Turning a credit spread into a condor can be one way to reduce the maximum loss of a credit spread if the trade goes against us.

Contents

Picking a random stock in OptionNet Explorer, we will use Netflix (NFLX) for this first example.

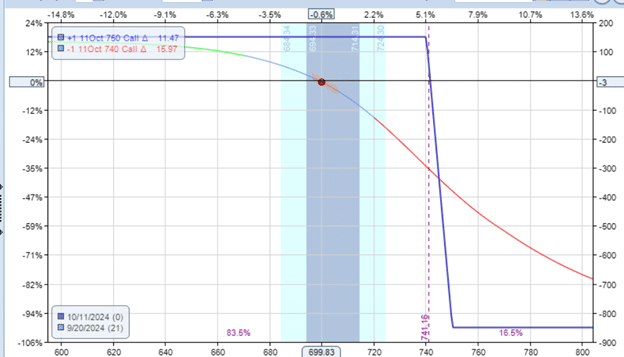

Suppose the trader initiated a bear call spread on September 20, 2024, expecting a downward move in the NFLX stock price.

Date: September 20, 2024

Price: NFLX @ $699.83

Sell one Oct 11th NFLX $740 call @ $4.20

Buy one Oct 11th NFLX $750 call @ $2.67

Credit: $153

The initial risk graph shows a maximum potential loss of $847:

Source: OptionNet Explorer

The number can also be determined by $1000 – $153 = $847.

This is the maximum loss on the spread minus the credit received.

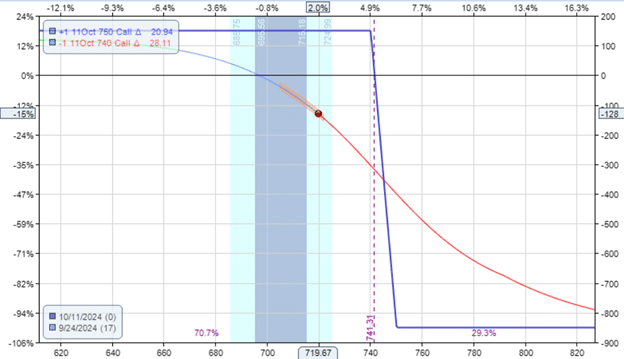

The next two days, the stock went up instead of down.

Oh, bad luck.

The trader picked the wrong direction.

With P&L at -$128, the risk graph is now…

Based on the capital at risk of $847, the trade is at a 15% loss because:

$128 / $847 = 15%

The Greeks, at the moment, are

Delta: -7.16

Theta: 5.02

Vega: -6.91

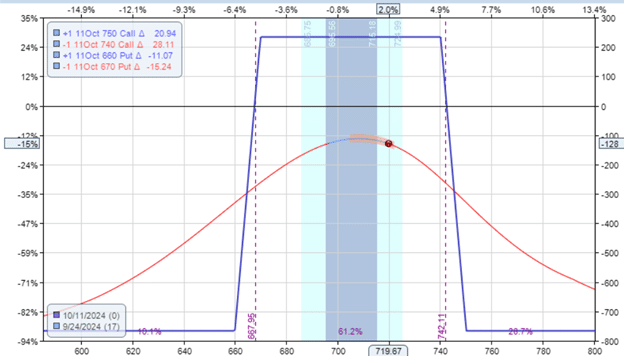

So, the trader decides to turn the bear call spread into a condor by selling a bull put credit spread:

Date: September 24

Price: NFLX @ $719.67

Buy one October 11 NFLX $660 put @ $1.91

Sell one Oct 11 NFLX $670 put @ $2.75

Credit: $84

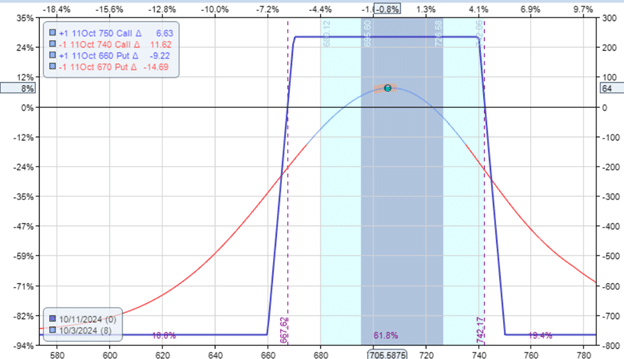

Because the width of the put credit spread is 10 points wide (the same as the width of the initial bear call spread), we end up with a symmetrical iron condor:

The max risk on the upside if NFLX goes way up is the same as the max risk on the downside if NFLX goes way down.

The max risk in either case is $763, less than the max risk of $847.

By selling the put credit spread to turn the trade into an iron condor, we have reduced the overall max risk in the trade – from $847 down to $763.

How did we determine the max risk of $763?

Because the put credit spread gave us an additional credit of $84, we reduced our max risk by that same amount:

$847 – $84 = $763

We can confirm that this is the case by performing a thought experiment.

What would happen if NFLX is way down past the put spread at $640 at expiration?

Then the bear call spread will just expire worthless.

The put credit spread would be at its maximum loss.

For a 10-point-wide spread, we would lose $1000 for that one contract.

Because we would have to buy NFLX at $670 and sell it at $660, we would lose $10 per share at 100 shares per contract.

So the net result would be:

Initial credit for bear call credit spread: $153

Credit for put credit spread: $84

Max loss on the put credit spread: -$1000

Max potential loss in trade: -$763

Benefits of Condorizing a Credit Spread

We will leave it to the reader to confirm that if NFLX expires way past the bear call spread, the max loss on the condor would also be $763.

Not only did condorizing the spread reduced our overall risk, but it also reduced the directionality of the trade.

If we look at the Greeks after the adjustment:

Delta: -3

Theta: 10.60

Vega: -14

We see that we reduced the delta from -7 to -3.

It made the trade less bearish, which would be appropriate when NFLX stock is flying up to the moon.

It also increased our theta from 5 to 10.

This would be of benefit if NFLX decides to consolidate at its current price range.

And we let theta bring in a bit of profit from time decay.

Final Thoughts

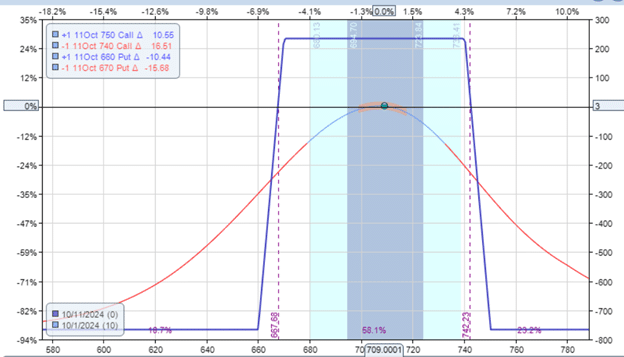

If we were to play this trade out with historical data in OptionNet Explorer, we would see that the trade returns to break even on October 1 after 11 days in the trade and with ten days till expiration.

The trader can exit here by saying that “bringing a losing trade back to break-even is a win.”

Or the trader can continue with the trade.

Holding the trade two more days, the trader (in this case) was rewarded with a net P&L of $64…

And that’s a win for converting a credit spread into a condor.

We hope you enjoyed this article about condorizing a credit spread.

If you have any questions, send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.