If you’re an options trader and you aren’t paying attention to volatility, then you are missing out on a chance to gain a significant edge.

If you can master implied volatility then you will put yourself ahead of most of the other traders out there.

Implied volatility is perhaps the key component when determining:

1. What trading strategy to utilize

2. When to enter, adjust and exit trades.

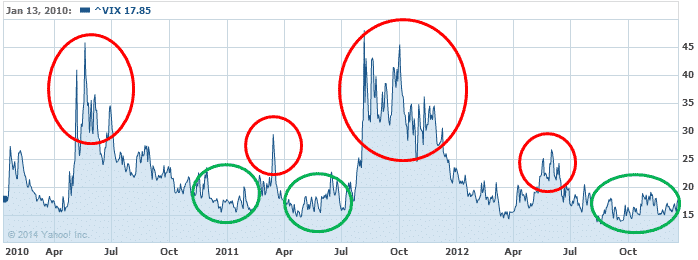

Take a look at this chart of volatility from 2010-2012 and think about what strategies might make sense during the different areas highlighted.

It doesn’t take a rocket scientist to know that you should be trading short volatility during the red circles and long volatility in the green circle.

If you’re not looking at volatility on a daily basis, then you are missing out on a significant edge. Start working an analysis of VIX, RXV and VXN into you daily or weekly rituals and your trading will improve as a result.

Have a think about where volatility is right now compared to the recent past. Should you be short or long volatility right now?

Remember to check out my free eBook, Volatility Made Easy – Effective Strategies For Surviving Severe Market Swings by clicking the box below.