Here are some charts I’m currently watching. These come courtesy of Top Down Charts:

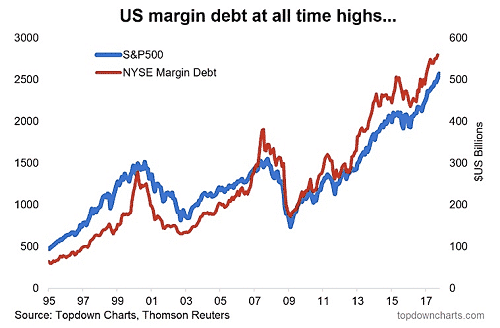

Margin Debt

I’ve previously shared margin debt data a few times here on the blog. Margin debt continues to make news highs which a lot of traders see as a warning sign, but as I’ve said in the past tops generally don’t form until margin debt starts to drop.

So as long as people keep borrowing money to invest, then then party goes on, right?!

One thing we do need to keep an eye on though is the rate of acceleration of margin debt (second chart). It’s already showing signs of slowing and we’ll need to keep an eye on this over the next 3-6 months.

Click Here For My Top 5 Technical Indicators

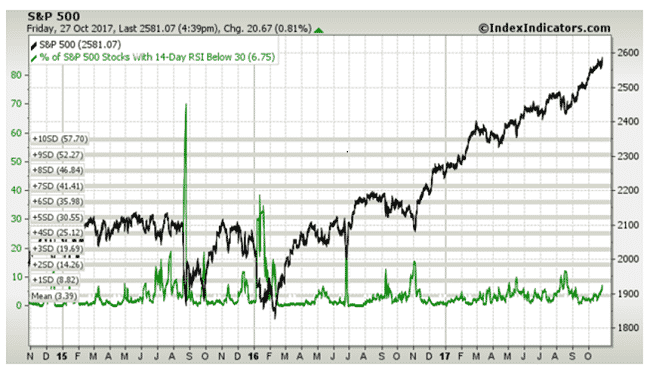

Oversold Stocks

I’ve been looking at a few different breadth indicators lately and this is another one that suggests the strength of the rally is starting to fade.

While the S&P500 has continued to rise, the number of stocks with RSI below 30 is starting to pick up.

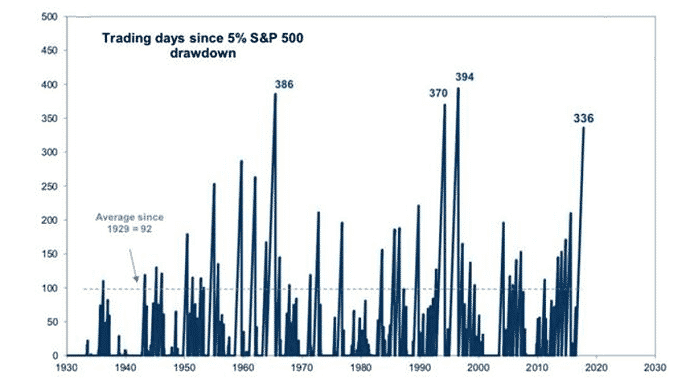

Overdue Correction

I don’t think anyone can argue that we are overdue for a correction, but this chart shows just how long it’s been.

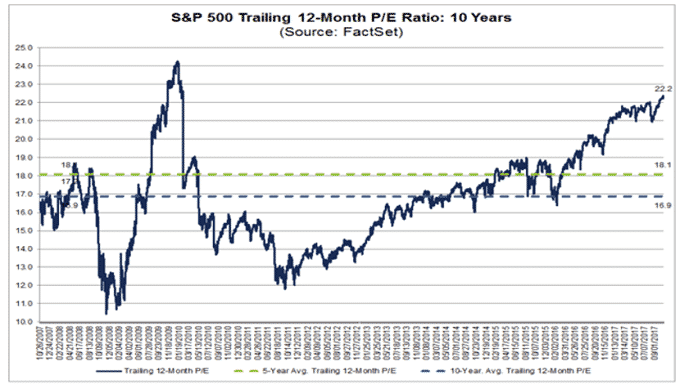

Valuations

We’ve also looked at a few different valuation metrics recently, but this one again show that valuations are a bit stretched here.

Canary in the Coal Mine?

Sometimes bond traders are more savvy than equity investors and we’ve seen a few times in recently that drops in junk bonds has led to a fall in equities. Definitely one to keep an eye on.

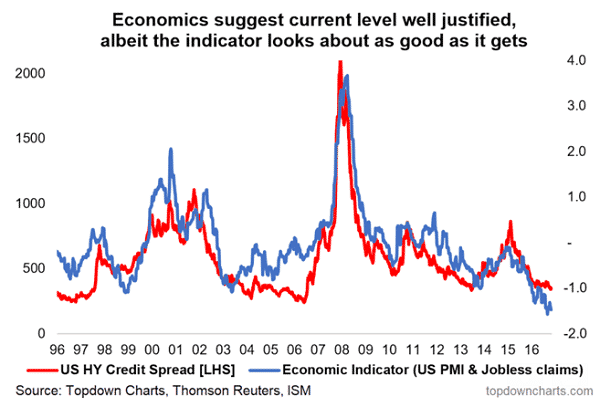

Credit Spreads

Credit spreads are not blowing out so that is a good sign and general economic indicators point to strong tailwinds for the economy. According to Callum: “Selloff risk = high, correction risk = medium, bear market risk = low”

Market Peaks

The chart below shows that the last stage of a bull market tends to produce the most spectacular returns. So while markets are extended here, if we haven’t peaked, the cost of going to cash could be massive.

Trade Safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.