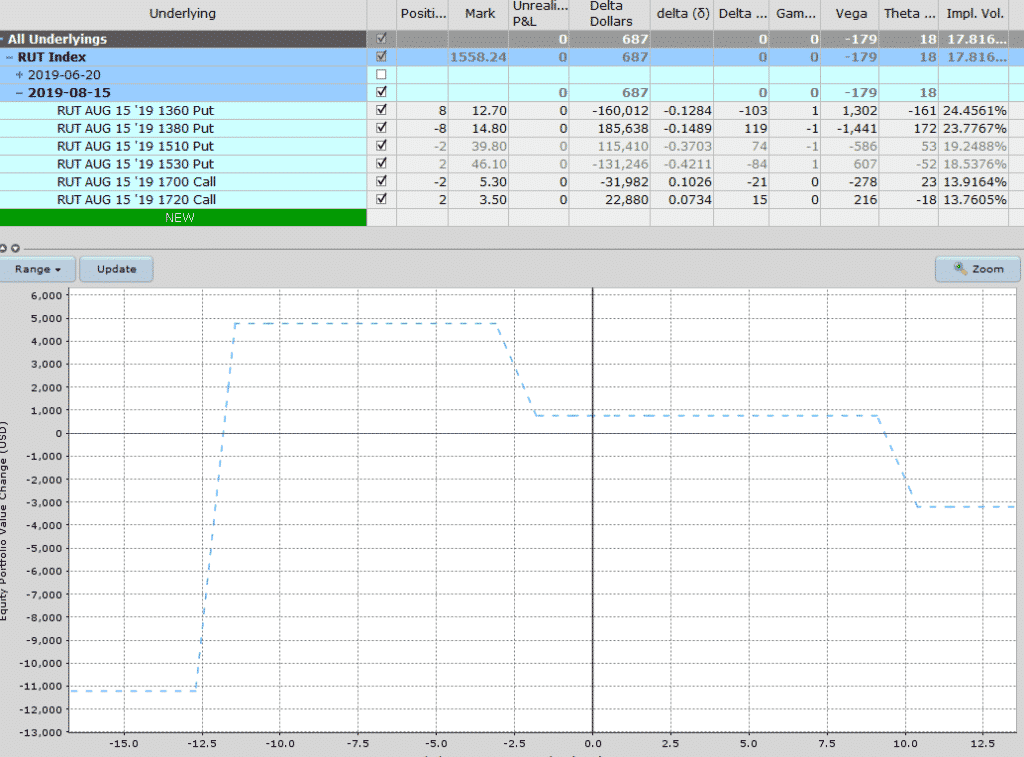

I have a special treat for you today guys and girls, this one is my favorite trading strategy. It’s a variation on an Iron Condor that I call a Trapdoor. I call it that because we create a profit zone or trap below the market where we want RUT to fall into.

The key is, we don’t want it to fall in there too quickly.

I like Trapdoor’s because they can still make a really nice profit, the handle bullish markets better than a Condor and the also move a bit slower.

Set up is pretty simple, start with 2 calls spreads around delta 10, then BUY 2 put spreads 20 points below the market, then finally sell put spreads around delta 15. In adjust the number of put spreads to get me to around delta neutral, in this case 8.

If I had done 10 put spreads, the position would have positive delta, that’s also fine if I had a bullish outlook, but mostly I prefer to be pretty close to delta neutral to start the position.

Adjustment points are pretty similar to a Condor – if either short option reaches delta 25 I’ll adjust and I’ll set a stop loss at $1,000.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

1000 dollar is a 10% stop?