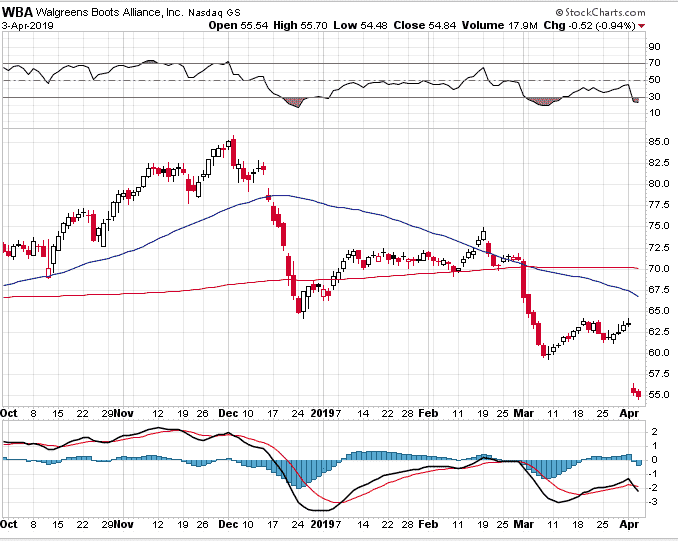

Walgreens has been absolutely decimated lately. Having hit a high of $85.79 in December last year, the stock is now down over 35% and is sitting at $54.84.

This includes a nearly 15% drop just a few days ago.

As an option trader, I LOVE volatility like this as it throws up some excellent trade opportunities.

As an option trader, I LOVE volatility like this as it throws up some excellent trade opportunities.

Long-term, I think the stock has some work to do before experiencing a meaningful recovery.

In the short-term I feel like we might see sideways to slightly lower prices.

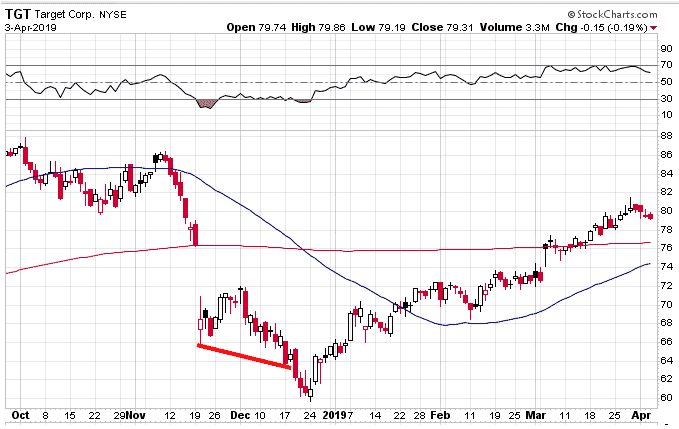

I’ve seen this play out a number of times over the last few years. TGT is a stock that has done this a number of times in recent years and is also a stock being impacted by the Amazon juggernaut.

Here is an example from 2018-2019. After the initial drop, TGT had a bounce but eventually ended around 3% lower 17 trading days later.

If WBA were to do the same thing and drop another roughly 3% over the course of the next 3-4 weeks, that would put it around $53.

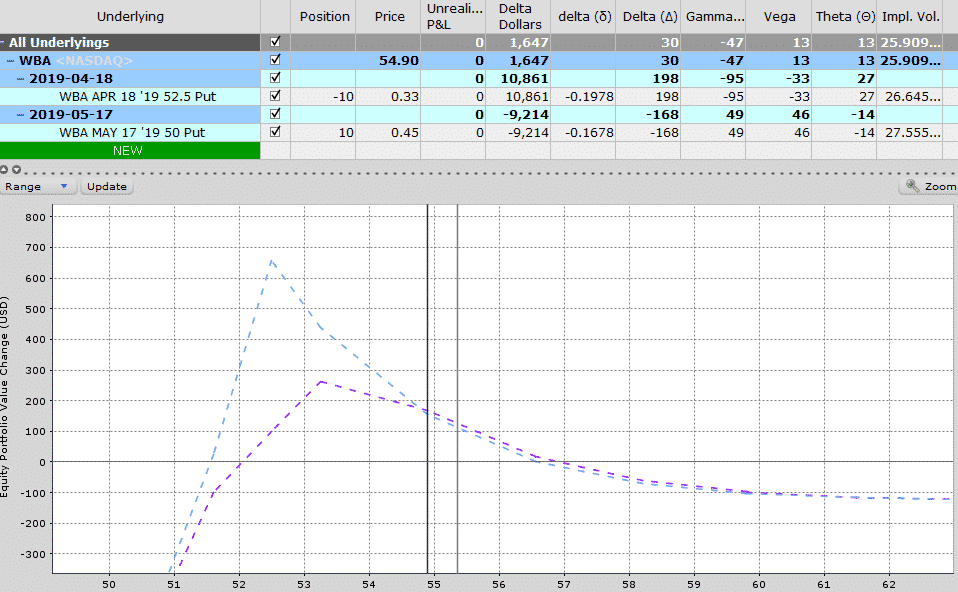

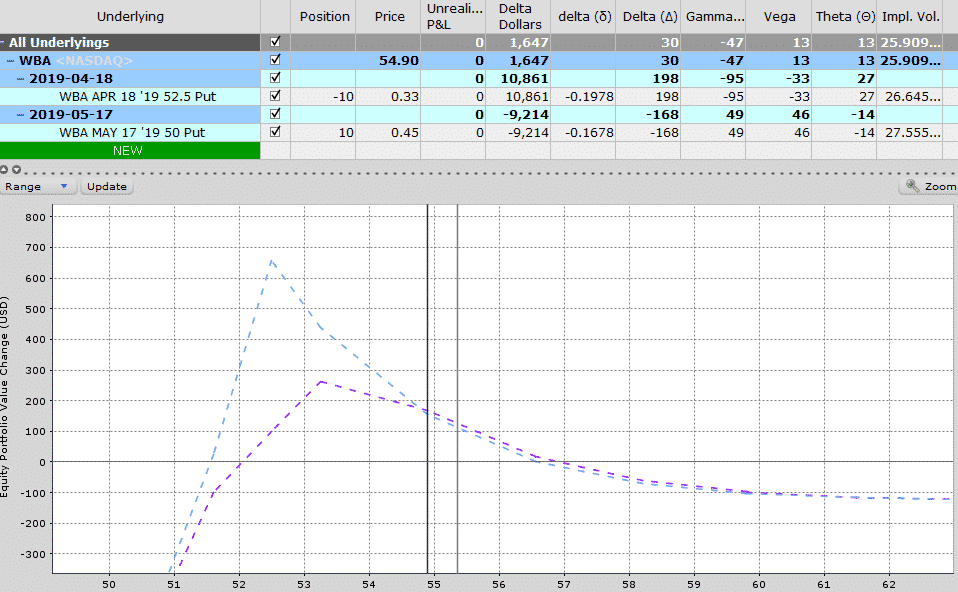

With that in mind, I like a trade called a Diagonal Put Spread which involves selling a short-term put and buying a longer-term, further out-of-the-money put for around the same price.

Here is an example set up below. Notice that we have very little risk on the upside, only about $120.

Access the Top 5 Tools for Option Traders

You can’t see it on the graph, but the bulk of the risk is on the downside with a maximum loss of $2,370 if WBA drops below about $43.

The trade has a nice profit zone between $52 and $55 which is about where I think WBA might end up in 14 days time.

My profit target on the trade would be 10%, so about $230 and my stop loss would be the same OR if WBA dropped below $51.50.

Hope you liked this trade, check back in a few weeks to see how it worked out.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.