Read Part 1 – The Basics

Read Part 2 – How To Set Profit Targets and Stop Losses

In Part 3 of the Options Trading IQ Butterfly Course, we’ll be looking at various methods for legging into butterfly trades in order to increase profits.

How to Successfully Leg Into a Butterfly

Legging into a butterfly spread should only be attempted by advanced traders or those with at least one years’ experience of trading butterflies. Legging into trades involves more risk because you are basically taking a directional view prior to implementing the full butterfly spread. If that directional view turns out to be wrong, you are behind the 8-ball from the start, and it’s a struggle to work your way back. That being said, if your directional opinion is correct, you can end up with a substantial profit or even risk free trade that you can ride into expiration. We’ll take a look at a couple of different ways to leg into a butterfly – using a long call, using a debit spread and using a credit spread.

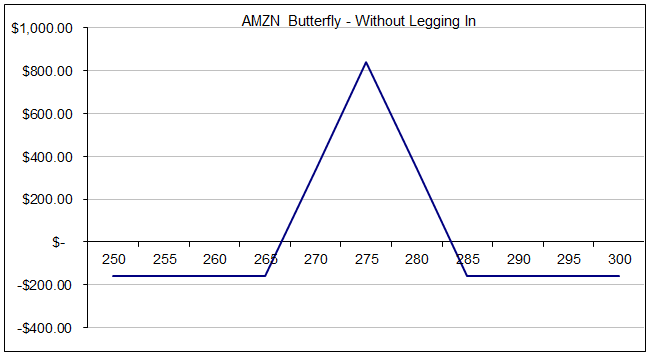

First, let’s look at a standard butterfly so we can compare:

Date: July 4th 2013,

Current Price: $265

Trade Details: AMZN Butterfly Spread

Buy 1 AMZN July 19th $265 call @ $10.00

Sell 2 AMZN July 19th $275 calls @ $5.75

Buy 1 AMZN July 19th $285 call @ $3.10

Premium: $160 Net debit

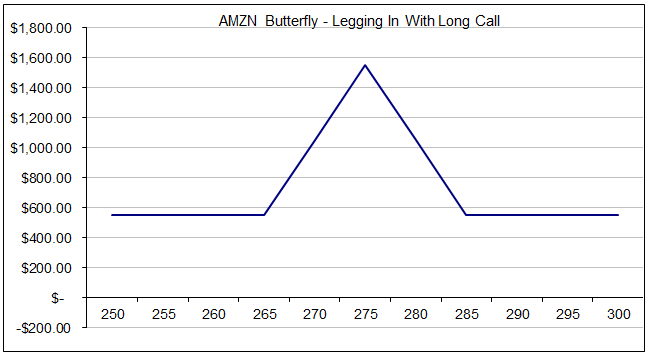

LEGGING IN WITH A LONG CALL

Suppose you were bullish on AMZN and decided to leg in using a long call. On June 4th, with AMZN trading around $265, you buy a July 20th $265 call option for $10.00. Two days later, AMZN has rallied to $275. You then sell two July $275 calls and buy one July $285 call. Here are the details of the trade:

Date: July 4th 2013,

Current Price: $265

Trade Details: Legging in to a butterfly with a long call

Buy 1 AMZN July 19th $265 call @ $10.00

Two days later, AMZN has risen to $275.

Date: July 6th 2013,

Current Price: $275

Trade Details: Completing the butterfly

Sell 2 AMZN July 19th $275 calls @ $11.10

Buy 1 AMZN July 19th $285 call @ $6.70

Premium: $550 Net Credit

You now have a riskless butterfly where you will make at least $550. Even though you are selling more options than you are buying with the second trade, your broker will realize you already have one long call so this will not be considered a naked trade. Here’s how the payoff diagram looks, you can see that this trade will make at least $550 no matter where AMZN finished at expiry

Of course, this is all very easy in hindsight and much harder to do in practice, but you can see that legging in to butterflies can be very lucrative if you can get your timing right. Imagine for example, that you were legging in to this trade, but AMZN dropped $10 rather than rising $10. At that point you would either have to close out your long call for a loss, or if you complete the butterfly, you would have a position where the majority of the tent was below the profit line.

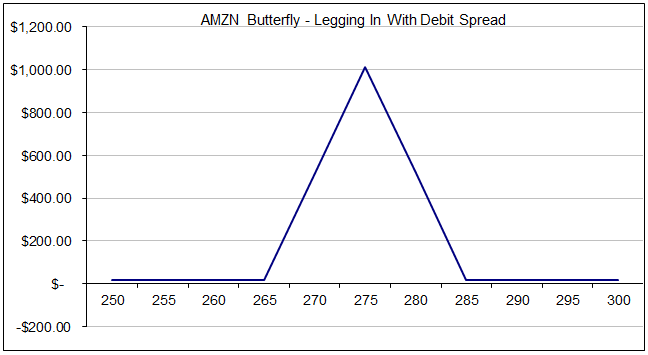

LEGGING IN WITH A DEBIT SPREAD

Legging in to a butterfly with a debit spread follows a similar logic to using a long call, but the risk and delta exposure is much lower. Taking our previous AMZN example, let’s take a look at how this might work.

Date: July 4th 2013,

Current Price: $265

Trade Details: Legging in to a butterfly with a bull call debit spread

Buy 1 AMZN July 19th $265 call @ $10.00

Sell 1 AMZN July 19th $275 call @ $5.75

Date: July 6th 2013,

Current Price: $275

Trade Details: Completing the butterfly with a bear call credit spread

Sell 1 AMZN July 19th $275 call @ $11.10

Buy 1 AMZN July 19th $285 call @ $6.70

Premium: $15 Net Credit

By legging in to the butterfly with a debit spread we have still managed to create a risk free trade, although our profit will be smaller than legging in with just a long call. Keep in mind though that our risk on the second trade is lower. We only had to use $425 to create the second position rather than $1,000.

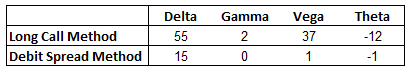

Let’s also compare the greeks of the two methods. You can see that there is a much larger exposure to both Delta and Vega when using the long call method. A slightly less significant consideration is the faster Theta decay, but considering you would only hold the long call for 1-2 days before completing the butterfly, this should not be your primary concern. The long call method of legging in has higher potential profits, but as you would expect, along with that come higher risks.

LEGGING IN WITH A CREDIT SPREAD

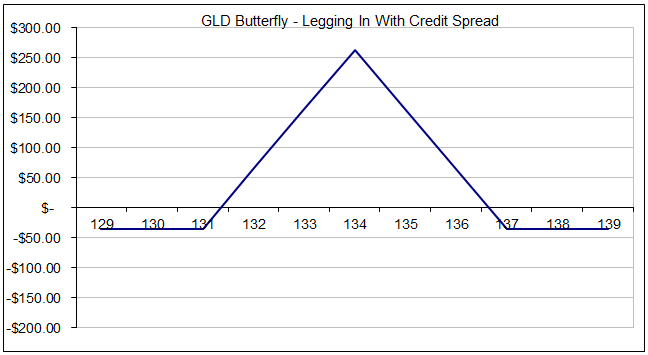

Another method for legging in to a butterfly would be to use a credit spread. As the previous examples have been on a rising stock, let’s take a look at a falling stock – GLD

Date: July 4th 2013,

Current Price: $135

Trade Details: Legging in with a bear call credit spread

Sell 1 GLD July 19th $134 call @ $4.25

Buy 1 GLD July 19th $137 call @ $2.81

Two days later, GLD has fallen to $134.

Date: July 6th 2013,

Current Price: $134

Trade Details: Completing the butterfly with bull call debit spread

Buy 1 GLD July 19th $131 call @ $5.15

Sell 1 GLD July 19th $134 call @ $3.35

Premium: $36 Net Debit

This trade example, doesn’t quite give you a risk free trade, but $36 is still very low and gives you a potential profit of $264.

Reasons with you might want to leg in with a credit spread rather than a debit spread include:

* Decreasing Volatility – If you think volatility will decrease, initiating the trade with a credit spread will give you a short Vega exposure

* Time Decay – Even if it is just 1-2 days, initiating with a credit spread means time decay is working in your favor rather than against you as with a debit spread.

If you are bullish on a stock, you can also leg in using a bull put credit spread. I won’t go through the details as I think you get the idea. Basically you enter a bull put spread to start, then once the stock has risen, you buy a bear put spread.

great post. many adjustments are possible with butterflies.

Do you have or know of any videos that I may watch on this Butterfly Spread so that I could get a better understanding on how this NO RISK B’fly spread works. “A picture is more than a 1000 words”. Other than that, I’ll just keep studying this strategy.

Sorry, I haven’t got any videos on this.

“You now have a riskless butterfly where you will make at least $550.”

Doesnt the time decay reduce this profit untill expiration? Why not taking off the trade to realize the profit? Sorry, I do not understand the idea.

Thank you!

Mark

Hi Mark. If the stock is within the profit tent, time decay is working for you, increasing profits.

Hi Gavin. What if instead of building a butterfly (ref. to this example with AMZN) to sell call 275, and to add a put debit spread with 275/265 to “box-in” the profit? I´m thinking about pro and cons of the butterfly and the “box-in”. What is your opinion? Thank you!