Today, we are looking at the best moving average for intraday trading.

We will learn about which moving averages to use and how to implement them correctly.

Let’s get started.

Contents

- Introduction

- What Are The Best Moving Averages For Intraday Trading?

- How Do Such Moving Averages Help To Initiate A Trade?

- How Can Such Moving Averages Help To Avoid Whipsaws?

- Advantages Of Such Moving Averages In Intraday Trading

- Bottom Line

Introduction

Intraday traders use moving averages as a tool for developing their trading strategies.

Such averages are used in isolation or in combination with other indicators.

Different moving averages are used depending upon the strategy.

Some prefer to use simple moving averages, while others use exponential moving averages by giving more preference to recent prices.

What Are The Best Moving Averages For Intraday Trading?

The best moving average to use for intraday trading is a subjective matter.

Typically, for an intraday scalper trading off 1-min charts, 10 & 20-period simple moving average (SMA) is enough to initiate a trade.

The intraday traders, i.e., those initiating positions from morning till the end of the day, prefer a combination of moving averages.

Two commonly used combinations are 12 & 24 SMAs and 5, 8 & 13 SMAs on a 5-min chart.

How Do Such Moving Averages Help To Initiate A Trade?

12 and 24 moving averages

The combination of moving averages helps in initiating an intraday trade.

Let us start with the first combination of moving averages, i.e., 12 & 24-period SMAs.

The rising moving average indicates the continuation of a trend.

Similarly, when a combination of moving averages is used, then the increasing distance between such moving averages signals a rising momentum in a rally.

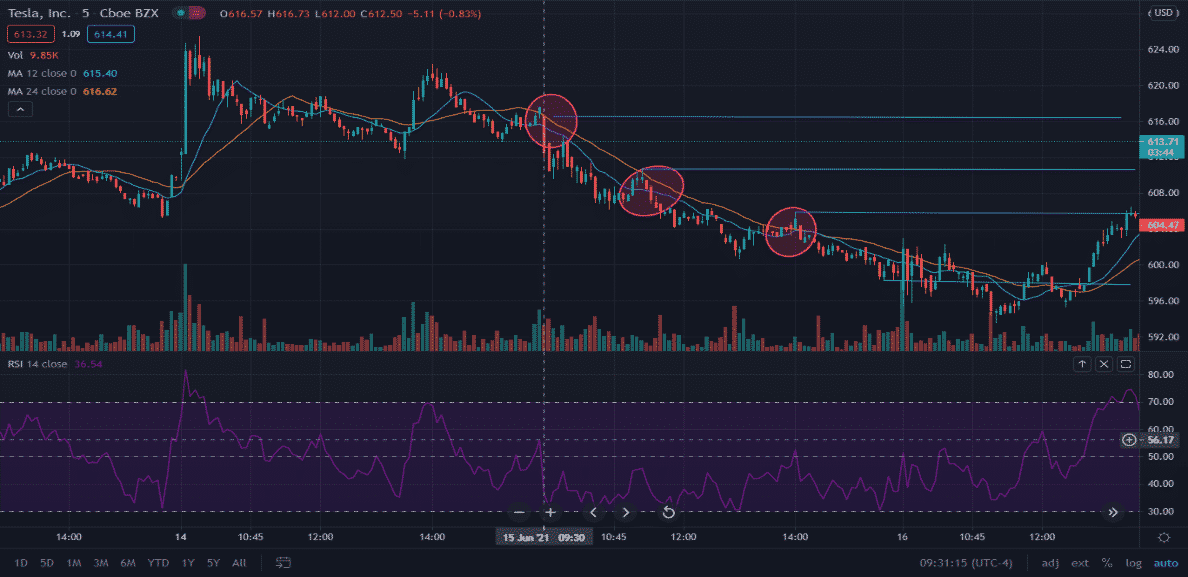

The chart below is of Tesla (TSLA) on June 15th, 2021.

Selling pressure was seen in the stock right from the opening at $ 616.65.

The price moved below the 12 SMA, which in turn was below the 24 SMA.

Traders can initiate a short trade when the price moved just below the 12 SMA at around $ 614.

The initiated trade can be continued by keeping the exit at the close of the candle above 24 SMA.

Increasing distance between the 12 & 24 SMAs confirmed the selling momentum.

The price tried to touch the 24 SMA at 11:15 a.m. but failed to close above it.

Around 2 p.m., the price gave a close above 24 SMA, and it would serve as an exit from the trade at around $ 605.

Such a combination of 12 & 24 SMAs can capture the intraday momentum in the stock.

The increasing distance between the averages confirms the strong rising momentum in the sell-off, which can be used for riding a trend.

5, 8 & 13 moving averages

The other combination of moving averages that intraday traders use is 5, 8 & 13 SMAs.

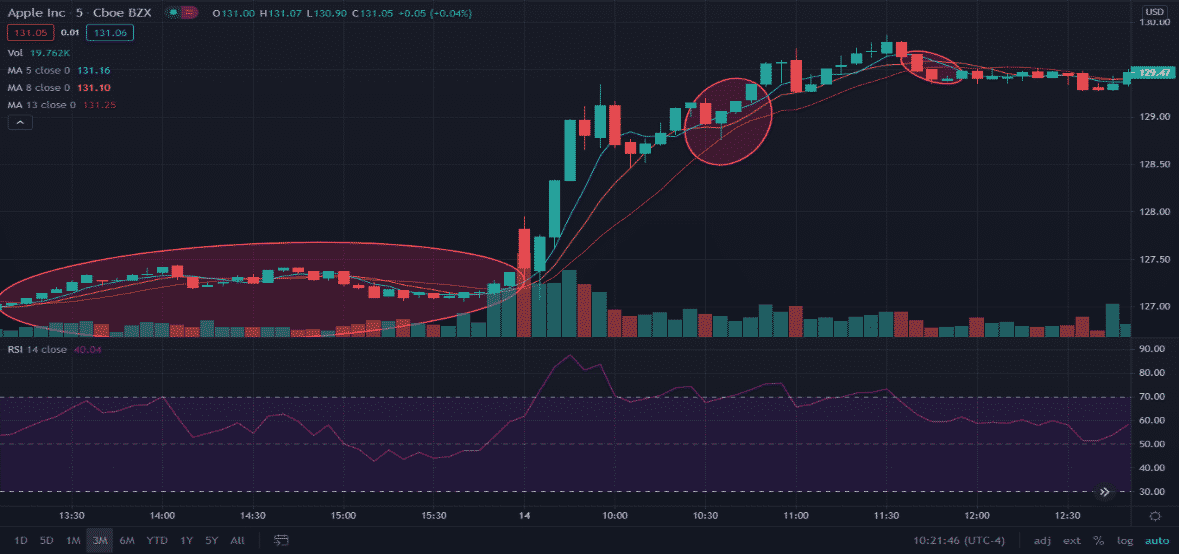

The chart below is of Apple (AAPL) on June 14th, 2021.

The stock consolidated during the closing hours of the previous session.

Stock was bullish at the start of the session, with the price moving above the three averages.

A long trade can be initiated above $ 127 when the moving averages 5, 8 & 13 were rising, with the 5 SMA leading the way.

The increasing distance between the averages signaled strong upward momentum.

Around 10:35 a.m., the price crosses below the 5 & 8 SMA but only to find its support at the 13 SMA.

Aggressive traders could exit the trade after the price crosses below 5 SMA or wait for the price to close below 13 SMA.

After this point, the moving averages flattened, and the price closed below 13 SMA around 11:45 a.m. An exit from the long trade could have taken place at around $ 129.35.

How Can Such Moving Averages Help To Avoid Whipsaws?

Moving averages signal a rising or falling trend.

While often the market listlessly moves along, there are periods of volatility which drastically expand a stock’s trading range.

Such scenarios pose a danger for the trend followers and momentum traders of quickly getting whipsawed in and out of positions.

Despite this, it is often said that capital preserved during whipsaws in volatile markets is also a battle won.

The whipsaws during volatile and trendless markets reduce the efficacy of the moving averages.

They tend to show multiple crossovers with no alignment whatsoever.

Traders should try to avoid this situation.

The chart of Microsoft Corporation revealed whipsaws during the morning session on May 27th, 2021.

There are frequent crossovers of 5, 8 & 13 SMAs with no alignment making the stock untradeable. Such scenarios are often better not traded.

Sometimes no trade is the best trade.

Advantages Of Such Moving Averages In Intraday Trading

- They signal the continuation of a trend by rising or falling prices.

- The increasing distance between the combination of averages such as 12-24 and 5-8 -13 signifies a rising trend.

- They help intraday traders to spot an optimal entry

- Can also be used to exit the trade when the price moves below and above averages for long and short trades, respectively.

- They help in avoiding trades during whipsaws in volatile and range-bound markets.

Bottom Line

Moving averages are often referred to as trend indicators.

Different combinations of such averages can be used to suit the trading needs of any individual.

Every trader needs to find their own mix and align it with their strategy and test it to see if it provides optimal results.

Intraday traders commonly use the 12 & 24 and 5-8-13 SMAs, though other combinations of moving averages can be used.

They should be used in the trending markets to capture the rising momentum in the trend and avoid volatile markets.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.