On October 13th, I wrote an article about how Walgreens stock had been hammered by the Amazon juggernaut and had dropped 18%.

In the article I noted that implied volatility had jumped from 15% to 30% and that perhaps the selloff had been overdone.

Following the selloff, we discussed 3 trades ideas, a put ratio spread, a short strangle and a cash secured put.

Let’s take a look at how each of these would have performed:

PUT RATIO SPREAD

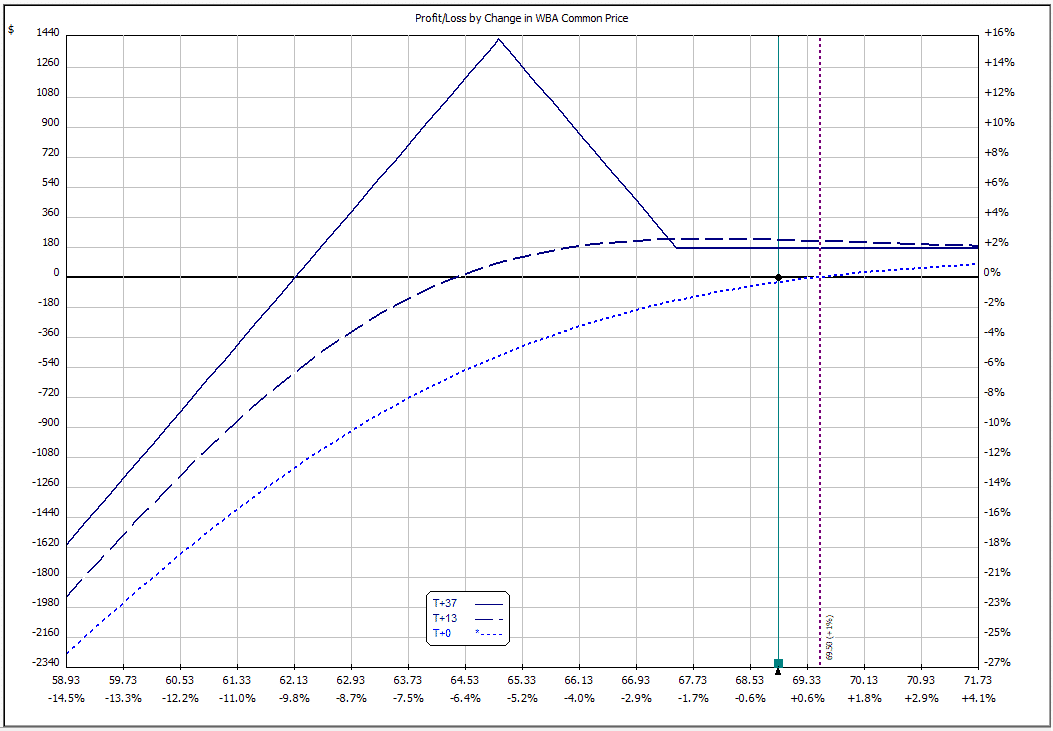

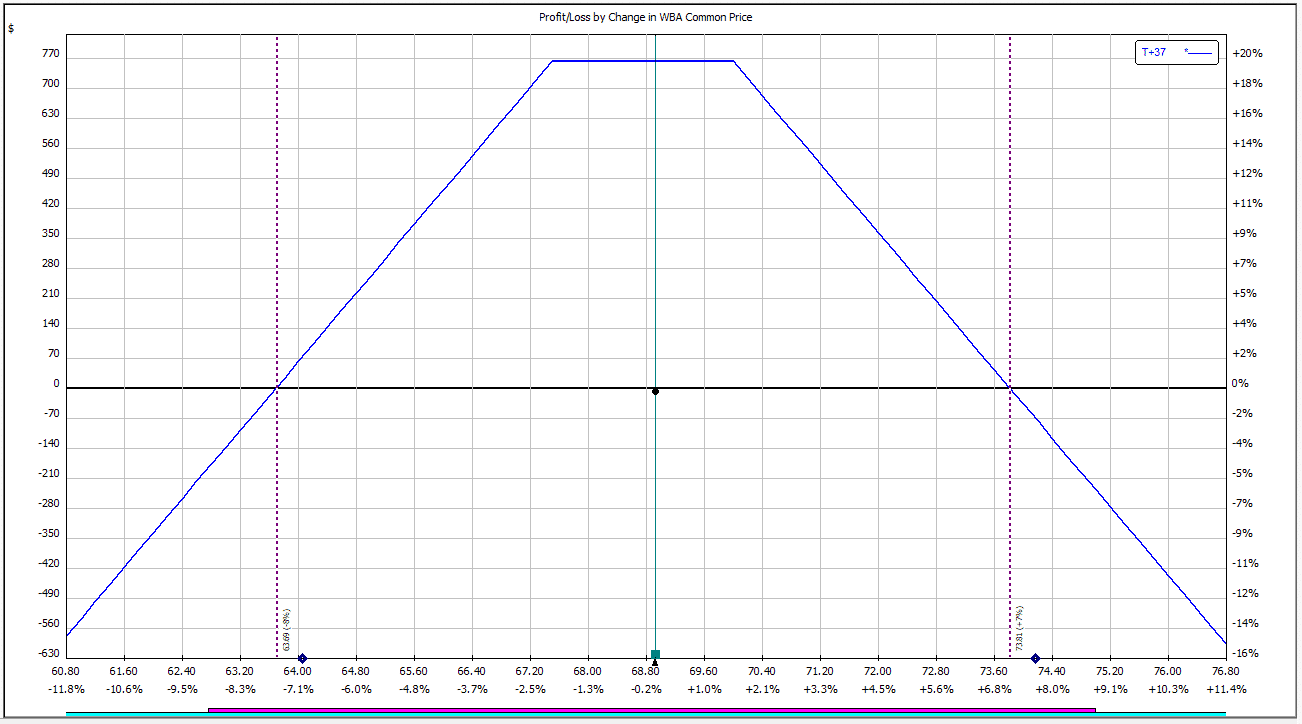

In my mentoring group, we looked at two different put ratio spreads, opened on October 11th. Firstly a November expiry 67.5 – 65 spread:

This trade did well and expired for a profit of just over 2%. The stock didn’t quite head down into the profit zone, but this was a good return in a short space of time nonetheless.

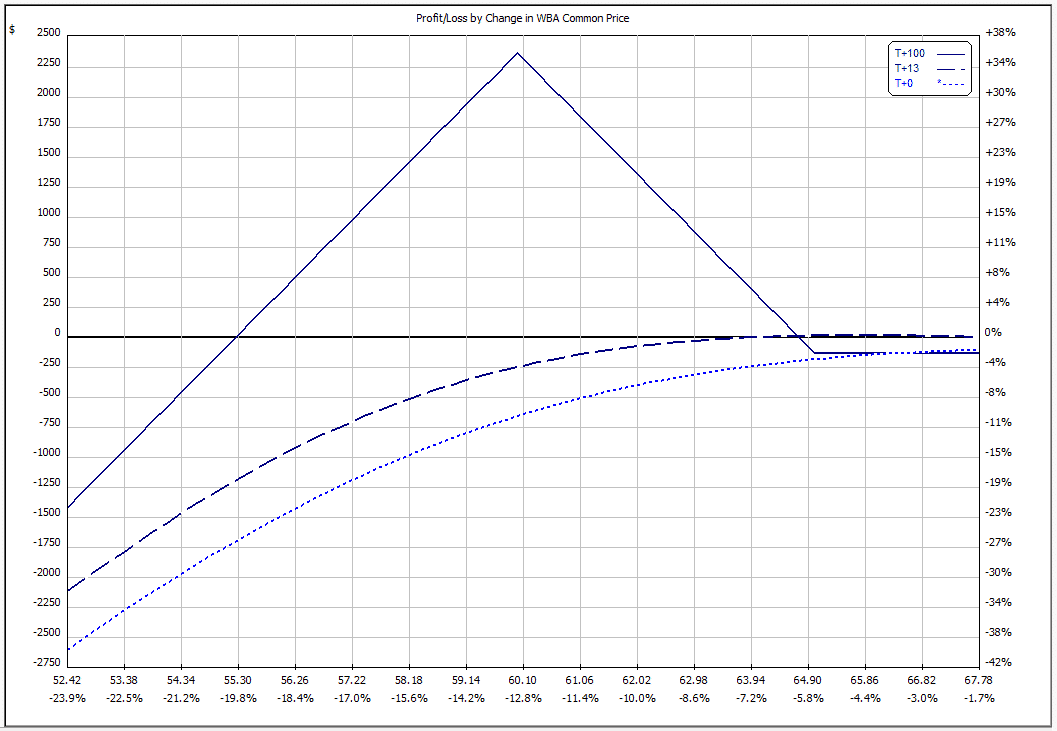

The second put ratio spread we looked at was longer term. We went out to January and used the 65 and 60 strikes. This spread didn’t have any income potential, in fact it cost us $155, but it had a really nice profit zone if WBA continued to decline.

With WBA rallying from $68.92 to $71.33, the trade isn’t really working out as hoped so far. Still, we have a few months left for the stock to start to decline down to the $65 level. I’m still hopeful.

SHORT STRANGLE

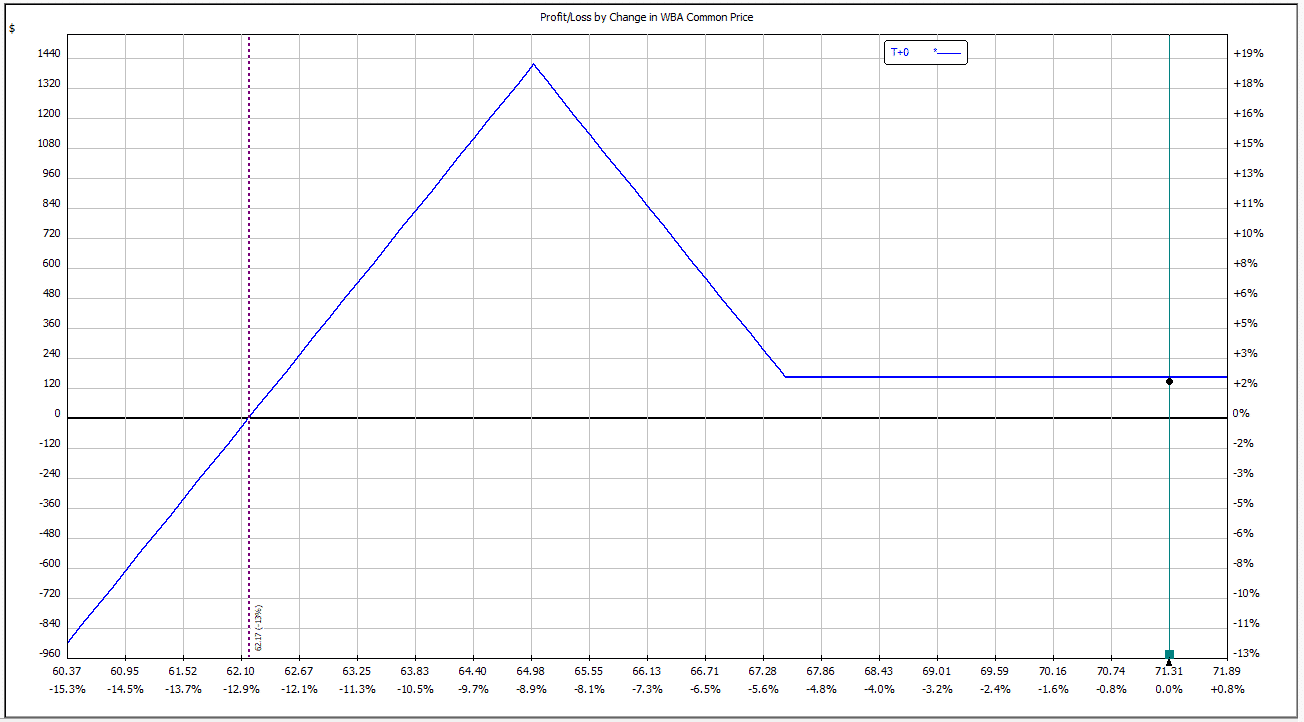

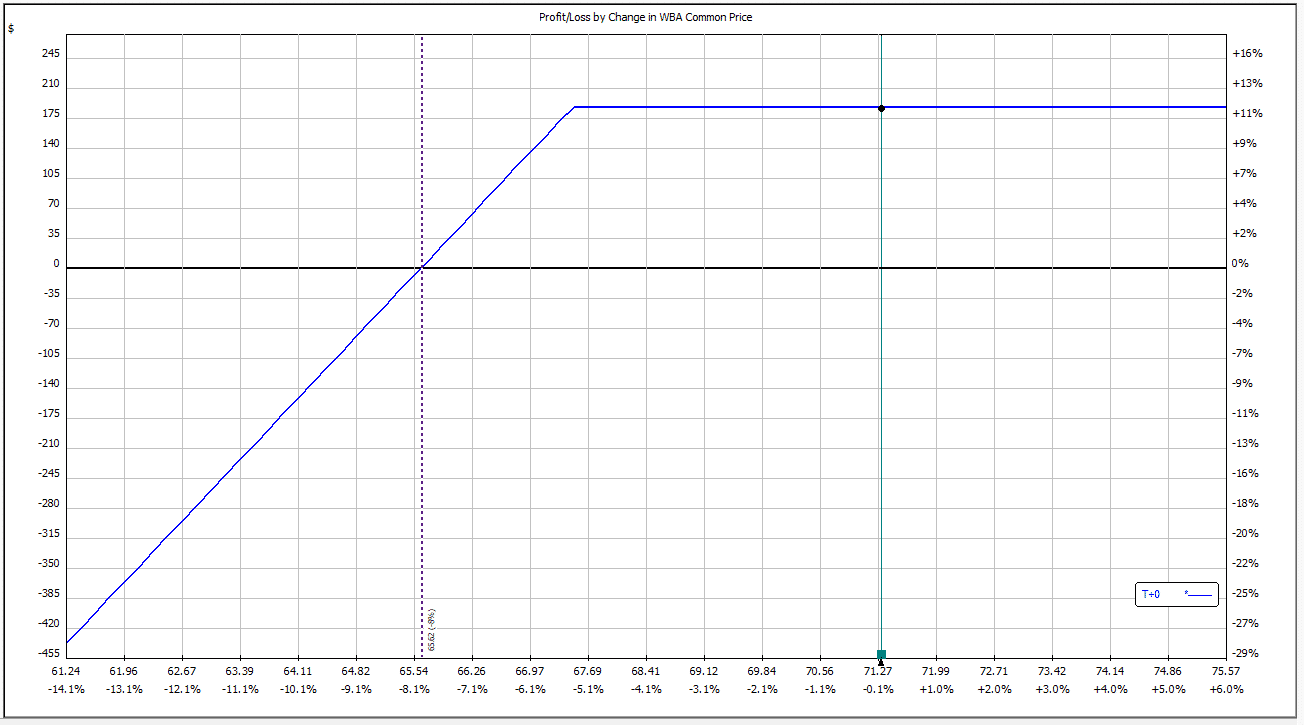

On October 11th, with WBA trading at $68.92, we didn’t have the available strikes to go with a short strangle, so we looked at a straddle instead, using the $67.50 and $70 strikes.

Last week, at expiration, the trade expired with a gain of $500 or around 13.5% return on margin.

CASH SECURED PUT

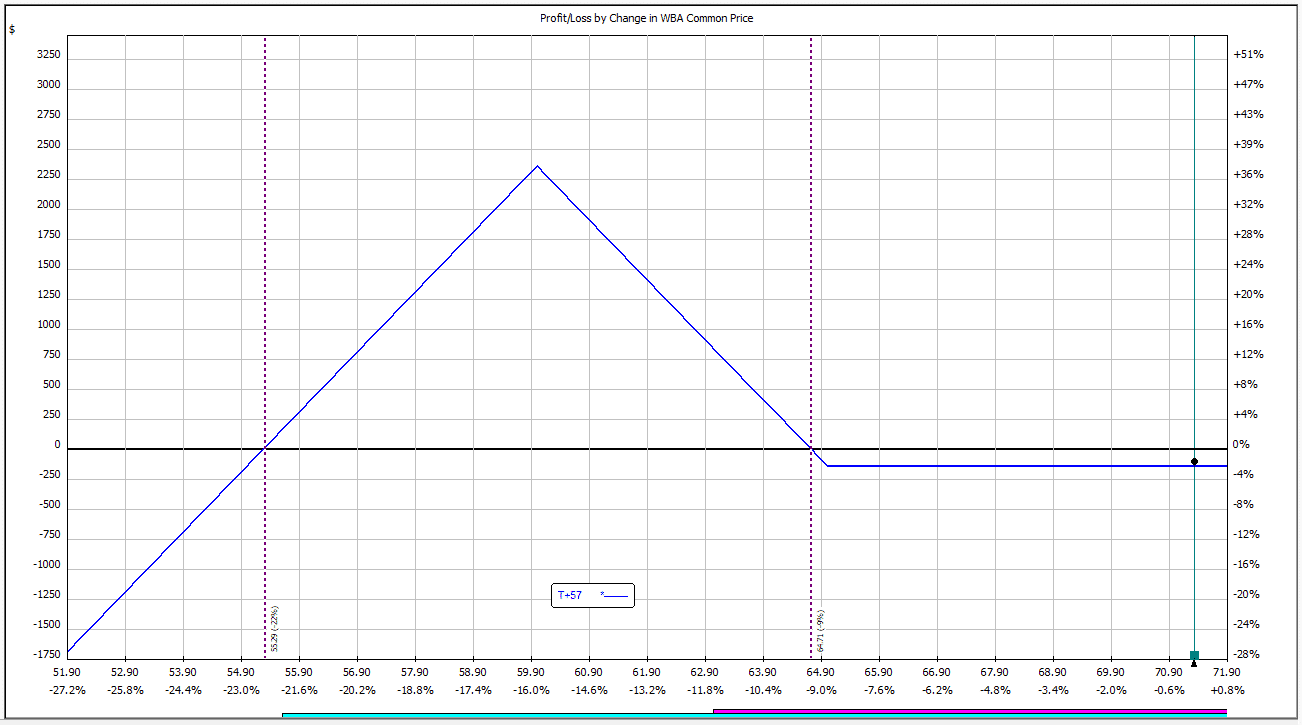

For the cash secured put, we looked at selling the next strikes out-of-the-money which was the $67.5 strike. For selling this strike we received $188.

This position expired worthless for a full gain of $188 or 2.86% return on capital.

I hope you enjoyed these Case Studies. Let me know in the comments if you want to see more of this in future.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Yes.

Real time case studies are very helpful.

Thanks.

Thank you very much Gavin.

i liked this Case Study.

Please keep post more of this.