This trade is a bit different to what you might have seen before but is something I’ve used in the past and it should get you thinking. I don’t really have a catchy name for it but Sold Puts With Delta Hedging will do the job as that’s exactly what it is.

I’m using OIH as an example because it has been sold off heavily recently and implied volatility is also elevated.

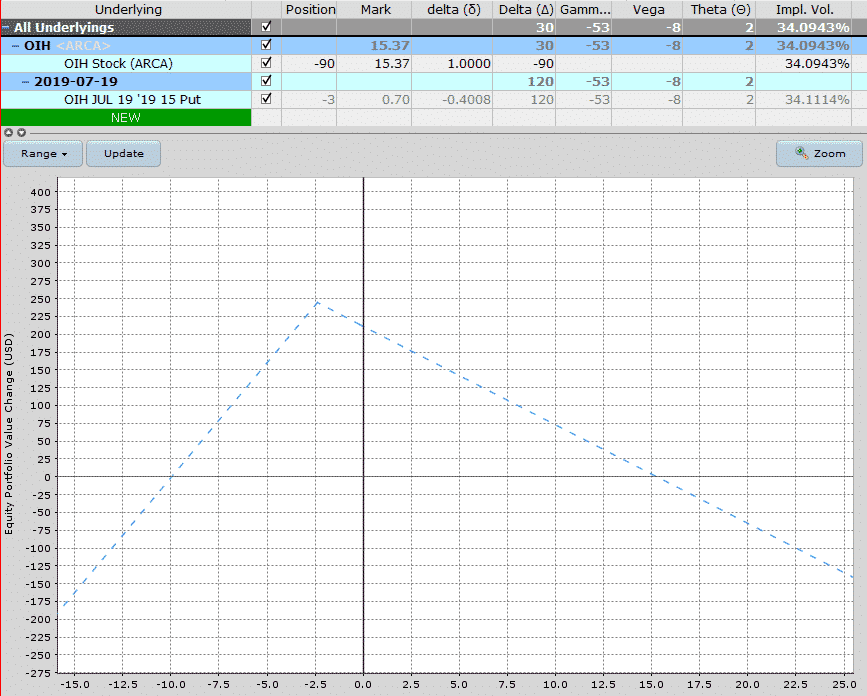

We start by selling some puts below the market, in this case with OIH trading at $15.37 I’m selling the $15 puts for $0.70.

Next, we sell some shares to hedge out the delta. We can either fully or partially hedge the delta, depending on whether we want to accept some directional exposure.

In this case the delta of our puts is +120 and I’ve decided to sell 90 shares given a net delta of +30.

The beauty of using stock to hedge delta is that there is no cost in terms of time decay. And you can buy/sell more stock as the underlying moves to keep exposure at an acceptable level.

With this setup, the zone of profit is between 10% lower and 15% higher.

A couple of things to be aware of with this strategy – The margin requirements can be high given the puts are naked and sometimes there can be restrictions on selling stock.

As always be careful and paper trade first.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.