Investors and traders alike had a bit of a scare over the past few weeks with the Nasdaq and Russell 2000 declining precipitously and threatening to derail this 5 year bull market. After becoming deeply oversold, these indexes found support near their 200 day moving averages with RUT bouncing 40 points in two and half days.

Five year bull markets do not die overnight, however we are not out of the woods yet as we still have a serious of lower highs and lower lows. While the S&P 500 is back near all-time highs there are definitely some warning signs starting to develop.

There have been a number of distribution days lately so keep an eye on volume as light volume rallies should be viewed with scepticism in this environment. I’ll be watching the financials (XLF) and semiconductors (SMH) for any sign of weakness, as well as the 50 and 200 day moving averages on the major indexes. Momentum stocks have been crushed recently as well and they should provide a good leading indicator of risk appetite going forward.

The RUT chart looks very similar to June 2011 as I pointed out here, and I think the market has one last rally in it before a bit of a wash out. It has been over 15 months since the Russell has had a 10% correction, so it is well overdue.

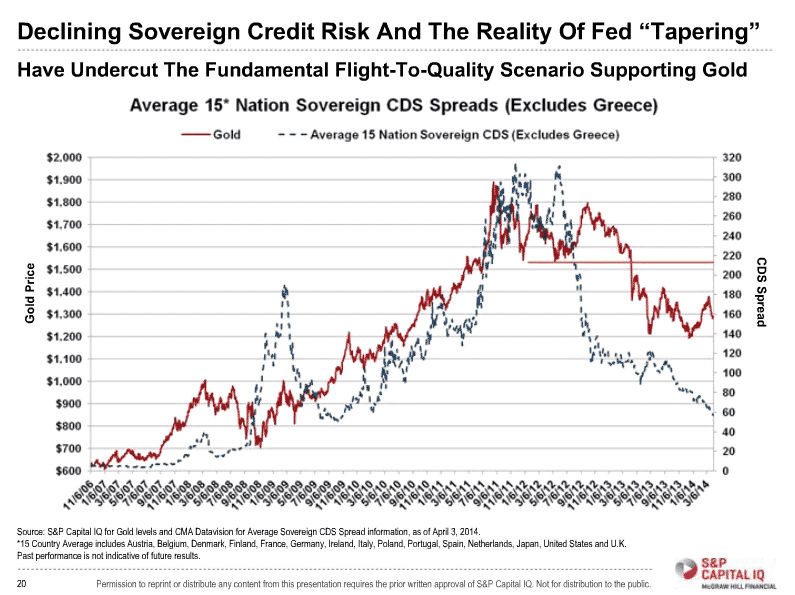

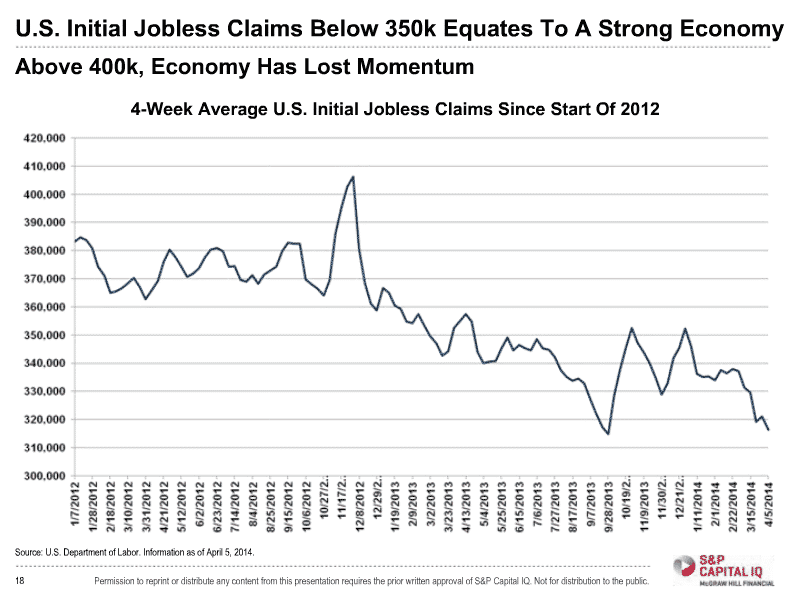

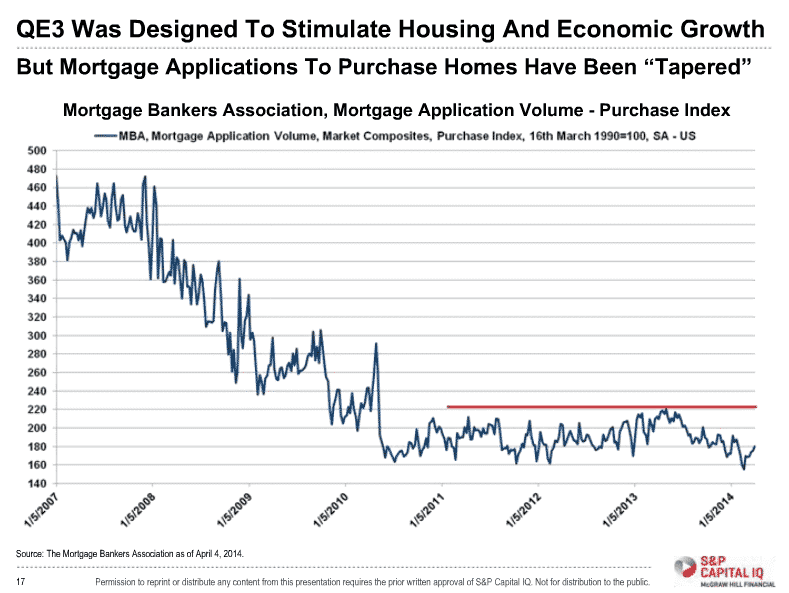

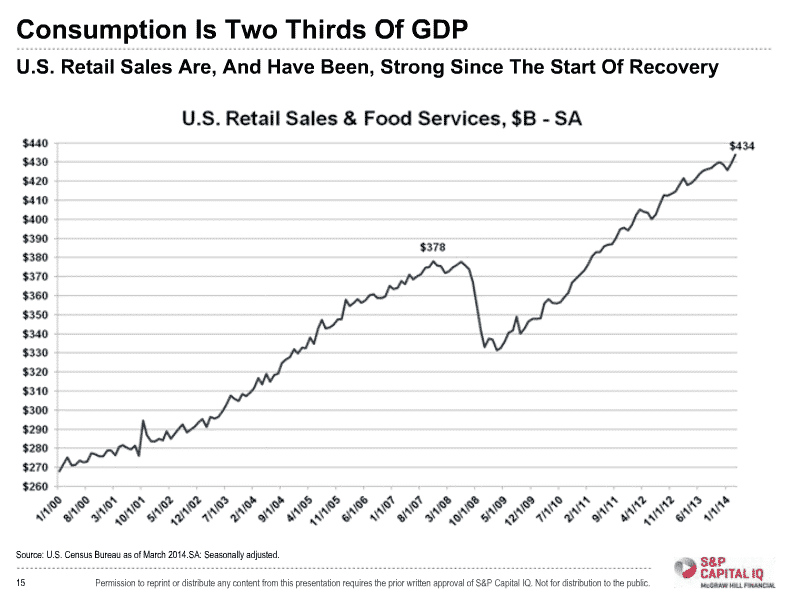

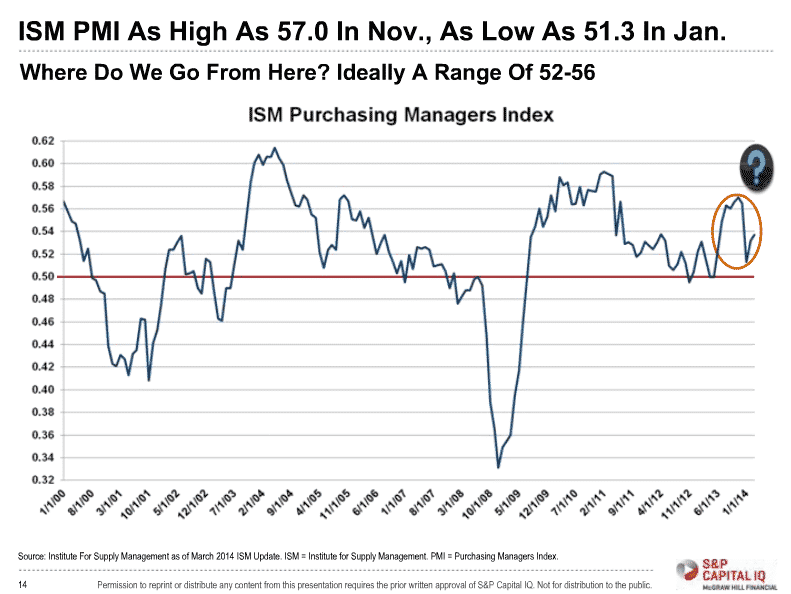

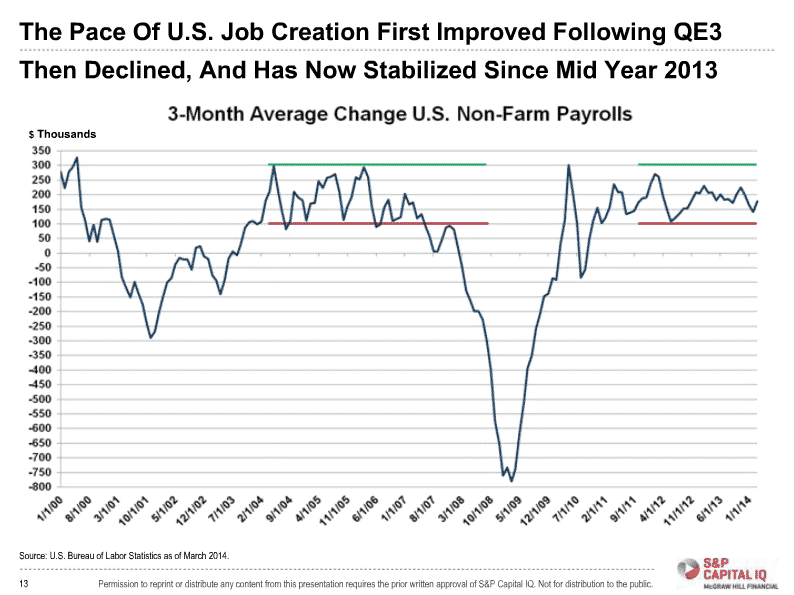

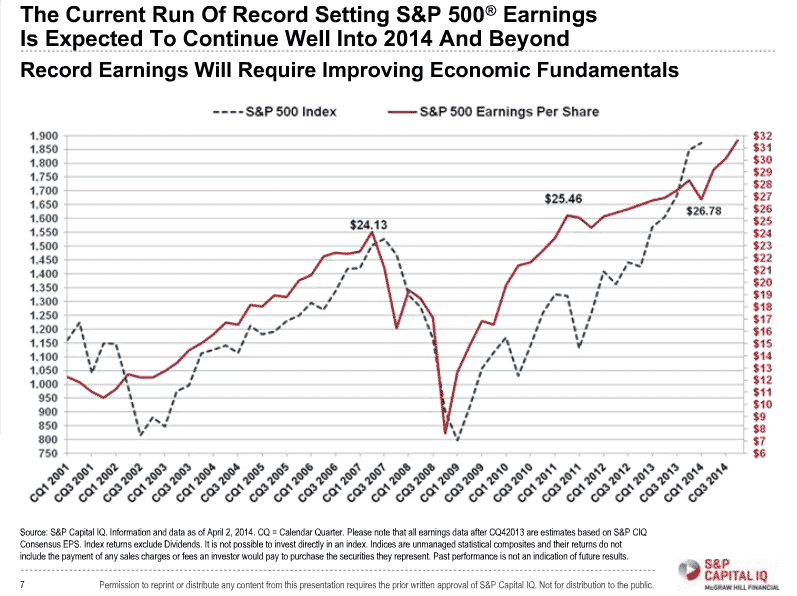

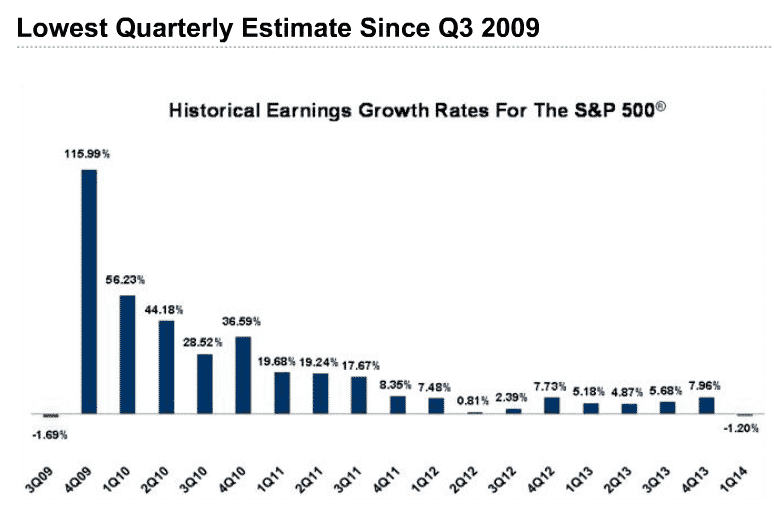

I attended the Standard and Poor’s market outlook webinar last week and took the following screenshots which you might find interesting.

Enjoy.

Thanks for sharing the fundamental charts from S&P CIQ. Very good data perspective.

No problem, Kevin. I find there market outlook webinars pretty good, although I usually just watch the replay and skip the bits that don’t interest me.

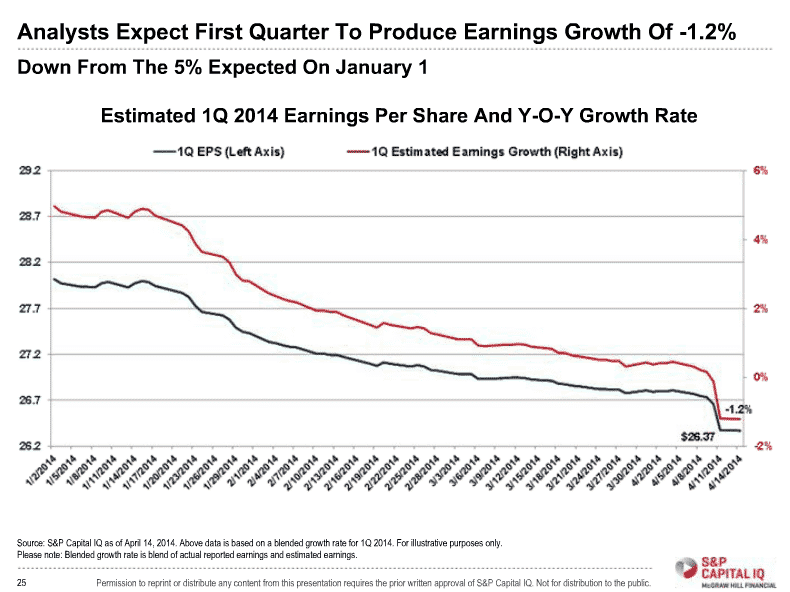

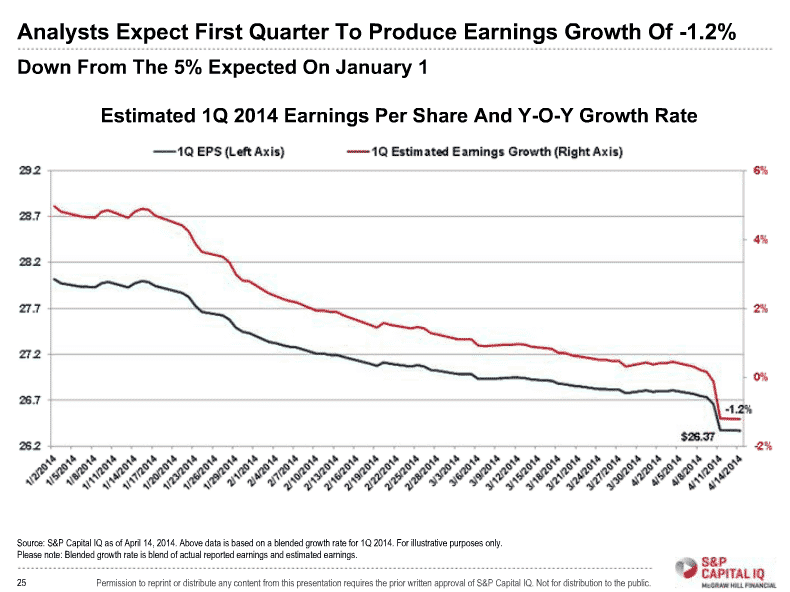

I was particularly interested in their outlook for Q1 earnings and they are predicting a pretty sizeable decline.