Contents

The AIC22 is a market-neutral options strategy that is designed for all market conditions.

It is not a completely new strategy.

Various incarnations of the strategies have been around for years with names such as the Weirdor and the 14-day asymmetric iron condor.

These are all strategies within the iron condor family.

Introduction

In March 2024, Amy Meissner updated and revamped the strategy and dubbed it with the new name of AIC22.

It is clear that the “AIC” stands for asymmetrical iron condor.

But it is not exactly clear what the 22 stands for.

It does not reflect the year the strategy was introduced because we are in 2024.

Since Amy was also the creator of the A14 strategy in which the 14 refers to the days-to-expiration (DTE) the trade started, one would naturally assume that 22 refers to 22 DTE.

After watching the YouTube video where she introduces the strategy, it is clear that this assumption is incorrect.

The AIC22 starts at 40 to 50 days to expiration but typically ends before 30 days in the trade.

Its target exit time is at 14 days till expiration.

It is a monthly strategy designed to be put on every month with no overlapping trades.

After watching the video twice, I think it became more transparent what the 22 stands for.

The first “2” refers to how the strategy works in rallies and crash market conditions.

The second “2” refers to the fact that there are two possible entry configurations depending on the trader’s directional bias at the time.

The “simplified” entry configuration is more bullish because it does not have the bear call spread piece.

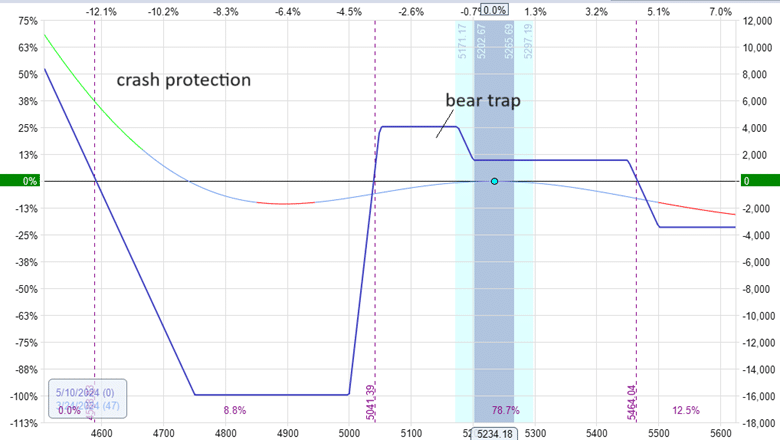

The “classic” entry configuration looks more like an asymmetric iron condor with a bear trap plus crash protection.

This strategy has a lot of pieces and can not be initiated with a single order entry.

AIC22 Trade Configuration

In Amy’s presentation, she does not reveal the exact configuration because the details are reserved for her paid workshop.

However, based on the expiration graphs that she presented, let’s see if we can reconstruct what the classic configuration might look like:

I can not say that I got the configuration exactly correct.

Perhaps you can try to mimic her expiration graph for practice to see how closely you can replicate it.

It is called an asymmetric iron condor because the upside risk is less than the downside risk.

The legs of the condor are asymmetric.

The notable piece in the expiration graph is the bear trap.

It is called the bear trap because if the market is bearish and prices march down, it can fall into that high-profit area of the expiration graph.

The bear is trapped.

It also has crash protection (with out-of-the-money put options, no doubt) so that it turns a typically downward-sloping T+0 line upwards and has the effect of flattening the T+0 line further; this is also how it can survive a market crash.

Frequently Asked Questions

How is the AIC22 different from the iron condor?

The AIC22 has a flatter T+0 line and is less sensitive to volatility changes.

How is the AIC22 different from the Rhino?

The Rhino is of the butterfly strategy family.

The AIC22 is of the iron condor strategy.

AIC22 has a more or less fixed margin, whereas the Rhino’s margin can increase and decrease quite a bit more due to its scaling in process.

How is the AIC22 different from her A14 strategy?

The A14 is a weekly strategy and requires more active management.

The AIC22 is a monthly strategy.

The A14 is a butterfly, whereas the AIC22 is a condor.

They are meant to complement each other and can certainly be traded at the same time.

What is the planned capital of the AIC22?

The planned capital usage of the AIC22 is $18,000.

An account size of at least $20,000 is recommended.

Although, the AIC22 can be modified to be half its typical size.

What is the profit target of AIC22?

With the simplified entry configuration, the profit target is 50% to 90% of the credit received.

With the classic entry, the profit target is 6% to 7% of the trade margin if no adjustments exist.

If there were adjustments, decrease this to 2% to 4%.

What is the theoretical win rate of the AIC22?

It is around 85%.

What is the underlying asset in which the AIC22 is traded?

It can be traded on the RUT or the SPX indices, which are the typical assets being traded on by market-neutral strategies due to their liquidity and relatively stable underlying.

Final Thoughts

Finally, the most important question people like to ask is what the performance of the AIC22 is.

Because of the good results, the performance statistics are not kept a secret.

There is just too much detail in this introductory article.

You can see all the detailed statistics in Amy’s presentation.

She shows manually backtested results from 2018 to 2023 on the SPX.

Amy shows manually backtested results of both the simplified and classic entries for the RUT for the year 2023.

She also backtested the trade through the Covid-2020 crash.

It is important to remember that all backtests are hypothetical because they do not reflect the impact of market factors such as liquidity, slippage, and commissions/fees.

Although she did show live results of the original AIC/Weirdor trades from 2014 through 2019, the results look equally good.

This is not to say anyone can just put on an AIC22 and expect the same results.

No.

Showing you the initial trade configuration is not the secret.

While the trade configuration can help, the key to her performance numbers is in her adjustments – when to adjust, how to adjust, and how much to adjust based on a reading of the market.

Also, when should we take profit, and when should we exit the trade?

While there are general guidelines, there is no exact secret recipe.

That only comes with practice.

Look at the number of backtests she manually practiced before going live with a new strategy.

And this is for a professional trader with two decades of trading experience.

We hope you enjoyed this article on the AIC22 trade.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.