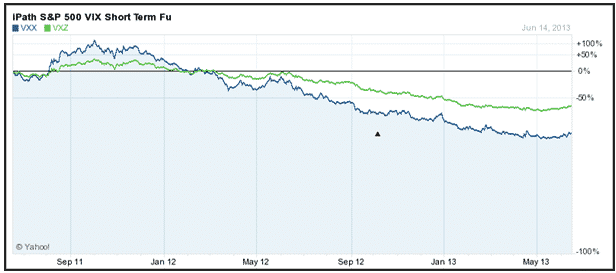

VXX vs VXZ. What’s the difference? The key difference is that VXX is based on short-term futures (month 1-2) and VXZ is based on medium term futures.

Contents

Gauging market sentiment is an important aspect of generating income within the capital market.

Most equity traders follow the direction or a stock or index in an effort to capture capital gains, dividend income or a combination or both.

Markets can either move up, down or sideways, but can also be categorized as either volatile or complacent.

To capture movements that are either volatile or complacent investors can trade options or investment products that mimic implied volatility.

Implied Volatility

Stock options are investment products that give an option buyer the right but not the obligation to purchase or sell an underlying stock at a certain price on or before a specific date.

Options are valued by market participants who estimate the value of an option by using an options pricing model.

The most popular model is the Black Scholes options pricing model.

Options pricing models use a number of inputs which include the current price, the strike price, time to maturity, current interest rates and implied volatility.

Implied volatility is the markets estimate of how much a security will move over a specific period of time on an annualized basis.

Changes to implied volatility greatly affect the value of an option.

As fear infiltrates its way into investor’s psyche, implied volatility rises increasing the price of options.

When complacency gathers strength implied volatility generally declines, reducing the price of options.

Trading options on stocks or indices with the goal of capturing implied volatility is a sophisticated process, but there are a number of products that can be used to mimic implied volatility many of which follow a specific index.

The VIX

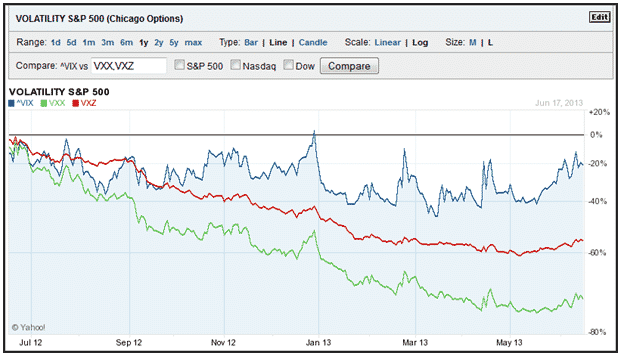

The VIX volatility index attempts to capture the implied volatility of the S&P 500 index “at the money” call and put options. Essentially the VIX gauges fear and complacency and allows investors to monitor option premiums through and index.

The range of the VIX over the past 3-years is 12 to 48.

During the peak of the European debt crisis the VIX hit 48%, and generally the VIX is negatively correlated to the direction of stock prices. For example, as the S&P 500 index climbs, the VIX generally falls.

As the S&P 500 declines, the VIX generally rises.

Volatility ETN’s

The expansion of investment products over the past decade has increased investor interest in products that are tied to numerous assets which include implied volatility.

There are a plethora of choices that are currently listed on major exchanges that provide investors access to investment products that attempt to mimic the returns of the VIX volatility index.

Two such investment vehicles are the iPath VIX Short-term Futures Index (NYSE:VXX) and the iPath VIX Medium-term Futures Index (NYSE:VXZ).

Both of these exchange traded notes have robust liquidity.

Exchange traded notes are investment products that are designed to provide access to the returns of specific indices or baskets of stocks.

The returns of ETNs are gauged to match the performance of a benchmark. When an investor buys an ETN, the underwriter promises to pay the amount reflected in the index, minus fees.

The note is a senior, unsecured debt security issued by an underwriting bank and backed only by the credit of the issuer, without collateral.

VXX vs VXZ

Let’s compare VXX vs VXZ:

VXX is an exchange traded note which attempts to replicate the S&P 500 VIX Short-Term Futures Total Return Index.

The index provides risk to rolling long positions of the front month and back month futures contract trading on the Chicago Mercantile Exchange.

The futures held by the underwriter of the index are continually rolled from the first month contract to the second month’s contract through the course of the month.

VXZ tracks the S&P 500 VIX Medium-Term Futures Total Return Index.

The index provides risk to rolling long positions in the 4th, 5th, 6th and 7th VIX futures contracts traded on the Chicago Mercantile Exchange.

The futures are also continually rolled from shorter dated contracts to longer dated contracts throughout the course of the month.

Contango

Investors who purchase VXX or VXZ exchange traded notes are exposed to long option volatility.

For that benefit they need to pay a premium similar to a stock option buyer. The futures held in VXX or VXZ are similar to long positions in “at the money” call and put options on the S&P 500 index.

The time decay that is inherent in “at the money options” is therefore transferred to VIX futures contracts.

With this in mind, one can understand why back month contracts will have a greater price than nearby contracts, with the difference mainly made up by time-decay.

When a back month futures contract is greater in value than a front month contract the term structure of the futures curve is said to be in contango.

The contango in the VIX futures market is one of the reasons for the poor performance of VXX and VXZ over the past couple of years.

This leads one to believe that the historical volatility needed to compensate for owning “at the money” call and put options generally does not actually occur.

The large contango priced into the VIX futures makes owning them over the long term a losing proposition.

VXX has a more volatile return profile given its exposure to shorter term VIX futures contracts than the VXZ.

The contango of the front month versus first back month contract, which the VXX is exposed to, is generally greater than the contango between the 4th and 5th month contract which is the roll exposure of VXZ.

Over the past 3-years VXX and VXZ have seen extreme volatility during the heart of the European debt crisis and robust returns, as well as extreme complacency which has led to very poor performance post that period.

The VIX as an index seems to display tendencies of a mean reverting stochastic process, which can be traded using tools such as Bollinger bands which capture a distribution. VXX and VXZ are different given their holdings which are VIX futures.

Low levels of implied volatility, combined with a steep contango in futures markets, led to declining values of the VXX and VXZ. With this in mind, iPath announced in 2012 a 1-for-4 reverse split on VXX.

The VIX is a solid measure of implied volatility.

Both the VXX and the VXZ attempt to capture the returns of the VIX by using an ETN that holds VIX short-term or medium-term futures contracts.

The contango in VIX futures reflect the time-decay of the options that the VIX futures seek to replicate.

Historically the returns of the VXX ETN and the VXZ ETN have lagged the VIX because of the steep contango associated with VIX futures.

Thanks for great article! Have one question. You may know XIV which is basically the opposite of VXX. It’s ETN as well and the only difference is that in XIV you are shorting first two months of VIX futures. I was wondering what would happen if both VIX futures shoot up overnight, say, by 200 %, which is not imposible. Correct me if I am wrong but in that case, the value of ETN would be negative and the question is, whou would pay the bill.. Issuing bank or holder of ETN? Any ideas? Thanks for any imput 🙂

Hi Jay, that is a good question, and I don’t know the answer to be honest. Shoot me your email address and I will try and find out for you.

Thanks, that would be great. Please, let me know if you find anything. My email is jezzi/at/centrum.cz