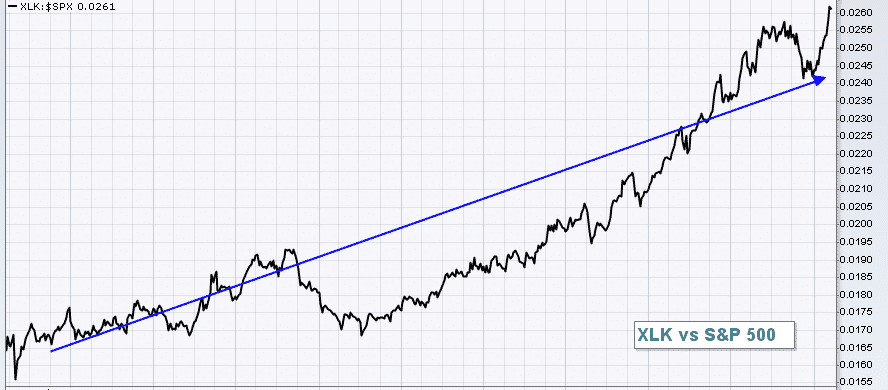

In a healthy bull market, investors want to see aggressive sectors performing well. As you can see from the chart below, technology has been performing very well on a relative basis.

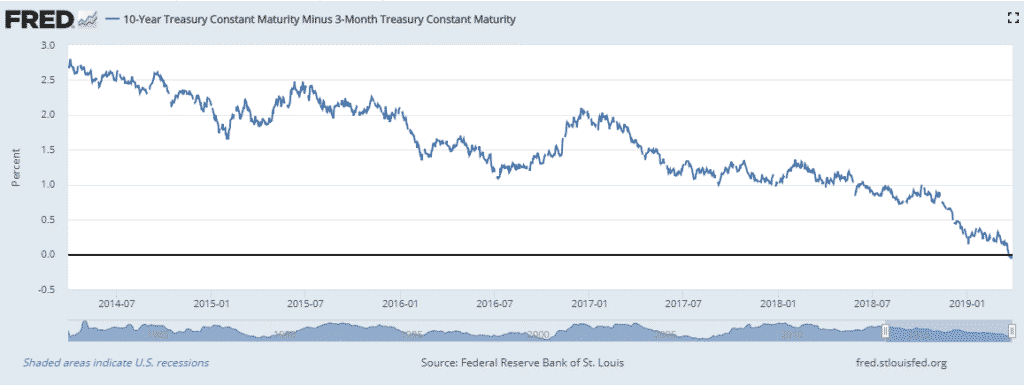

While there has been a lot of focus recently on the yield curve inversion and the usual forecasts of impending doom, we can clearly see here that investors continue to position themselves in the aggressive sectors.

Not what you would expect if a recession was just around the corner.

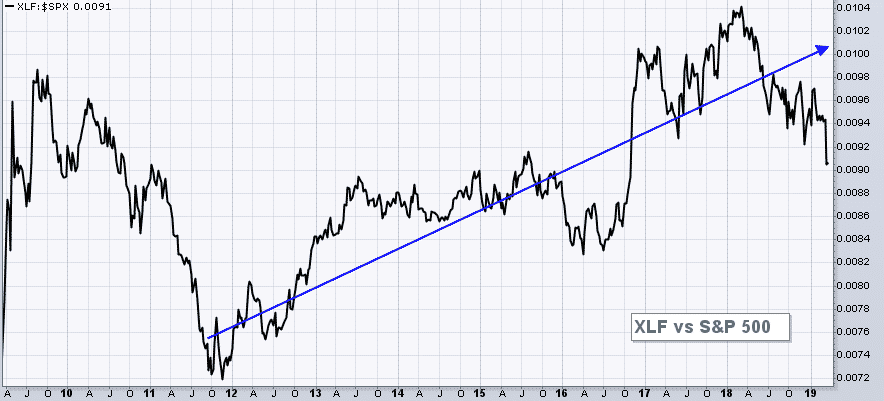

The yield curve does seem to be causing some problems for the banks though as they have been big relative under performers in the last 12 months.

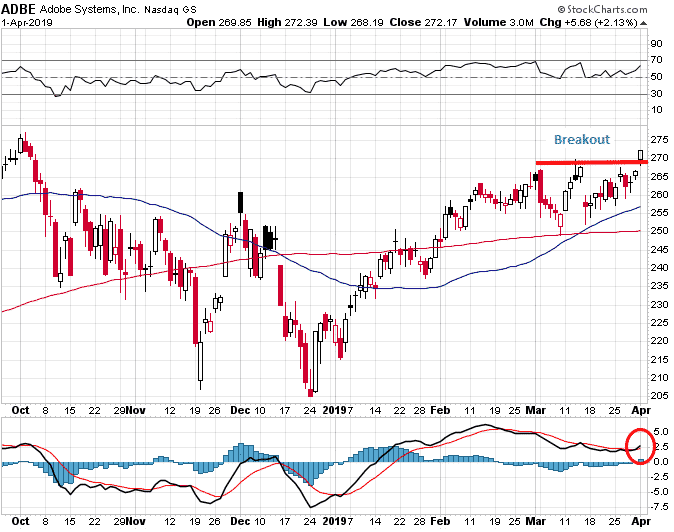

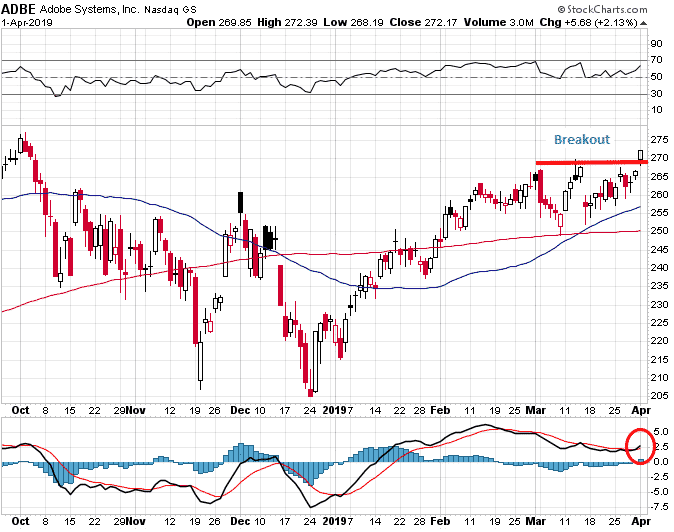

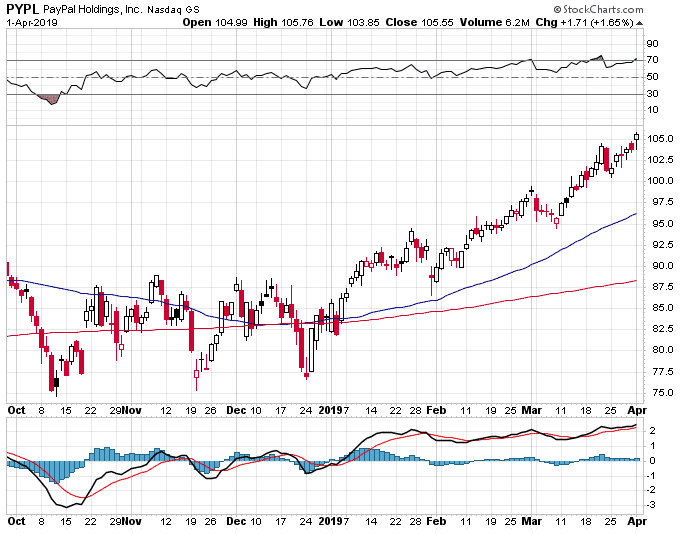

Some of my favorite tech stocks right now are ADBE, MSFT, V and PYPL

ADBE has been performing well ever since it broke above the 50 day moving average. After a nice breakout yesterday, it looks like further upside could be ahead.

MSFT has been on an amazing run this year. I tend to think upside is going to be limited from here and I’ll be waiting for a better entry point on the long side.

MSFT has been on an amazing run this year. I tend to think upside is going to be limited from here and I’ll be waiting for a better entry point on the long side.

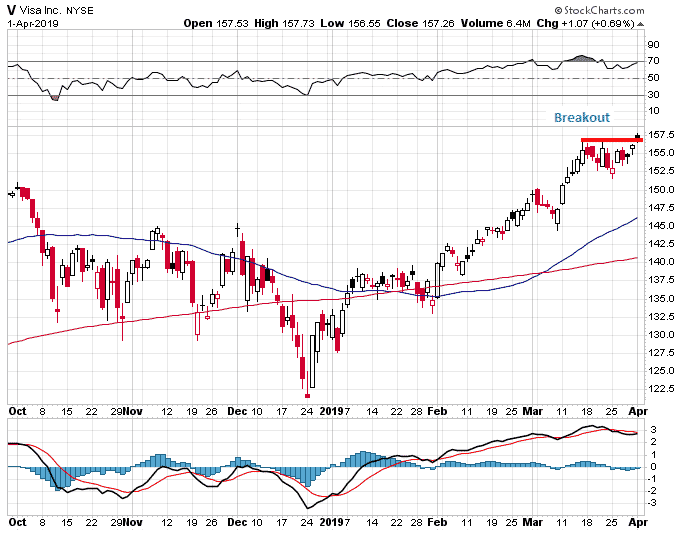

Like ADBE, V also had a nice breakout yesterday and looks like it wants to continue powering higher. In cases like this, I like bullish butterfly or call diagonals.

Like ADBE, V also had a nice breakout yesterday and looks like it wants to continue powering higher. In cases like this, I like bullish butterfly or call diagonals.

PYPL has been a beast of a stock this year. Maybe a little late to get involved hear, but it’s hard to argue with that strength.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.