Contents

The YieldMax ETFs uses a synthetic covered call options strategy to generate income from underlying equities symbols.

For example, the YieldMax ETF with the ticker symbol MSFO is based on the underlying asset of Microsoft stock (MSFT).

Similarly, for the following YieldMax EFTs:

- ABNY – underlying stock ABNB (Airbnb)

- AMDY – underlying stock AMD (Advanced Micro Devices)

- MRNY – underlying stock MRNA (Moderna)

- PYPY – underlying stock PYPL (Paypal)

- DISO – underlying stock DIS (Disney)

- JPMO – underlying stock JPM (JP Morgan)

- XOMO – underlying stock XOM (Exxon Mobil)

- TSLY – underlying stock TSLA (Tesla)

- OARK – underlying stock ARKK (ARK Innovation ETF)

- APLY – underlying stock AAPL (Apple)

- NVDY – underlying stock NVDA (Nvidia)

- AMZY – underlying stock AMZN (Amazon)

- GOOY – underlying stock GOOGL (Alphabet)

- NFLY – underlying stock NFLX (Netflix)

And many more. You can see the full list at yieldmaxetfs.com

What Exactly Is A Synthetic-Covered Call?

A synthetic covered call is a covered call on a synthetic stock position.

A synthetic stock position is constructed by selling an at-the-money put and buying an at-the-money call.

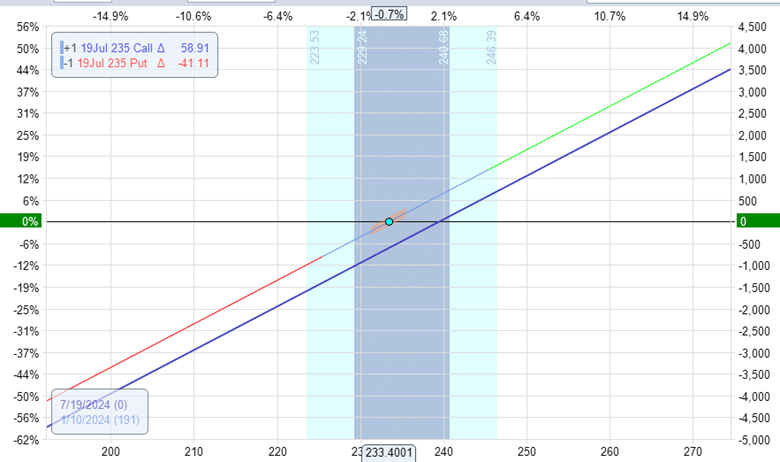

Let’s construct a hypothetical position in OptionNet Explorer so that you can see what the profit/loss graph looks like.

Date: January 10, 2024

Price: TSLA at $233

Sell one July 19, 2024, TSLA 235 put @ $29.08

Buy one July 19, 2024 TSLA 235 call @ $33.60

Debit: -$453

This creates the synthetic stock position:

The T+0 line is not exactly on the expiration graph.

This is because this position has negative theta time decay.

If the stock did not move, the position would lose money at expiration.

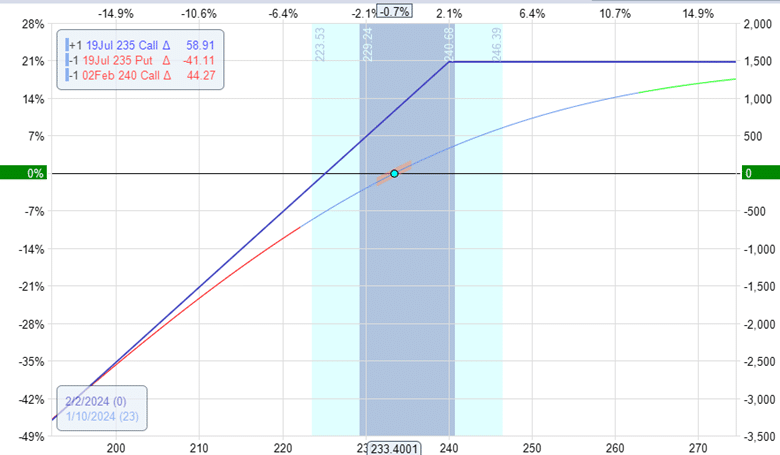

The YieldMax ETF would apply a shorter-term call option on this strategy…

Sell one February 2, 2024 TSLA 240 call @ $8.95

Credit: $895

The combined graph of the synthetic covered call will look like:

The upside is capped.

But the downside risk is unlimited.

Of course, I would assume that the fund manager will apply necessary risk management to prevent that from happening.

Nevertheless, there will be drawbacks to this strategy.

You can see the performance of their various funds on the website.

If you read their prospectus, you can find details of the strategy.

Their synthetic stock positions have expiration six months to a year out with the strikes of the call and put option near-the-money.

They sell covered calls 0 to 15% out-of-the-money with a short-term expiration of one month or less.

Their primary objective is to generate monthly income.

Their secondary objective is to gain exposure to the underlying stock price appreciation.

The strategy does not involve owning the underlying shares of stock. Hence, you do not get dividends.

However, the synthetic stock position uses less capital than a standard buy-and-hold stock position, so the extra capital is invested in risk-free US.

Treasury Bills.

Frequently Asked Questions

Can there be an ETF of an ETF?

Yes. An example is the OARK YieldMax ETF, which is based on the ARKK ETF.

Are YieldMax ETFs a good idea?

I recommend reading the 100+ page prospectus that is publicly available on their website to determine if these exchange-traded funds are right for you.

I cannot answer that question.

That is like asking a doctor, “Are statins good for me?”

To some people, yes. To other people, no – depending on their particular health condition.

Any financial strategy or vehicle can be good for one person and not for another, depending on their financial situation, risk tolerance, and investment objective.

These are questions more suited for a financial advisor.

I am not a financial advisor and cannot provide individual financial advice.

Can I implement a synthetic covered call strategy on my own?

Perhaps. It depends on your level of experience with options.

There are nuances to the strategy that need to be managed properly.

How the position is managed makes a big difference in whether the strategy is profitable.

For example,

How far out of the money to sell the call?

What is the price technical pattern determining the timing to enter and exit?

When should you exit the trade if the trade is losing money?

When to exit and roll the position?

Or hold to expiration?

In any case, it is better to paper trade it first before trying to trade a synthetic covered call live.

Conclusion

ETFs are very popular because you can buy and sell shares of ETFs just like shares of stock.

Today, we looked at the YieldMax ETFs, which use a synthetic covered call options strategy to generate income.

We now have ETFs on just about everything.

We hope you enjoyed this article on the YieldMax ETFs.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Would you do this with cash-secured puts or naked puts?