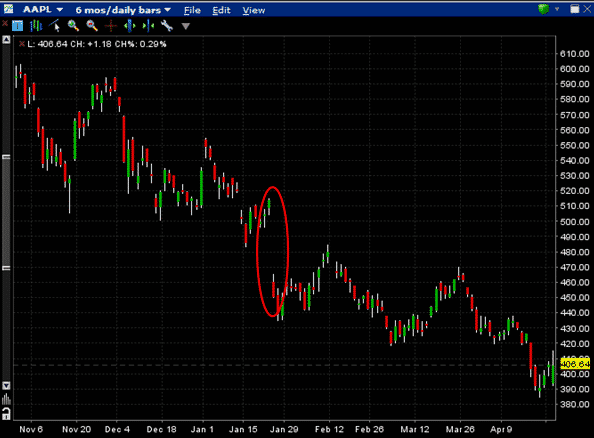

So many people these days are obsessed with certain stocks. AAPL, GOOG, NFLX, PCLN and CMG to name a few. These names have all had a lot of action over the last few years.

Everyone has their favorites that they just can’t seem to stay away from. Some of the banks like C, BAC and JPM have also been very popular with option traders.

Everyone wants to get a piece of the next ten bagger, but chances are you not going to strike it lucky and retire off one great trade.

Plus, watching so many different stocks, quite frankly gets tiresome. A while back I got so fed up of monitoring a portfolio of stocks and options, that I now just make between one and three trades per month.

I trade indexes rather than individual stocks and as such there is no earnings risk AND no risk of early assignment. Have you ever had an option exercised early? It’s not fun. Indexes are European style which means they are cash settled. There is no risk of early assignment.

If you look back over the last 12 months for the stocks mentioned above, you will see that they have all had significant gaps up or down. That’s great if you’re on the right side of the trade, but a disaster if you’re not.

There are a lot of traders who trade individual stock options and do it well. Some even specifically trade around earnings, looking to snag that big winner. Joe Kunkle is one guy who is successful trading like that.

Maybe it’s just me and my personality, but I’m more drawn to the non directional index trades. Consistently picking market direction is very difficult, as is predicting earnings related moves.

For me, non directional is so much less stressful and much easier to manage.

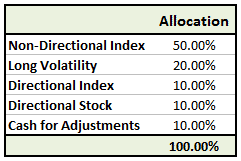

If you still want to keep trading those high flying individual names, that’s fine, but make sure you include some not directional option trades in you portfolio. A typical portfolio allocation might look like this:

If you want to learn more about portfolio allocations for options traders, just drop me a line.

This is a great article Gav!! In medium term, stock’s performance is primarily determined by overall market direction, sector performance and to a lesser extent on its own performance, in the same order of importance. Index trading comes with many great benefits: 1256 tax benefits, European style, diversification, no-earnings-surprise and liquidity. My vote is for index options 🙂

Thanks Option Oz, glad you agree!

How has the non-directional trades been working in this1% a day market? Seems like one side is always being tested and blown thru when using iron condors placed at the same time. Also is that the best strategy in this low vol environment?

Hi Mkt Monkey, the period around April-May was particularly tough. IV was low, so you had to place your short strikes a lot closer to the market, then when the 1% daily moves started, the positions were under pressure very early. The market was also very choppy so traders were adjusting their positions only to see the market move 2-3% in the other direction. Not fun. I was down about 2% in April, but up 2% in June so was flat over that period, but it was not an easy time for delta neutral traders.

Hi Gavin,

Thanks for the article.

I noticed that it is really not obvious for me to manage more than four positions per month due to my work. Two main positions that I carry out every month are Iron condors on RUT and SPX. In addition, another IC on GOOG (and the like) and a diagonal Call Spread on a low volatile stock (like HTZ) for the long term (I use LEAPS Calls).

However, I am looking for another delta neutralize strategy to add to my portfolio, each month like the IC, as a generating income. I was thinking of Double Diagonal Spreads but would be happy to have your advice.

Thanks,

Josefico

Hi Josefico,

Yes, Double Diagonals would be good, or you could try the Bearish Butterfly.

https://optionstradingiq.com/trading-course-replay/

Gav.

Hi Gavin, love your articles and advices. Stocks options are more likely to be manipulated, so yes, better to weight more index than stocks options.

Regards from Spain

Hi Andy, thanks for stopping by and commenting. Spain is a great place, I hope to get back there someday.

Hi Gavin, maybe you are right i prefer to trade index option too. but only to focus on non directional move you only can trade iron condor or maybe spread, for this trade you need a very high premium and the return is very less.

Yaa i want to know the alocation

Hi Gav

Would be great to get more info on portfolio allocation.

Thanks

Thanks Mik, will see what I can put together for you.

I second the request for more on allocations. Also, can you give examples of the “Long Volatility” allocation? Thanks!

Hi Gav,

That’s a really good point you make. So what Indexes do you trade?

Cheers

Mostly RUT and SPX. Occasionally NDX.

Hi, I’d love to learn more about portfolio allocations for options traders.

— Ken

If you want to learn more about portfolio allocations for options traders, just drop me a line. – See more at: https://optionstradingiq.com/why-you-need-to-stop-trading-stock-options-today/#sthash.6uaIkD74.dpuf

Please contact me … 561-395-0691

I am having difficulty getting much yield from my SPY ICs in this low IV market. I’m getting only 5-8% premiums when I set up the ICs every month. Can you give a specific example of how you are setting up one of your index ICs for March?

Thanks!

I’m not. Haha. Vol is too low for me so I am looking at other strategies right now.

Ahhh! Care to share your favorite strategy and index for this low volatility environment? I’ve been selling naked puts and covered calls to fill the void.

I’ve been doing some cash secured puts. Also a strategy called a Trapdoor which I have developed. Then also bearish butterflies and diagonal call spreads once market get too far extended to the upside.

Awesome, thanks for the great info!

Hi Gav

Great post. I do like to buy call spreads at the money in selected stocks when the market seems to be on a sustained strong rise (ie since December) as the probability and expectancy is on your side. You can manage them with along index positions if you set them up with an order to sell. But you can do this also with SPY. So agreed a portfolio approach is a good idea and you can allocate some funds to stock options.

Looking forward to your next instalment!

Great comment David. Sounds like your trading is going well which is great to hear.

what are your returns for 2017 ?. Some of the directional traders made killing anywhere from 30% to 100%.

14.3%. I aim for around 12-18% per year. I don’t trade directionally and I don’t take on too much risk. 100% returns are great, but you need to take on a lot of risk to get those returns.