Trading options around earnings introduces distinctive challenges for investors.

These challenges arise as earnings events have the potential to magnify profits or losses beyond what traders might experience by simply holding the equity.

With that added level of risk, though, comes added flexibility and potential.

Let’s look at a few ways a trader can use options to trade earnings reports.

Contents

Considerations

Before trading options around earnings reports, there are a few things that a trader should look at to make sure that it fits their risk: reward profile.

Volatility:

Earnings releases often produce a lot of volatility in the underlying equity when the report is released and often through the next trading session as bigger books and larger traders adjust their positions.

Many options traders look for this volatility to be profitable, but it’s not the best fit for every trader or strategy.

Timing:

The next thing to consider is timing.

There are two main components to this: when to place the trade.

If you enter a long options position too close to the release, your cost may be elevated due to high implied volatility.

If you sell an option too far away from the release, you have the opposite problem: the natural elevation in implied volatility works against as options tend to hold their value in the lead up to earnings.

The second aspect of timing is regarding the actual release.

Most releases occur outside of normal market hours.

Most options are only tradable during regular market hours, so whatever your option position is when the market closes, the trader should be comfortable with any outcome because they won’t be able to adjust the position until the market opens the following day.

Strategy/Pricing:

The last item to consider is the strategy that is being traded through the earnings report.

Long options can produce the highest return on capital due to their uncapped potential.

A great example of this was the May 2023 Nvidia Earnings release.

The stock gapped almost 70 points up and would have returned a 1000%+ gain on several of the options strikes, but that came with a lot of risk.

If the stock remained flat or gained modestly after the report, many of those options would have opened up at a loss due to the iv crush.

Due to the possibility of being right in the direction and still losing on the option, many traders opt for a spread to play an earnings report directionally.

We will go over these in more detail below, but having your strategy dialed in before you place the trade will make trading options on earnings reports easier and more profitable.

Trading Strategies

Now that we have looked at some of the considerations before trading options on earnings reports let’s look at some of the common strategies used to trade earnings.

We ordered the strategies so that the simplest strategy is first and the most complex is last.

The Naked Option:

The most simple option strategy is the naked call or put option.

The naked option is just buying a call/put and making a bet that the price will go in your favor enough to cover the elevated cost of the option.

This is a common strategy among newer options traders because it can potentially replicate some of the astronomic gains posted on the internet.

This also comes with some of the highest risks to capital because it’s possible to be correct in direction but wrong on the magnitude of the move.

Your risk is still capped at the cost of the option.

Cash Secured Put:

This is a common strategy for traders looking to produce income while waiting for a stock price to fall.

One can adapt this strategy to trade earnings, but it can come with an elevated risk due to volatility.

The regular Cash Secured Put works, but what some traders do to capture some additional premium is sell an at-the-money or in-the-money put with the assumption that the following drain on implied volatility will be profitable for them.

If they are incorrect, they will end up owning a stock they don’t want at a price that is now well above where it’s trading.

If this is a strategy you plan on utilizing for earnings, be sure you like the stock you trade.

The Vertical Spread:

The debit spread/credit spread is slightly more complex.

This strategy is more popular with more experienced traders and traders looking to trade an earnings report directionally but with limited risk.

The vertical spread involves simultaneously buying and selling an option contract, often one or two strikes apart.

This either creates a net credit to your account (a credit spread) or helps to mitigate the cost of the long option (a debit spread).

This trade caps the potential reward but also greatly mitigates the cost of the position.

Straddle/Strangle:

The main difference between a straddle and a strangle is how far apart the put and call strikes are, so for purposes of this article, we are grouping them.

The straddle or strangle is a good strategy for when you expect a large move in the underlying when it reports but are unsure of the direction.

This is a common strategy for some of the more volatile names in the market because the trader only needs to get the magnitude correct; the direction is covered.

This does have a unique set of risks, though, whereas in some other strategies, the direction needs to be correct to profit.

With a straddle/strangle, if the magnitude of the move is too small, it’s possible to still lose on the trade because of the cost of both options.

The Ratio Backspread:

This is the most complex strategy on the list but has the most benefits.

The ratio backspread is when a trader both buys and sells calls or puts in varying ratios (hence the name).

Let’s look at an example of a call ratio backspread.

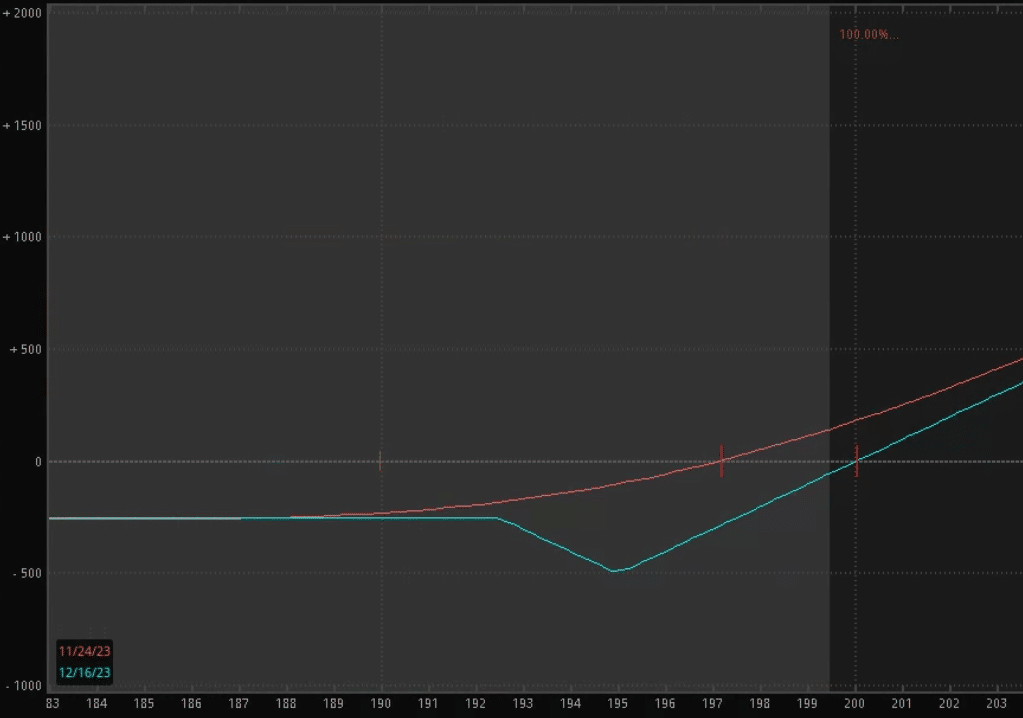

The trader is looking to play AAPL earnings long, and the current price is $190/Share.

To execute a call ratio backspread, the trader will buy 2 $195 calls and sell 1 $192.50 call to help offset the cost.

This will create a profile that looks like a backward check mark.

This allows the trader to benefit from the uncapped call potential while offsetting part of the cost with the short call.

The largest risk to the trader is if the price stands completely still.

One of the cooler aspects of a back ratio spread is that it’s possible for both the winning and losing sides to produce a profit, which means that as long as the stock moves, it’s profitable.

It should be noted that it’s rare to see that happen.

Wrapping it Up

With an elevated cost associated with the option and the risk of not getting the direction of the move correct, trading options on earnings reports are things that should only be considered if you are comfortable with the elevated risk.

If you wish to trade earnings reports even after considering the risks involved, the strategies above are a great place to start.

Spreads are often popular due to their more controlled risk profile, but sometimes a long call or put is the best strategy to rack up some profit.

Whatever you do, just ensure it is within your risk parameters, and you can afford to lose the entire premium.

We hope you enjoyed this article on trading options around earnings reports.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.