The S&P 500 is continuing what seems like an inevitable march towards 3000. Pretty much every indicator I look at is flashing bullish signs (which in actually makes me a little nervous, by the way), and the market continues to grind higher.

We’ll likely see a correction in about 4-8 weeks times, but for now it’s full steam ahead and the much focused on level of 3000 is seemingly drawing SPX higher like a magnet.

Let’s take a look at a couple of trade ideas on SPX.

BULLISH BUTTERFLY

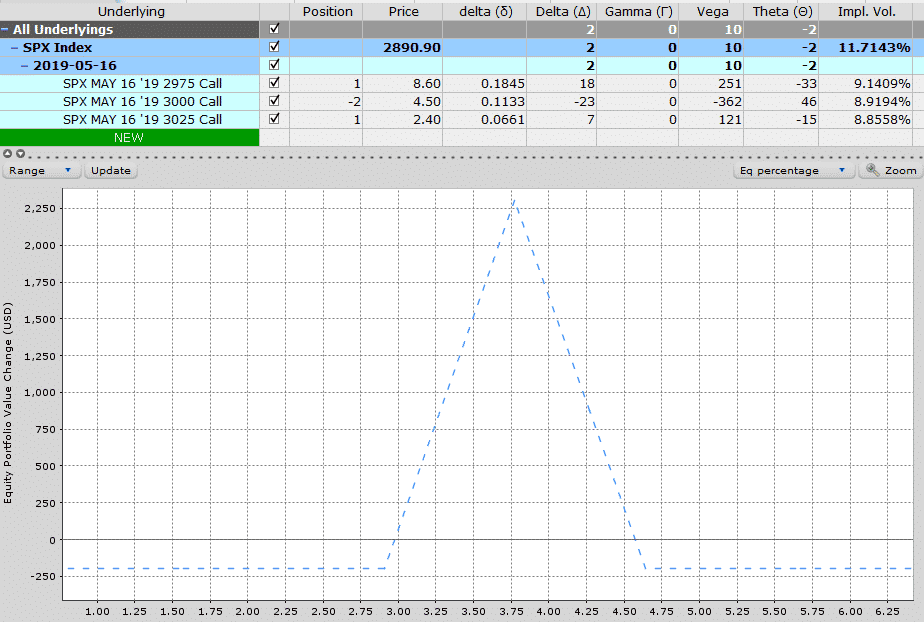

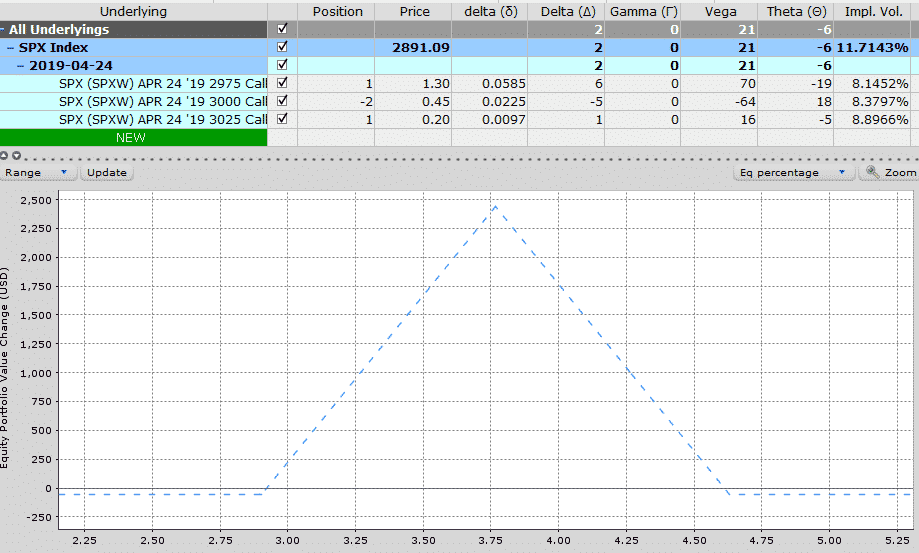

One of my favorite ones to play a grinding higher market is with a bullish butterfly. Pick a spot where you think the market might reach by expiration (hello… 3000) and place a butterfly around that strike. This can usually be done pretty inexpensively which means it doesn’t cost you much if you’re wrong.

This butterfly can be placed for $200 with a maximum potential gain of $2,300. The zone of profit lies between 3% and 4.6% higher than the current price.

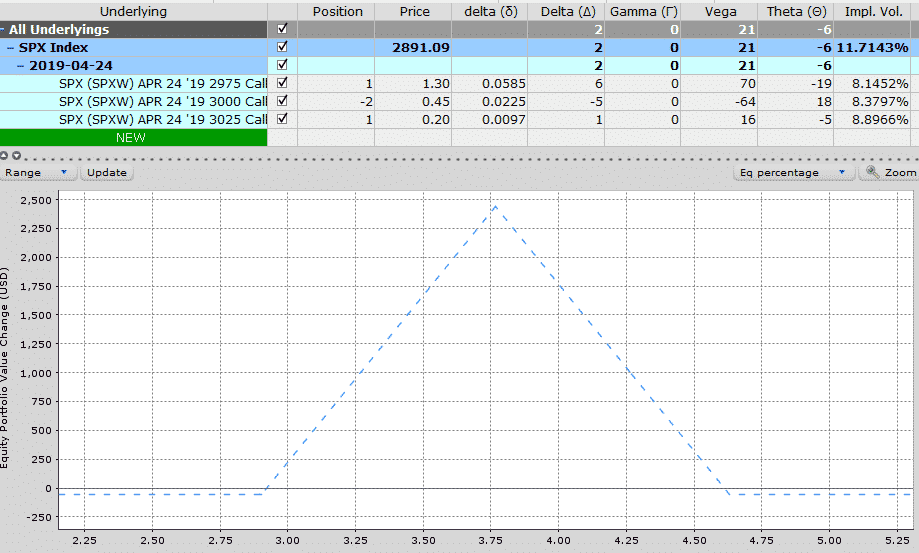

Traders who think the move to 3000 might come even sooner than mid-May might try a shorter-dated butterfly. This trade using the April 24th weekly options can be placed for only $60. Now that’s a very cheap way to play a 3% move higher in the next two weeks!

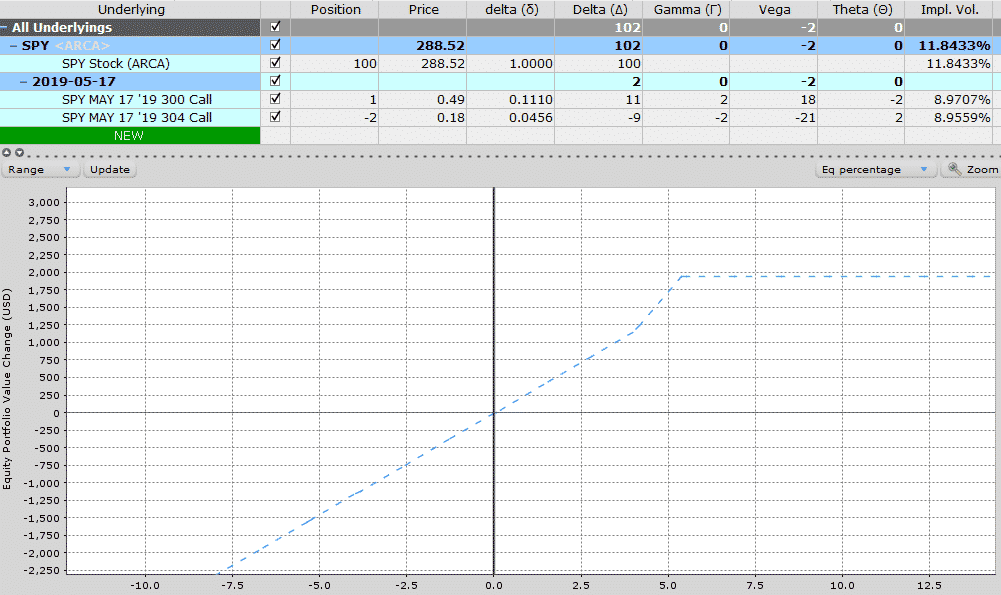

STOCK PLUS CALL RATIO SPREAD

This one is more for traders with a large capital base or large holdings of SPY. By writing a call ratio spread on top of your stock holding, traders can gain a nice little bump in profits if SPY moves 4-5% higher at expiry. The downside is that you give up any gains above that level.

10x Your Options Trading Course Replay

There is a lot more risk on the downside with this one compared to the two butterfly trades.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.