The market is breaking out to all-time highs and it seems every man and his dog is buying in. When your taxi driver starts telling you what stocks he’s buying, it’s time to SELL, SELL, SELL!

However, as the old saying goes, “the market can stay irrational longer than you can stay solvent”. That certainly rings true right now and, while I think stocks are looking a little toppy, I would not be aggressively shorting them right now.

I do have a couple of reasons for not buying into this rally which I will outline below.

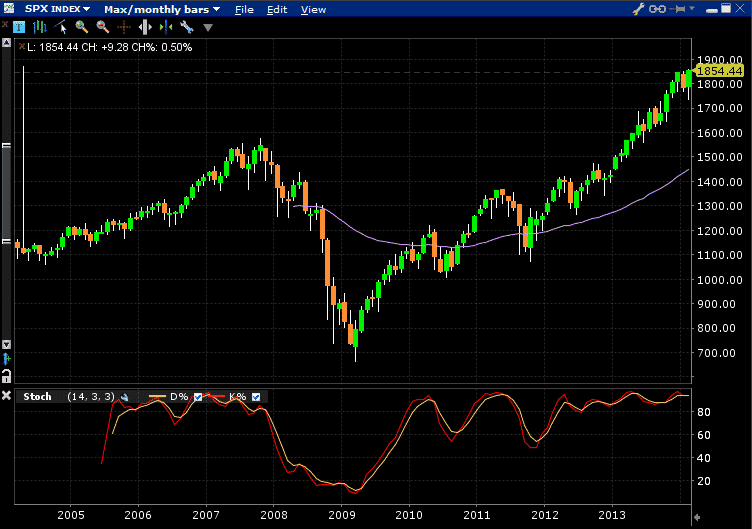

First and foremost, look at the monthly chart. Holy moly! That is about as overbought as you will ever see it.

MONTHLY SPX CHART

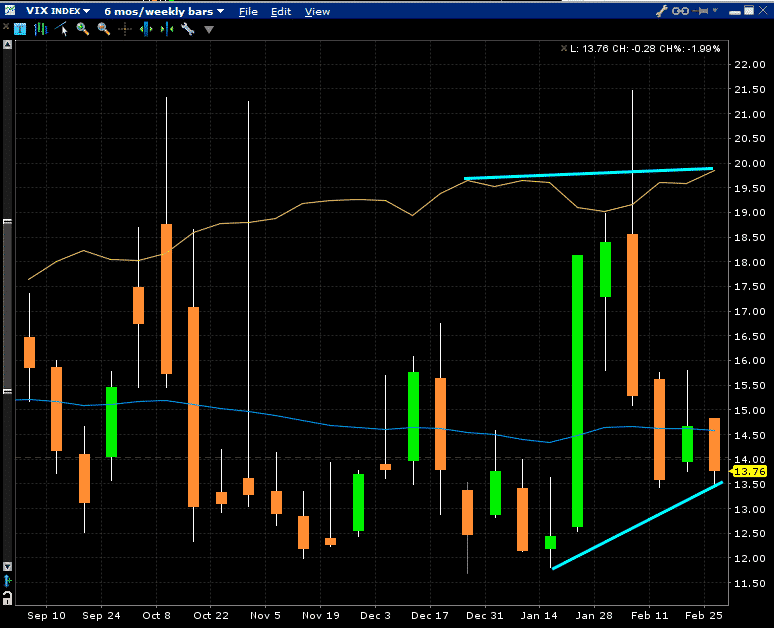

Secondly, despite the market, quickly recapturing the highs after the recent selloff, VIX is much higher than it was the last time stocks were at these levels. This signals to me that there is more fear in the market and is an example of negative divergence.

VIX COMPARISON WITH SPX

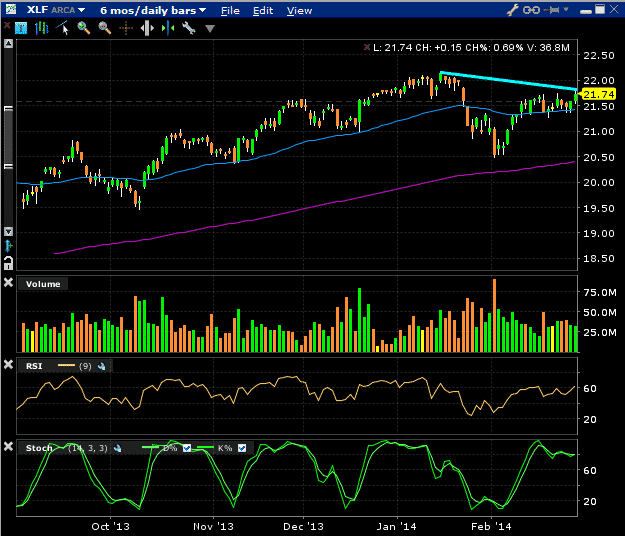

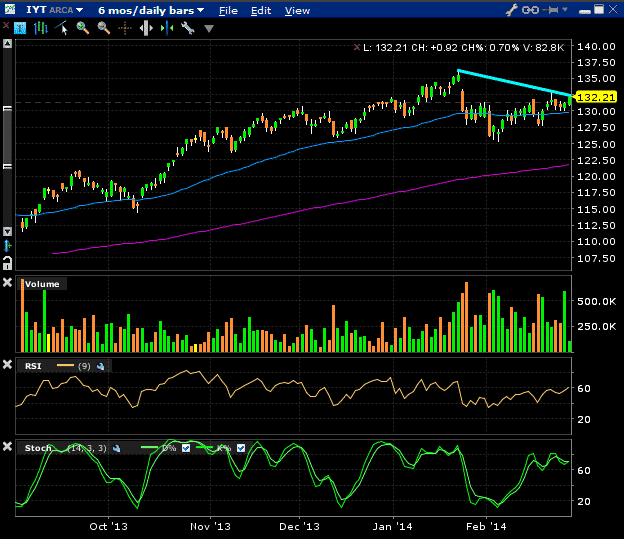

Finally, two very important sectors of the market have yet to confirm the all-time highs. Those are the financials and the transports. In a strong bull market, you want these sectors leading.

XLF – FINANCIALS

IYT – TRANSPORTATION ETF

I’m not aggressively shorting this market, but I will not get aggressively long either.