Stocks have been very choppy lately and selling pressure has started to pick up. That being said, the dips buyers have been out in force since yesterday afternoon.

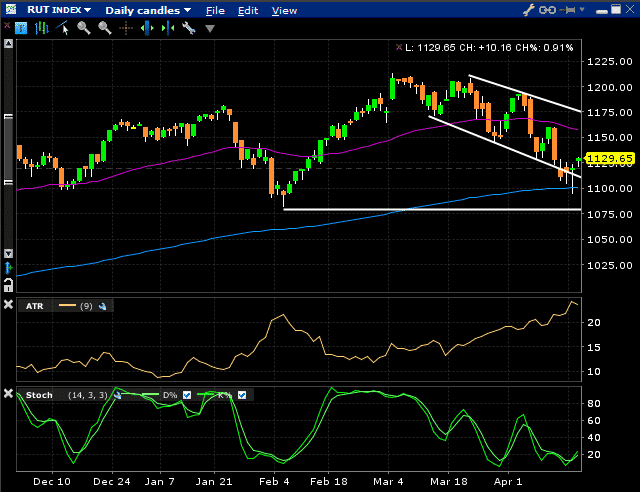

RUT and NDX have been particularly volatility with the daily range of the former picking up. Over the past 6 months you could expect a 10-15 point daily range in RUT, but that is now picking up to 30-40. The ATR in RUT has jumped from the low teens to the mid 20’s as you can see below.

We are oversold on a daily timeframe and there is room for this bounce to continue, but expect 1150 to provide resistance which is the location of the declining 200 day moving average.

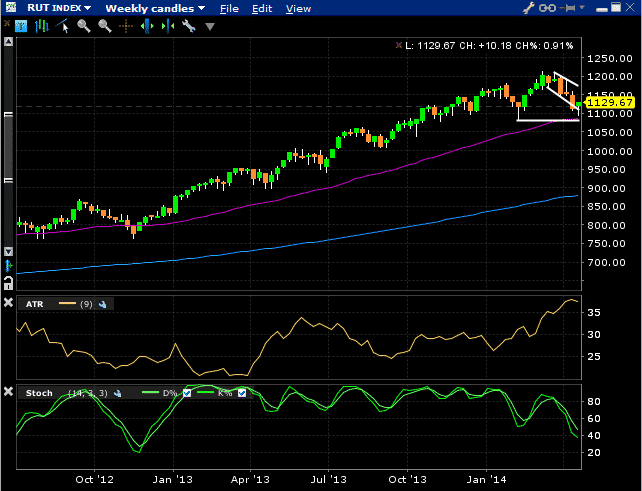

The weekly timeframe was overbought for a very long time and the indicators are now heading lower. On the weekly timeframe there is room for lower prices ahead.

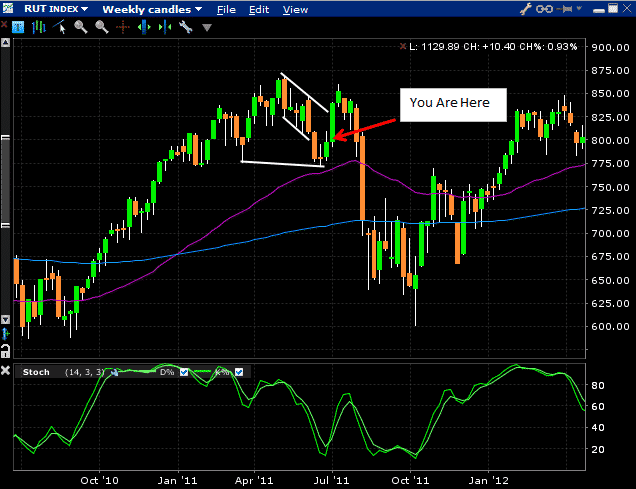

The current RUT chart reminds me a lot of 2011. We had a long and sustained rally before a couple of mid-sized corrections. We got a big bounce in July 2011 before a severe drop in August of around 25%. Of course, the economic backdrop in 2011 was a lot different with the Eurozone crisis and US Fiscal Policy dominating the headlines. Still, could there be some other economic issue lurking beneath the surface that come up to bite us just as weakness is starting to creep into the market? There is definitely the potential for something like that happening.

Here are a couple of trade ideas you could employ in today’s market:

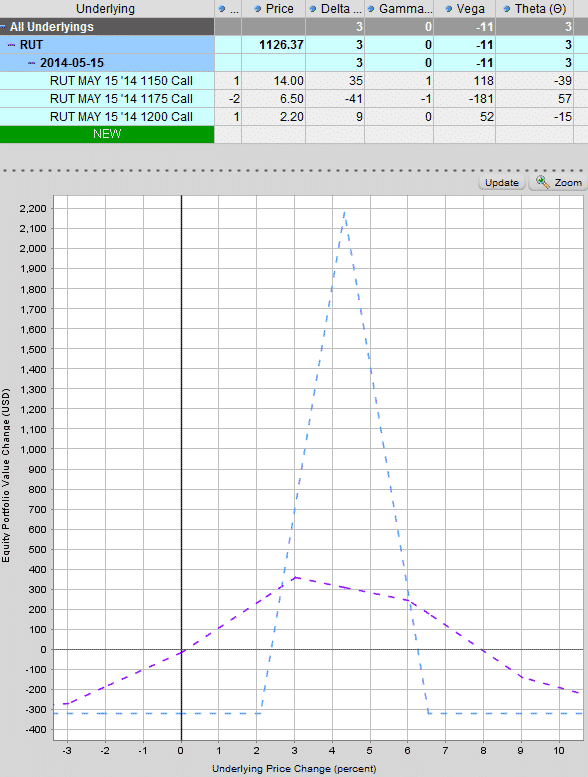

RUT BULLISH BUTTERFLY

If you think RUT is going to retrace this recent pullback and head back up to the highs, this is a great way to play it. Bullish butterflies are very cheap and you will not get burnt if you are wrong on the direction early on in the trade. The downside is that you have a fairly narrow profit zone, and you also don’t want RUT to get up to 1175 too soon. Right around expiration would be perfect. The purple line in the graph below is 3 weeks from now.

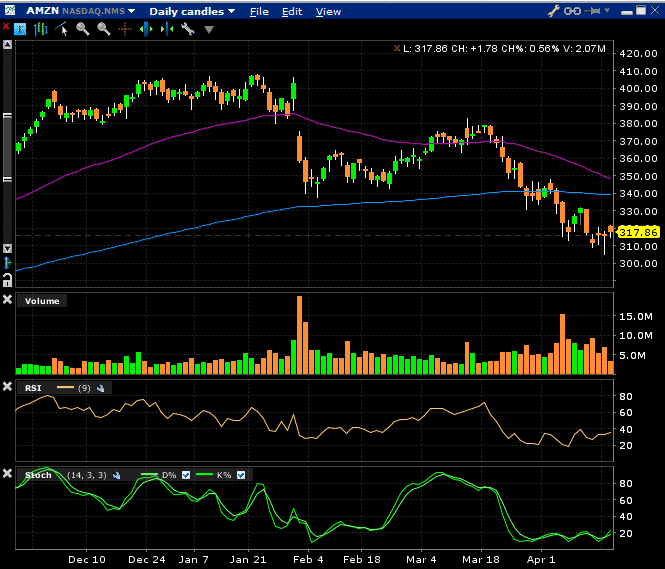

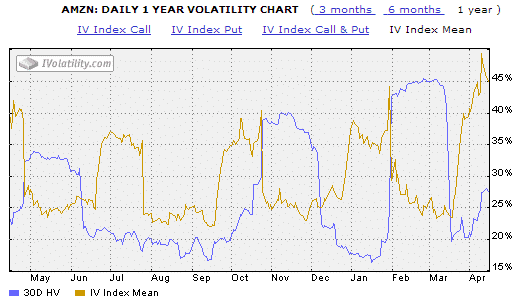

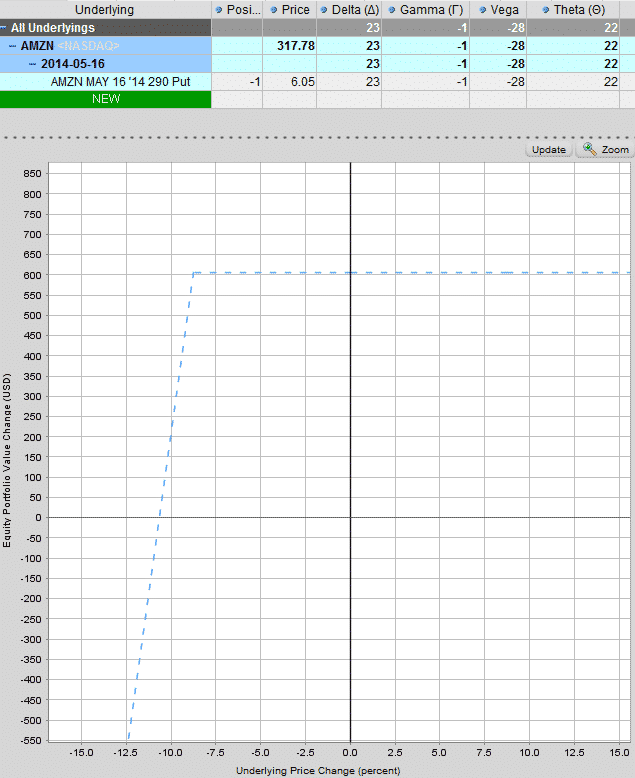

AMZN CASH SECURED PUT

AMZN has been crushed lately, but seems to be putting in a short term bottom. The chart is very oversold on a daily timeframe and volatility has spiked to 12 months highs. If you like AMZN and are looking at getting into the stock, a cash secured puts can be a great way to do it. Keep in mind that earnings are on the 21st! Expect $300 to provide a floor in the short-term.

If AMZN drops below 290 and you are assigned you can then sell a covered call on the stock. This is something that we looked at in detail during the recent trading course.

If AMZN drops below 290 and you are assigned you can then sell a covered call on the stock. This is something that we looked at in detail during the recent trading course.

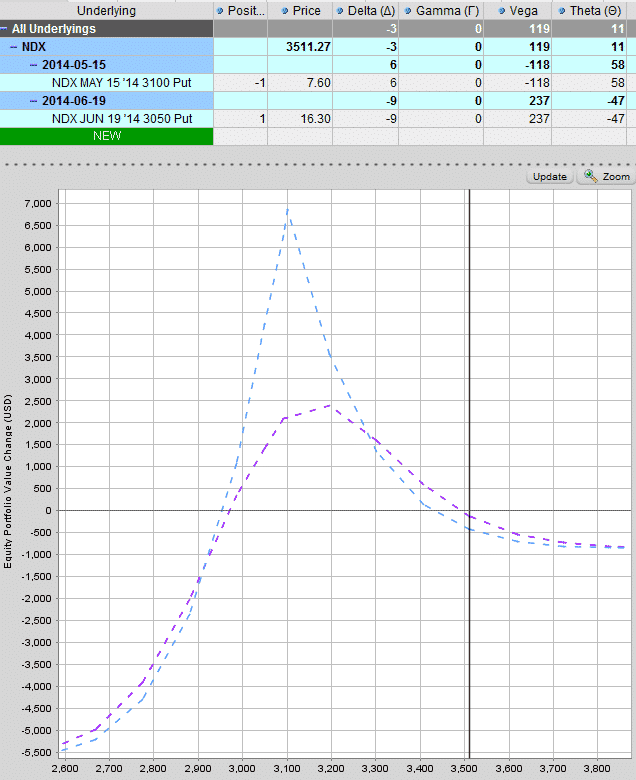

NDX BEARISH DIAGONAL SPREAD

If you think this is just the beginning of a more pronounced decline, a bearish diagonal spread on NDX could be the way to go. This trade has limited risk on the upside and has a large profit potential on the downside. It’s positive Vega so that will help in the event of a market decline. This is a low risk, high return way to play a potential market crash.

Remember to check out my free eBook, Volatility Made Easy – Effective Strategies For Surviving Severe Market Swings by clicking the box below.