The YieldMax ETF is a family of ETFs (exchange-traded funds) designed to use option income strategies to generate income.

Contents

Each fund uses a particular underlying stock for its strategy. A few popular ones are:

TSLY: Options strategies on Tesla (TSLA)

APLY: Options strategies on Apple (AAPL)

NVDY: Options strategies on NVIDIA (NVDA)

AMZY: Options strategies on Amazon (AMZN)

FBY: Options strategies on Meta (META)

GOOY: Options strategies on Alphabet (GOOGL)

CONY: Options strategies on Coinbase (COIN)

NFLY: Options strategies on Netflix (NFLX)

For today’s example, we will use the APLY fund, which uses Apple (AAPL) as the underlying asset.

While these funds are sometimes known as using covered call strategies, that is not entirely correct.

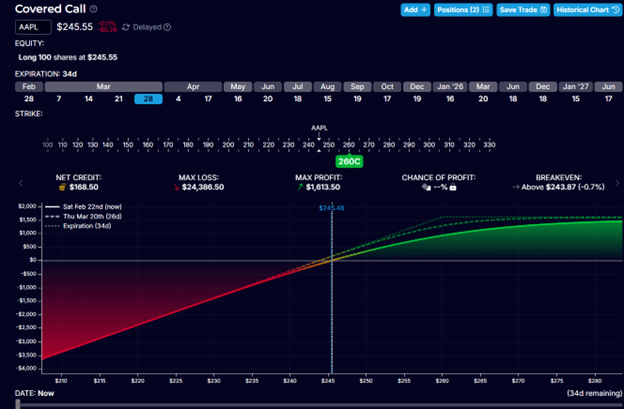

A traditional covered call option strategy sells one call option for every 100 shares of the stock owned and has the following risk profile:

Source: OptionStrat

However, as noted on the APLY fund’s page, the ETF does not invest directly in Apple stock; therefore, shareholders of the fund do not receive Apple dividends.

While the fund does not employ a traditional covered call, the ETF performance and risk characteristics are very similar to that of a covered call.

If the underlying asset increases in price, the ETF will gain profits – but only up to a certain point at which the profits are capped.

If the underlying asset goes down in price, the ETF will lose profits and may be “subject to all potential losses.”

The quote is from the fund’s page, but we can also see this downside risk from the risk graph shown above.

Income is generated from the premiums collected via the sale of option contracts.

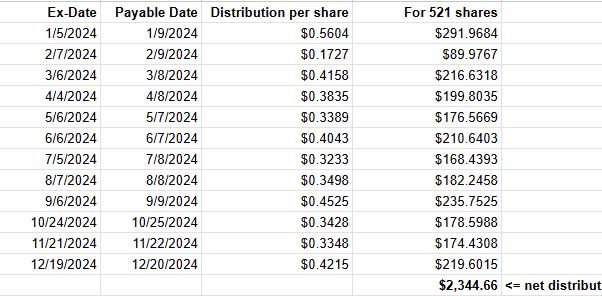

This income is then distributed to the holders of the ETF based on a distribution schedule:

Source: data from the APLY fund’s page

To receive the distribution, one must own the ETF on the date before the Ex-Date.

Suppose an ETF investor wants to spend $10,000 to buy 521 shares of the APLY ETF (which was trading at $19.19 per share at the start of 2024).

Then, the last column in the above spreadsheet shows the total amount of the twelve distributions the fund made to that shareholder in the year 2024.

This amounted to $2,344.66.

However, the NAV (net asset value) of the APLY fund dropped to $18.04 per share at the end of 2024.

With 521 shares invested in the fund, the investor lost $599.15 from the erosion of the fund’s net asset value.

($18.04 – $19.19) x 521 = -$599.15

Overall, the investor had a net gain of $1745.51 for 2024.

This represents a 17% return on an investment of $10,000.

How Does That Compare To Buy And Hold Stock Investors?

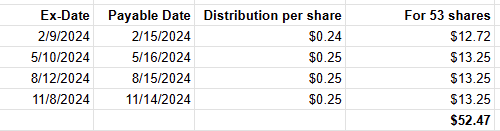

A traditional Apple shareholder who wants to invest $10,000 in Apple stock (AAPL) could purchase 53 shares at the start of 2024 when AAPL is trading at $187.15 per share.

At the end of the year, AAPL was trading at $250.42.

Apple had a great year in 2024; the investor made $3353.31 from the stock appreciation alone.

($250.42 – $187.15) x 53 = $3,353.31

Because the investor had the Apple stock directly, the investor was entitled to Apple dividends, which amounted to a total of $52.47 for the year.

A total gain of $3,405.78 represents a return of 34% for the year.

Final Thoughts

The APLY fund returned 17%, while the AAPL stock returned 34% in a bullish 2024 year.

The YieldMax ETF has the characteristics of a covered call.

Like a covered call, when the underlying asset does extremely well in price appreciation (like Apple did), the covered call style strategy will not be able to match its returns.

This is because the upside is capped in the option income strategy.

On the other hand, the option income strategy will likely beat the buy-and-hold strategy if the underlying stock does not appreciate at all.

The gain would come from the income generated from the option sales.

If in a downward market where the price of the underlying stock drops, the option income may compensate for the loss slightly but may not be enough to offset the losses of the underlying asset.

We hope you enjoyed this article on yieldmax ETFs.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.