that same amount.

From the graph, we see that our max risk is now less than $400.

The trade-off is that price of Netflix must now be between $545 and $600 for us to come out positive.

The range of price in which we are profitable has reduced.

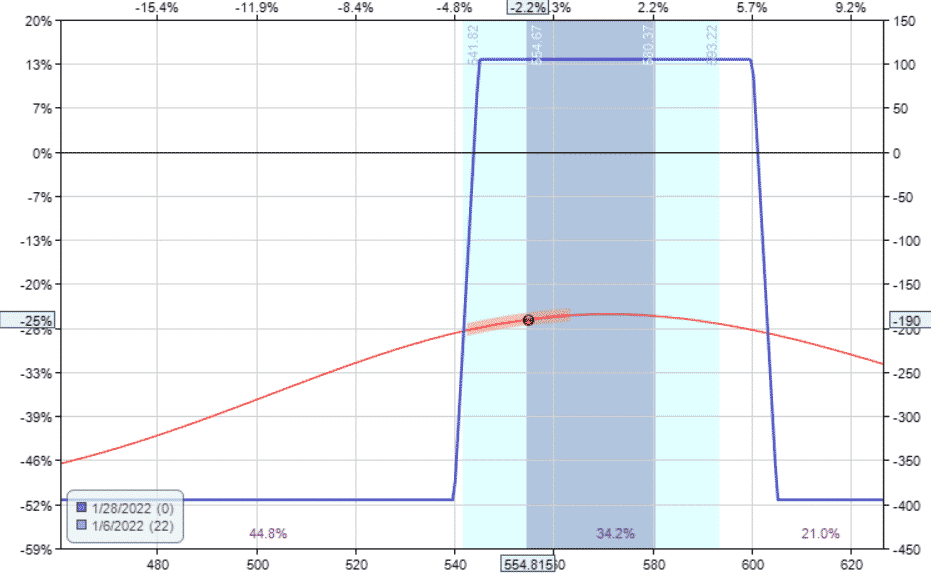

Can the risk be reduced further?

Yes, by narrowing the condor.

It can get as narrow as a butterfly.

Instead of selling the $600/$605 bear call spread, we sell the $545/$550 bear call spread and collect $257.50 in credit.

This reduces our max risk to $240, but with an even more narrow profit range:

Which choice is correct?

- Exit the trade on January 6 and take the $190 loss with no possibility of profiting on this trade.

- Reduce the risk to $500 by narrowing the spread.

- Reduce the risk to $400 by adding a bear call spread.

- Reduce the risk to $240 by moving the bear call spread closer

Decisions, decisions, decisions.

If we knew what the price of Netflix is going to be in the future, then we would know which is the correct answer to that question.

The outcome is going to be different every time.

As it turns out in this example, NFLX closed at $384 on expiration on January 28.

Doing option 1 would have lost $190. Option 2 would have lost $500. Option 3 would have lost $400.

Option 4 would have lost $240.

Technically, there was another option which was to do nothing.

It might have been the only option if one was unaware of the other options.

Doing nothing when the spread is clearly being threatened is not an option.

Conclusion

We trade by managing risk.

You should never have to take a max loss on a credit spread, even if it was discovered late that the spread was in trouble.

Now you know how not to take the max loss.

Trade safe and don’t forger to check out our YouTube channel.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

What about buying a call instead of the stock?

Yes, that works as well.

Do you routine hedge by buying the “opposite” arm trade? Have you found that to be valuable at all. For instance, whenever your bull put short strike is broken, you close it and buy the bear call, and vice versa, let’s say, as soon as you hit a loss of the amount of credit you would have gained on the first trade. So with each loss you can just about “break even” with the opposing trade. Is this reasonable?

Sometimes I will do adjustments like that.

What about in the first scenario, if you were to add a bull call debit spread with the same strikes as you were using in the bear call credit spread? Wouldn’t that mitigate some risk without being so capital intensive?