Today we will continue the series of articles on adjusting calendar spreads.

We will discuss how to adjust LEAPS calendars and double calendars.

In the last article, we learned methods #1 and #2 on standard calendar adjustment of rolling the front-month short strike vertically or out in time for a credit.

In this article, we will learn methods #3 and #4 for adjustments involving LEAPS and double calendars

Contents

- LEAPS Calendars

- Method #3: Take ownership of the stock and sell covered calls

- Method 4: Double calendars

- Conclusion

LEAPS Calendars

LEAPS calendars are just like standard calendars, except that the back-month long option is a LEAPS (Long Term Equity Anticipation Securities) whose option expiry is at least a year out in time.

Because we are buying so much “time” upfront, we want a low price when implied volatility (IV) is low.

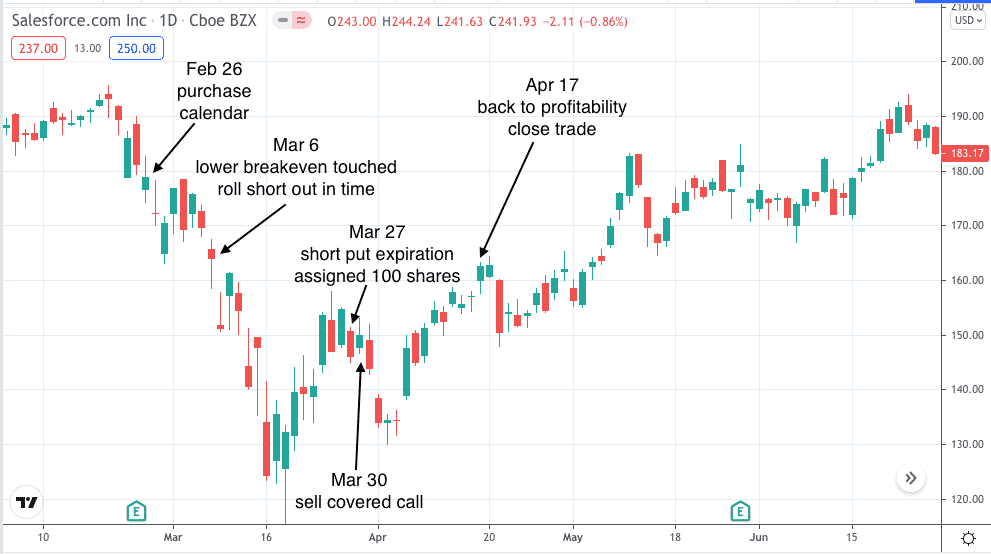

Suppose we buy a LEAPS calendar on February 26, 2020, one day after Salesforce (CRM) earnings announcement.

The IV of underlying drops right after an earnings announcement.

So that is also a good time to buy.

Date: Feb 26, 2020

Price: CRM at $178.87

Sell one Mar 20, 2020 CRM $180 put @ $6.25

Buy one Jan 15, 2021 CRM $180 put @ $19.53

Debit: $1328

Max Loss: $1328

The front-month option has 23 days to expiration (DTE), and the back-month option has 324 DTE.

Though this doesn’t meet the technical definition of being more than one year out, we will use the term LEAPS loosely.

The greater the time difference between the front-month and the back-month, the greater the theta value.

Right now, the position has a theta of 9.3.

Positive theta value is the mechanism for this spread to make money.

We want theta to be high.

The initial cost of the investment is $1328, and we are aiming for a profit target of $199 = 15% x $1328.

On March 6, the price is at the lower expiration breakeven.

If the price drops any more, we will start losing money.

Following our adjustment strategies in the previous article, we roll the short put out in time by one week, keeping the strike the same.

Date: Mar 6, 2020

Buy to close one Mar 20, 2020 CRM $180 put @ $15.78

Sell to open one Mar 27, 2020 CRM $180 put @ $17.40

Credit: $162.50

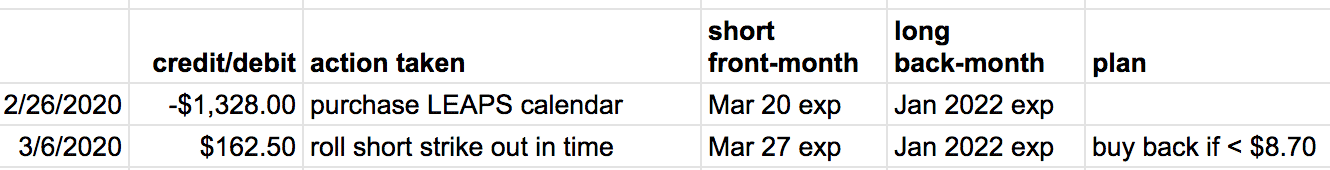

We received a net credit of $162.50 and tracked incoming and outgoing money in the spreadsheet below.

We also keep track of the new expirations of both options.

Because the March 27 put sale price was at $17.40, we plan to buy it back if its price drops below $8.70.

We are taking profits at 50% of max profit.

But that never happened because the price of CRM kept dropping due to the pandemic market selloff.

The price of the short option jumped to $55.65 on March 16, 2020.

This leg is losing money like crazy.

But fortunately, we are hedged with the long put, whose price ballooned from $19.53 to $61.35.

Doing the math, we get that the net effect is that our overall P&L is now –$595, which is a 45% loss of our initial investment of $1328.

Ouch! Still painful. But we didn’t expect this to come out all roses since we are stress-testing the LEAPS calendar through a severe market selloff.

Keep hanging on. On March 23, 2020, the short option had only days to live (DTL).

We see if we can roll it another week out for a credit at the same strikes.

But the price will not cooperate.

A debit is required.

Trying rolling out two weeks and three weeks.

Nope.

Rolling it out one month to the April 24 expiry will give a measly $7.50 credit.

Rolling it out to May 15 expiry will give a $125 credit.

We have four possible actions at this point:

- Call it quits and free up the capital in this trade by exiting the entire trade with the net P&L loss of –$505, or -38% of capital invested. Tip: do not over-allocate on these leveraged option instruments. If 100% of your portfolio is running these trades, then in a market move where all stocks move the same, your portfolio can be down 40% — a hole that is difficult to climb back out.

- Roll the short strike to May 15 expiry.

- Wait for expiration and get the option assigned.

- Close the short strike and leave the long put in place. In retrospect, one might say that this option would have been the best and would even be better if we exit the short option much earlier so that the long put can profit. However, when trading live at the right edge of the screen, that might not have been so clear at the time.

All four choices would have been viable.

Depending on what the stock does afterwards, each of the four options could have turned out to be the best.

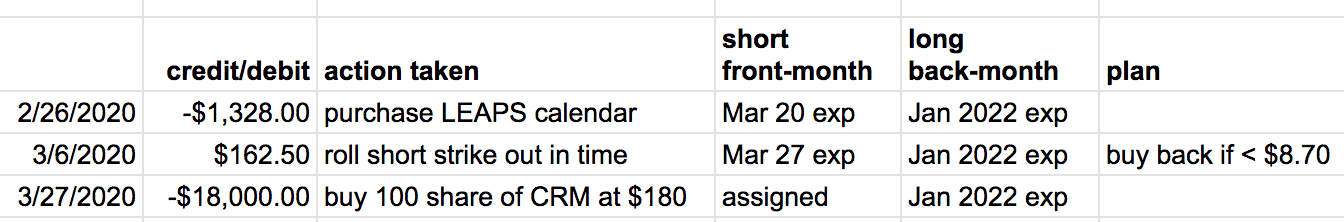

For our backtest experiment, we will let the short option getting assigned.

Method #3: Take Ownership Of The Stock And Sell Covered Calls

This method only works with put calendars (not call calendars) and should be used on good quality stocks (not indices) that you feel will recover and don’t mind owning.

Salesforce (CRM), part of the Dow Jones Index stock, fits this category.

Let’s suppose that we take ownership of CRM at the close on March 27.

The market price of CRM was $146.

But we would be obligated to buy 100 shares at $180.

We are comforted only by the fact that we can sell CRM back to the market at $180 per share anytime before the long put expiration on Jan 2021.

We now have a married put position:

One hundred shares of CRM, plus a protective put with a $180 strike expiring in January 2021.

This position has a defined risk with max possible loss of $1165.50.

If we had not been paying attention and panicked that we got assigned and exercised our long put to sell back 100 shares of CRM at $180, we would incur this max loss.

Currently, the value of our long put is $4240.

We don’t want to exercise and give that up, which includes giving up all the extrinsic value in that option.

No, don’t do that.

Tip: We need to have enough cash on reserve to buy 100 shares of CRM.

Otherwise, the broker can automatically exercise that long put for us, locking in the max loss of $1165.50.

As we stand, our net P&L is –$325.50 (use the spreadsheet to figure out how much we would get if we were to sell the 100 shares of CRM at $146 and sell the long put at $4240).

Let’s try to recover that $325 by selling covered calls.

We can not tell you what delta to sell at because every case is different.

You have to look at what the payoff diagram would look like post-sale.

Make sure the T+0 line is still upward-pointing so that you are making money as the stock price increases.

Don’t be too aggressive selling calls.

Calls to close to the money or in-the-money can make the whole position bearish, meaning that you lose money as the stock price increases.

Do not sell calls with strikes lower than the long put strike price.

That means the lowest call strike we are going to sell is $180. Selling the $180 call expiring April 17 gives a measly $21 credit.

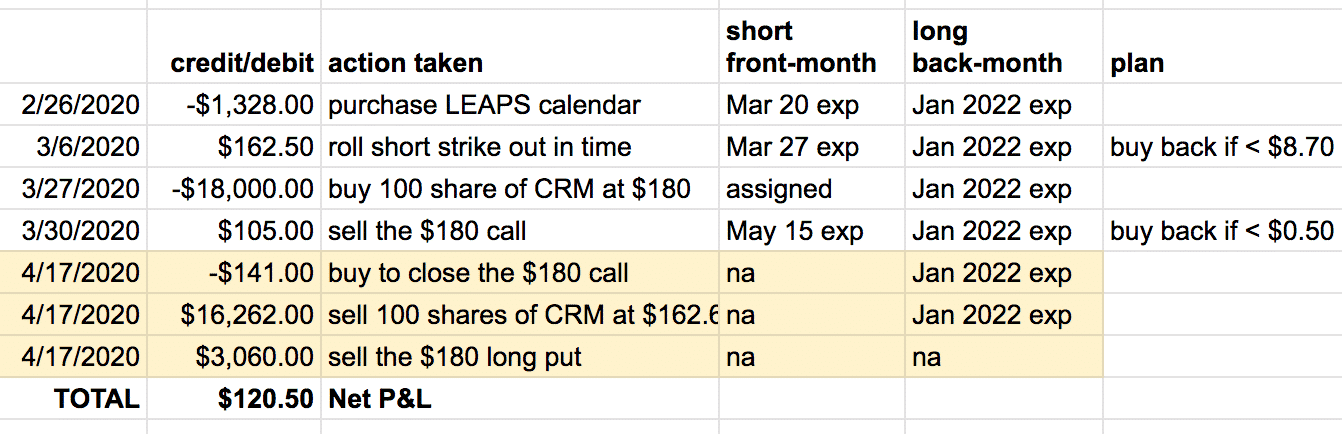

So instead, on Monday, March 30, we would sell the May 15 CRM $180 call to receive a credit of $105.

On April 17, 2020, the position came back into positive P&L.

How did we know?

In this backtest example, we looked at the historical option prices using OptionNetExplorer and performed the calculation in our spreadsheet.

In real-life trades, we would daily check the stock prices and options and determine what net credit we get if we were to liquidate all assets.

Time to exit the entire trade in the following order.

- Buy to close $180 short call for –$141

- Sell 100 shares of CRM at a market price of $162.62

- Sell the $180 long put for $3060

The long LEAPS put option gave us enough time for a quality stock to recover.

Method 4: Double calendars

The final calendar adjustment method applies to both standard calendars as well as LEAPS calendars.

Start with one calendar. Use put calendar if you think the stock will go down.

Use call calendar if you think it will go up.

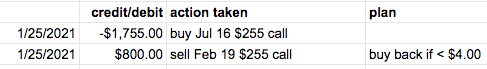

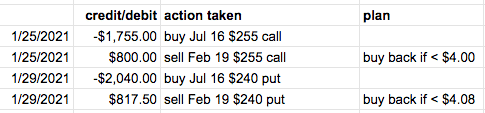

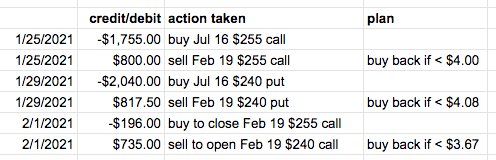

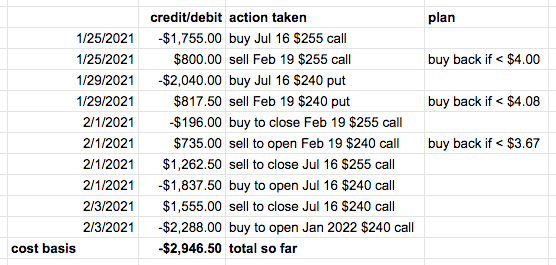

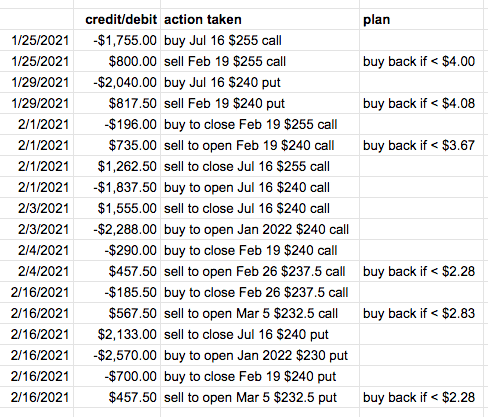

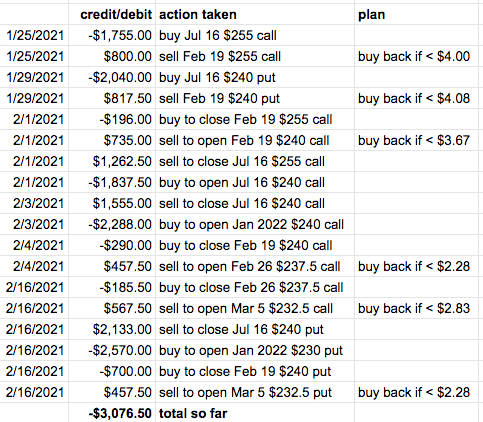

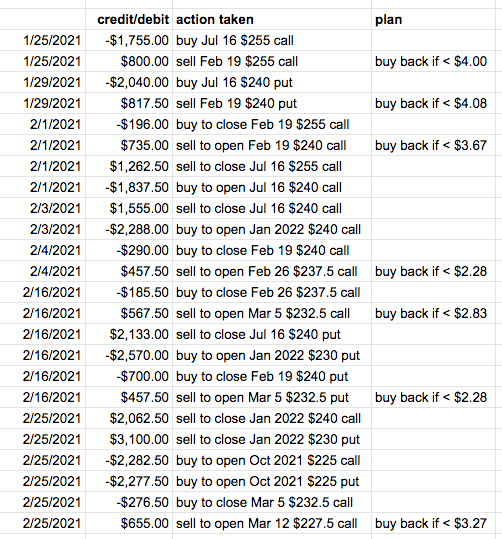

Suppose we use a call calendar on Amgen (AMGN) on January 25, 2021, with the back month expiry about six months away…

As the price moved down about 5% away from our strike price, we added the put calendar on January 29:

The total cost of both calendars is –$2177.50, and that is also our max risk at the current time.

It can change as adjustments are made.

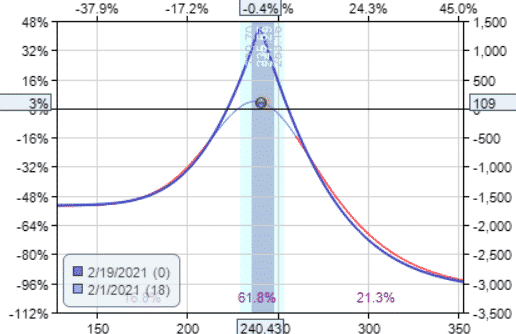

On February 2, the short call exceeded 50% of max profit.

We buy to close and sell another at-the-money call, receiving a net credit for the adjustment.

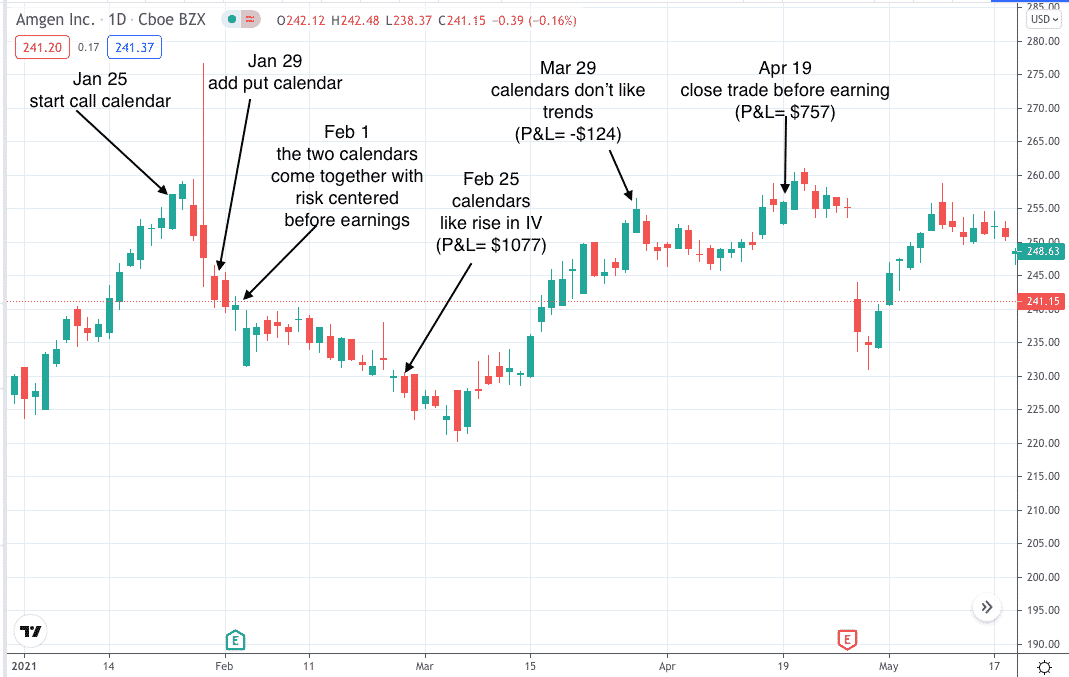

The resulting payoff diagram looks like this:

Making adjustments can change the max risk.

The risk has shifted with greater risk on the upside than on the downside.

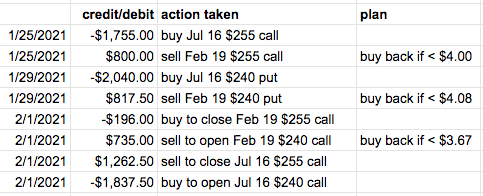

This occurred because move rolled the short call without rolling the long call, thereby creating a diagonal.

Sometimes this is fine.

However, we want the risk to be balanced going into any earnings announcement coming up on February 2 after the market close.

Hence, we balance the risk by rolling the long call to $240 to match the short call’s strike.

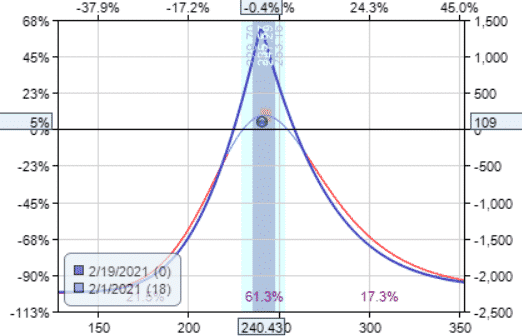

Now the risk is balanced on both sides.

While some investors will be calling this a double calendar, and they would be correct.

But we are not running the trade like a double calendar, which has payoff diagrams that shows two peaks.

Our payoff diagrams often have one peak because both calendars are on top of each other.

We are using the term “double calendar” to make this distinction.

When the strikes of all four legs are the same as in this case, we can also call this a calendar straddle.

This construction is very resilient.

Each leg is hedged by two other legs against price movements.

When price moves in one direction, two legs will profit, and two legs will lose.

This is a non-directional strategy.

Let’s keep an eye on the prices of Jan 2022 calls and puts.

If they become less expensive after the earnings announcement, we will want to buy them.

On February 2, before earnings, the prices are:

Jan 2022 $240 call: $24.43

Jan 2022 $240 put: $29.30

total for both: $53.73

On Feb 03 after earnings, the prices are …

Jan 2022 $240 call: $22.88

Jan 2022 $240 put: $30.52

total for both: $53.40

It didn’t change much.

However, the call might be worth getting.

We will have to buy them at some point because we don’t like to have our long options have less than six months till expiry.

The further away from the option expiry, the less time decay that option has.

We roll the long call from July to Jan 2022.

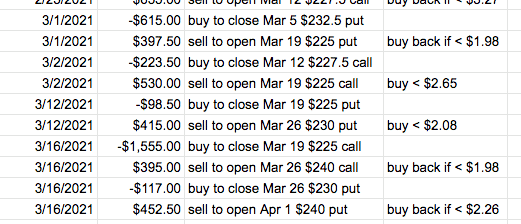

On February 4, take profit and roll the short call down and out in time.

And again on February 16.

Since the long put has only five months till expiry, we roll it to the Jan 2022 expiry to the at-the-money strike.

The short put is in its last week till expiration.

We roll it out in time, always to the at-the-money strike.

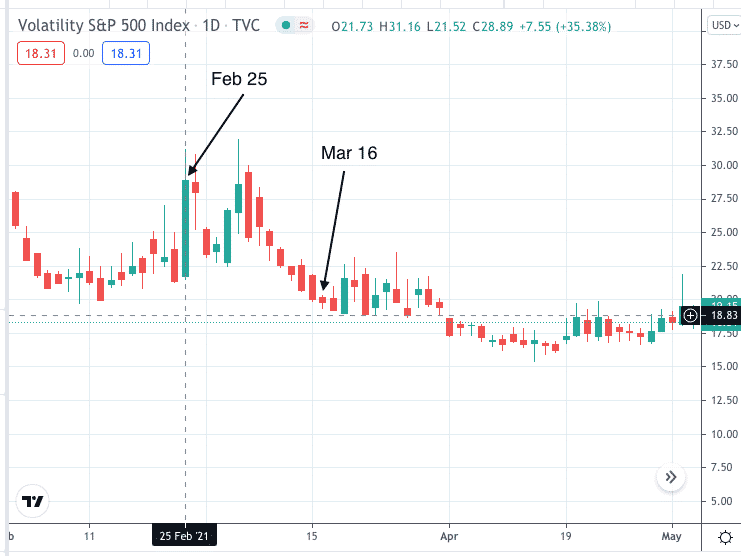

On February 25, we noticed option prices jumped due to a spike in the VIX.

Our long options are priced at:

Jan 2022 $240 call: $20.63 Jan 2022 $230 put: $31.00

The day before, they were,

Jan 2022 $240 call: $18.93 Jan 2022 $230 put: $26.65

With a jump in value like this, check our P&L and see how much we can get if we liquidate all assets.

Buy to close Mar 5 $232.5 put: $7.33

Buy to close Mar 5 $232.5 call: $2.77

Sell one Jan 2022 $240 call: $20.63

Sell one Jan 2022 $230 put: $31.00

We would get a credit of $4153.

Tallying the spreadsheet, we had put in only $3076 into the trade.

That is a profit of $1077, or 35% of the amount invested.

This should be enough for us to close the trade and take the profit.

But let’s keep going with this experiment.

At least we should take some profit off of those long options.

So we roll them forward in time from Jan 2022 expiry to Oct 2021 expiry, thereby selling off some of its day-till-expiration.

We all take profit on the short call by rolling down and out.

We continue with the various rolls in March,

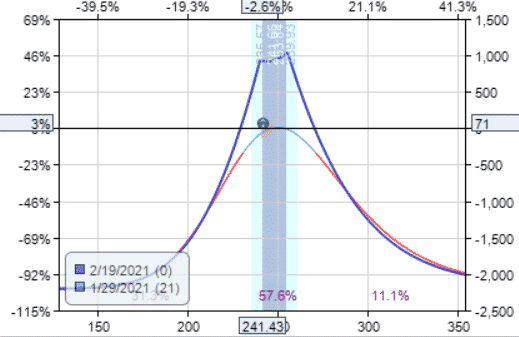

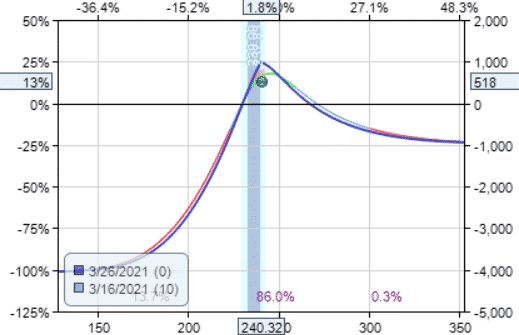

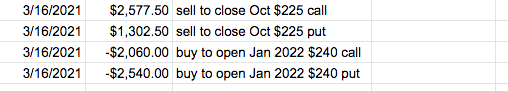

At this point, our P&L has dropped back down to $518.

And our risk graph is skewed.

By continually rolling the short options to the at-the-money strikes, the risk graph naturally gets skewed in the direction that the stock price is going.

In March, the stock price was going up.

The double calendars transferred the risk out of the upside to the downside, which benefits us if the price continues in its current direction.

However, if we want to maintain direction-neutrality, we can re-balance by rolling both long strikes to their corresponding short strikes.

Since we are rolling, let’s roll them out in time as well.

This is because VIX is very low at this time, meaning it is a good time to buy more long-term options.

Now it is back to being a perfectly centered calendar straddle.

With this configuration in place, we can stop watching the charts for a while and come back on March 22, the week of the short call expiration.

On March 22, the price is still within the tent; P&L has dropped to $329.

And the short put is ripe for taking profits.

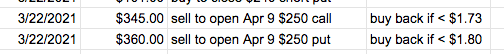

We roll both shorts to the April 9 at-the-money strike.

One week later, on March 29, the P&L was negative –$124.

Why?

What happened?

The chart shows that prices kept trending up in a straight line, and VIX kept dropping.

The calendar straddle losses money when the price trends and when IV drops.

It makes money when the price stays range-bound and/or when IV increases.

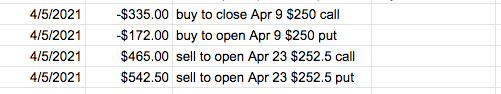

One week later, on April 5, P&L came back positive $272.

Time to roll the shorts further out in time.

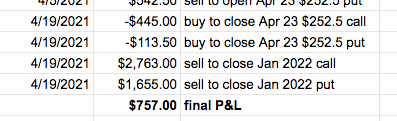

On April 19, the week that these shorts will expire, our P&L is showing a positive $756.

Earning is about to be reported on April 27.

Since we do not want to risk going through earnings, it is a good time to call it quits and exit the entire trade.

Conclusion

In this article, we’ve learned a lot.

Managing the double calendar or the calendar straddle or the double calendar (whatever you want to call it) is a bit different from managing a single calendar.

While in the latter, we want to make adjustments that give us a credit.

This is not always possible in the former since we have two opposing calendars (where if one wins, the other loses).

So, in that case, we simply roll the shorts of both calendars to the at-the-money strikes (these have the greatest extrinsic value to decay out).

The goal of all calendars is to profit from time-decay without letting major price movements take away those profits (which we saw that it did on March 29)

In most cases, the front-month options are mobile options, which we roll when making adjustments.

The long-dated long options are moved up or down in strikes to re-center the risk graph.

They are moved further out in time to “buy more time” when IV is low and option prices are cheap.

They are moved to a closer expiry to “sell time for profit” when “time premium” is high (which often occurs with high VIX and IV).

The value of doing this tedious manual backtest is to simulate the passage of time and accelerate our learning.

The paper trade started January 25 and ended April 19, where we have made many discoveries.

To learn those same discoveries would have taken four months.

The backtesting software we are using is OptionNet Explorer.

Hopefully, you can do more manual backtesting on your own to make new discoveries.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Great content, thanks!