Vega Definition

Vega is the measurement of an option’s sensitivity to changes in the volatility of the underlying asset.

Volatility measures the amount and speed at which price moves up and down, and is often based on changes in recent, historical prices in a trading instrument.

In simple terms, vega measures the risk of gain or loss resulting from changes in volatility.

Options tend to be more expensive when volatility is higher.

Thus, whenever volatility goes up, the price of the option goes up and when volatility drops, the price of the option will also fall.

Therefore, when calculating the new option price due to volatility changes, we add the vega when volatility goes up but subtract it when the volatility falls.

List of vega positive strategies

- Long Call

- Long Put

- Long Straddle

- Long Strangle

- Long Calendar Spread

- Double Calendar

- Double Diagonal

- Vertical Debit Spread

Possible trade plans

1. Huge market move. It’s fine to place a bet on a big move.

If the market were to rally or decline by 10% or more over a relatively short period of time, the option buyer should be able to earn a tidy profit.

Buy options that are not-too-far OTM and which that will become reasonably far ITM if your prediction comes to pass.

The options may seem dear, but if you are correct they will provide a handsome profit.

If you also want to bet on the direction of the move, you can save a lot of money by buying only calls or only puts.

If you want to plan on a big move, but one that is not large enough for your options to move deep ITM, then consider buying a bunch of OTM spreads.

Turning $0.50 or $1.00 into $5.00 is very possible.

If you do not have a directional play in mind, you can buy straddles, strangles, or both put and call spreads. That latter plan is the opposite of owning iron condors.

The risk: When buying premium, the trader has to be correct.

If the market move does not occur; or if time passes and IV does not explode; then the options are going to waste away to nothing.

2. IV Explosion. An alternative is to place a wager that IV will move a lot higher than it is right now.

That could be the result of a big market decline or simply a result of fear that comes with uncertainty.

If you believe America’s dalliance with the fiscal cliff is likely to provide that fear; if you are very bearish for some different reason; if you believe something startling will be announced; then betting that IV will increase is one way to go.

You could buy VIX options, but I must warn you that we have seen big (temporary) IV jumps without participation by VIX options.

These options use VIX futures as the underlying asset, and when the market participants see a rising IV but believe that IV will decline again by the time the futures settle, then VIX options do not tend to provide profits for their owners.

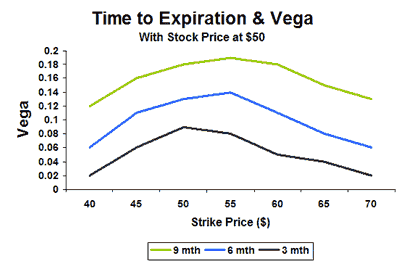

You could buy vega. The best way to do that is to own some options with a decent lifetime: perhaps three to six months.

If and when IV rises, those options are vega rich and should produce a handsome profit. Obviously you must select options on an asset whose IV rises.

The problem is that you have to be right without too much time passing.

However, there is a second chance to win.

IV may go nowhere, but if the underlying moves far enough in one direction, you could wind up with a very good profit.

A third plan is to buy gamma. Near-term options cost far less than longer-term options and decay rapidly.

However, they come with a lot of gamma and if you get the big move, the profits can be huge.

This is similar to loading up on vega because in either strategy, you become an option owner.

However, the real difference comes in choosing the lifetime of the options.

Longer-term options provide vega and shorter-term options come with more gamma.

Then you have the modified plan in which you buy lots of gamma but do not hold for the giant move.

Instead, you plan to adjust the position with some frequency (perhaps daily) in an effort to remain near delta neutral but earn profits by selling into rallies and buying on the dips.

This works very well when the market moves up and down, but provides disappointing results when the market makes a one-directional move.

-

- VIX Strangle.

Purchase VIX put options that expire 3 months out and are 2.5% out of the money and simultaneously buy 4th month call options that are 20% out of the money.

These positions are established each month on a date that is half way between the 3rd and 4th month expiration dates.

Two months later these option positions are rolled.

The put leg of the calendar strangle can help reduce the cost of the long call.

Typically, when hedging through purchasing an out of the money call option on VIX to gain protection against tail risk there can be an undesirable carrying cost for the position.

In periods of low volatility the long put position will benefit from the term structure of VIX futures pricing as the time to expiration for the option approached expiration.

The long call position will be in place to potentially benefit from market conditions that result high higher implied volatility for the market as indicated by VIX.

The general idea is that short term futures are declining faster than long term futures, and if VIX stays stable, the put gains will offset the call losses.

Basically the strategy will roll the trade every two months.

-

- Pre-earnings straddle. One of the most effective ways to go long volatility is buying a straddle option on a stock that is scheduled to report earnings. IV (Implied Volatility) usually increases sharply a few days before earnings and the increase should compensate for the negative theta. If the stock moves before earnings, the position can be sold for a profit or rolled to new strikes.

The ETF

If you plan to trade options on a specific ETF, be very careful. Do not take a long position in the double- or triple-leveraged products.

Yes, they are more volatile than the ‘regular’ ETF, but it is safer to stick with the investment that you understand.

The leveraged puppies act differently and are not constructed for anyone other than the day trader.

If you are going to bet on specific stocks, be careful. It is probably better to select a more volatile rather than a less volatile stock or ETF, but it is far more important to buy vega when IV is reasonably priced.

If you buy vega on a product with an historical volatility (HV) of 40 when IV is 60, you would be better off paying 30 IV for an ETF with a HV of 30.

At last you would not begin with a position that feels as if the premium is already too high. That is also risk management.

Kim Klaiman is a full time Options Trader and founder of steadyoptions.com – options education and trade ideas, earnings trades and non-directional options strategies.