Stocks go up and down, and it seems in recent years, the pace of those advances and declines has accelerated rapidly. From the flash crash in 2010 to the severe drop in August 2011, it’s seems volatility is here to stay. So, how can you use that to your advantage?

If you’ve been reading this site for a while, you will know that I’m very big on teaching people how to trade volatility. I firmly believe that if you can start to understand volatility and how to trade around it, you can develop a significant edge in the markets. The recent spike in volatility allowed us to enter some nice short volatility trades.

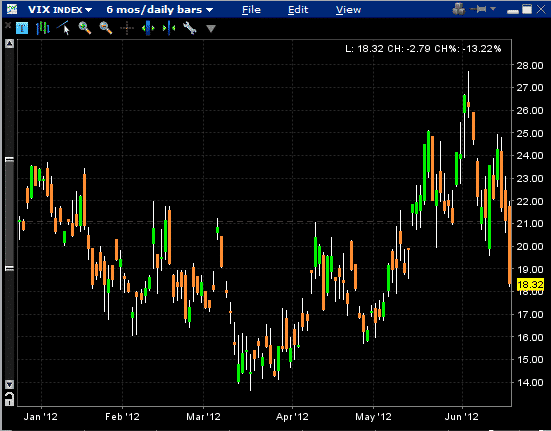

Today the VIX Index dropped over 13% following the election outcome in Greece over the weekend. Markets hate uncertainty, so having that potential problem off the table (for now at least), has allowed traders to breath a great big sigh of relief.

I’m going to look at an example of a Bear Call Spread and show you just how crucial it is to get an understanding of volatility and how you can apply it to your options trading. On Friday a July 830-840 bear call spread on RUT could have been sold for around $1.00.

Today, RUT has gone up by 0.10%. I’ll admit, not a huge gain, but it has still gone against the direction of our bear call spread. So what happened to the 830-840 July RUT spread? It is now trading around $0.70 to $0.75 meaning this trade has made a significant amount money despite the underlying moving against it.

Being able to trade volatility is a crucial skill for any options trader, if you haven’t started to analyze volatility and structure your trades around it, then now is the time to start!

Happy trading.