Read Part 1 – The Basics

Read Part 2 – How To Set Profit Targets and Stop Losses

Read Part 3 – How To Successfully Leg Into A Butterfly

In part 4 of the Butterfly course, we will be looking at setting up trading rules including when to enter, exit and adjust trades.

There are many variations when trading butterflies, but for now let’s look at a standard delta neutral butterfly and come up with some trading rules.

UNDERLYING INSTRUMENTS

The underlying instrument on which to trade butterflies is a key consideration. Highly liquid stocks and ETF’s will help reduce slippage due to narrower bid-ask spreads so this should be the first place to look for trades. The other advantage of ETF’s and Indexes are that you don’t have to worry about earnings reports. If a stock is reporting earnings during the life of your butterfly trade, it is likely to have a huge move, not something you want on a delta neutral trade. Most indexes are European style so there is no risk of early assignment which can be a problem for butterfly traders. This allows you to hold butterflies on indexes until closer to expiry and potentially achieve higher profits. Indexes such as SPX, RUT and NDX are great targets for butterflies as well as ETF’s such as SPY, GLD and DIA.

For individual stocks, you want to be looking for stocks that are trading for at least $75 and preferably over $100. The distance between strike prices is more favorable and you can trade fewer contracts which help keep trading costs down. Stocks such as AAPL, AMZN, GOOG and IBM are good examples just remember to keep an eye on earnings releases.

TIME TO EXPIRY

For butterflies you generally want to be looking at the monthly expiration cycle, particularly for beginners. Weekly options can be very risky no matter which trading strategy you are using. The sweet spot is anywhere from 30-45 days to expiry but some traders may also go out as far as 60 days. The minimum time to expiry should be no less than 30 days though. There is a time and place for trading weekly butterflies, but we will discuss that shortly.

VOLATILITY LEVELS

We know that butterflies are short volatility trades and that a spike in implied volatility will hurt us, so it makes sense to enter butterflies when volatility is high. However, volatility can be a double edged sword. Sometimes high volatility breeds more volatility. Also if you enter a butterfly when volatility has spiked, that generally means the market has sold off sharply. Reversals from those selloffs can be equally as sharp which could mean the price blows right back through the upper strike of our butterfly. Ideally what we want is a period of steady or slightly declining volatility over the course of the trade, particularly during the first 10-15 days. It therefore makes sense to look for an ideal range of volatility levels. You don’t want to trade butterflies when volatility is at extreme lows or extreme highs.

One way to look at volatility is to look at the range over the past 6 to 12 months and then disregard the top and bottom quarter. Let’s say implied volatility for the instrument you are looking at has had a range between 10 and 30 over the past 6 months for a range of 20. The top quarter of that range is between 25 and 30 and the bottom quarter is between 10 and 15. Now you have an implied volatility range of 15 to 25 with which to work. Entering trades when volatility is within these levels should give you a better chance of achieving success.

RULES FOR LEGGING IN

We have previously looked at different ways to leg in to butterfly trades and this is something you can incorporate into your butterfly trading plan. There are many different ways to leg in and many different rules you could set up. A lot of this comes down to personal preference and risk tolerance. Some trades will not want to leg in at all due to the directional risk, while others may be happy with that exposure.

For traders who want to leg in, your trading plan should include guidelines on when and how to do it. The how indicates the method of legging in. Will you use long calls and puts, debit spreads or credit spreads? When you leg in to a butterfly could be based on certain technical indicators or chart patterns. Some people prefer RSI, stochastics or MACD but any directional exposure you take by legging in should be planned in advance and detailed in your plan.

ADJUSTMENT RULES

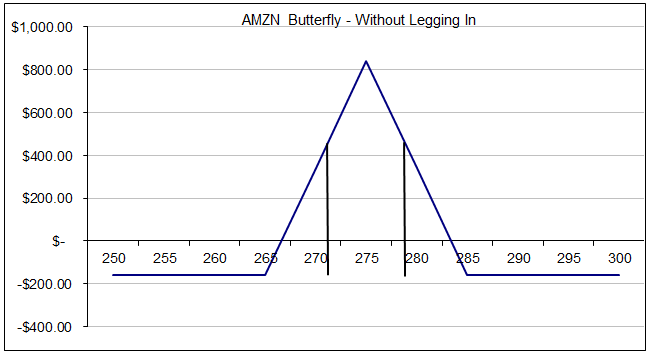

We will cover adjustments in detail shortly, but as a general rule, you want to be adjusting your butterflies before the stock reaches your breakeven points on the payoff diagram. Some traders will adjust their butterflies once the breakeven point is breached. I say a better method is to adjust before the stock gets to that point. When looking at a butterfly payoff diagram, you can break the profit tent into thirds. If the stock is in the middle third, you’re fine. Once it breaks into either of the outer thirds, you should look to adjust. Looking at the diagram below, provided the stock stays between roughly $272 and $278 there should be no need to adjust.

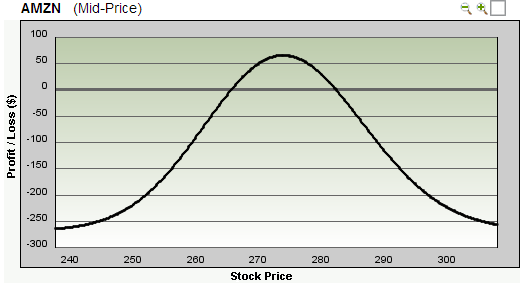

Looking at it another way, this is the same butterfly spread after 1 week. You can see how the profit line is very flat between $272 and $277 but really starts accelerate downwards once you get past those points. This is why adjusting based on the middle third makes sense and will help protect you from large losses.

EXITS

Choosing (and sticking to) your exits points is where a lot of traders fall down. Getting into a trade is the easy part, knowing when to get out is the hard part. With that said, let’s talk about some rules for when to exit a butterfly trade. For simplicities sake we will look at a standard butterfly trade.

The easiest and most enjoyable exit is when your profit target is hit. For a standard butterfly, if you’ve made somewhere in the range of 10-15% within about 10-15 days, then that is a very good time to take profits. You can create a hard profit target if you prefer, such as exiting when you are +15%. With options trading there are so many variables, so sometimes it is better to be a little bit flexible with your rules. For example, if I’ve made 10% on a butterfly within 1 week, I would be quite happy to exit at that point even if my aim was 15%. Never look a gift horse in the mouth because the market can take profits away from you very quickly.

The other less enjoyable way to exit a butterfly is via a stop loss. Typically, the maximum loss that you want to accept on a butterfly is around 20% but your acceptable level may be slightly higher or lower than that depending on your risk tolerance and position size.

Another method for exiting a butterfly is slightly less common but still an important one and that is using a timed expiry. As a butterfly approaches expiry, profits can fluctuate wildly if the stock is within the profit tent. The last week of an options life is referred to as gamma week for this very reason. Small movements in the underlying can have a big impact on your bottom line. For this reason, you generally do not want to take a butterfly into expiry week. Some traders will be lured in by the hopes of a significant return, but if you are treating your trading as a business, then you should not accept huge fluctuations in your account from one week to the next. Slow and steady wins the race.

In our next session, we’ll be looking at how to use butterflies to make cheap directional bets.

How to do adjustment when it go beyond the either of the outer thirds ..?

Part 12 of the course is on adjustments:

https://optionstradingiq.com/butterfly-course-part-12-adjustments/

You have a few options, you can reposition the entire butterfly, add a second butterfly, turn it into a credit spread etc.

Hi Gav, could you make us a real example of profit taking? To see how you calculate that 10.15%. Thank you.