Recent selling on Wall Street has seen volatility spike and VIX is currently sitting above 20 which means option premiums are elevated.

Iron Condors can work well in this environment although risks can be high in the short-term.

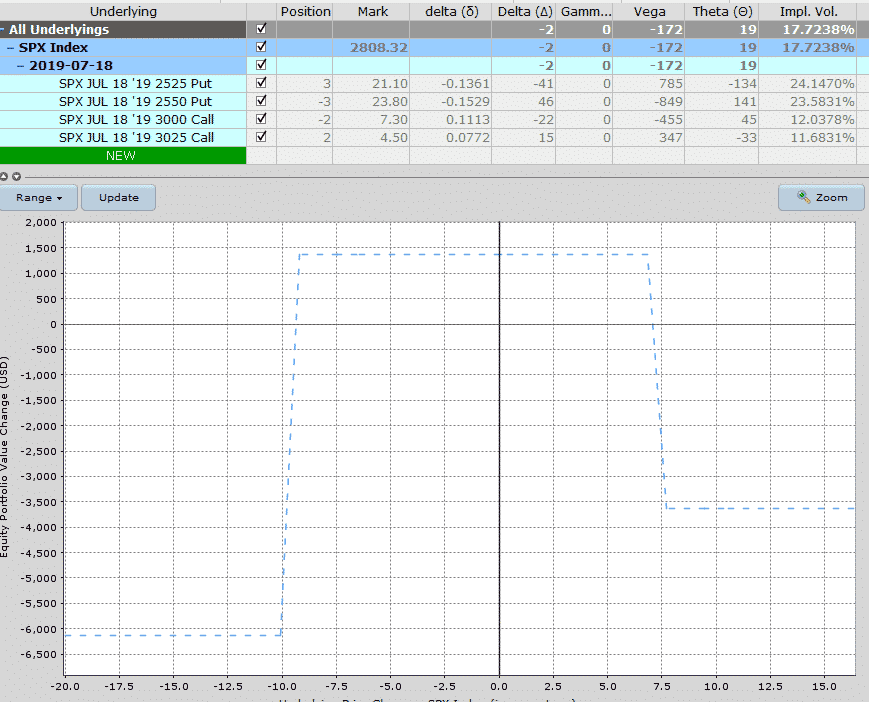

The below SPX Condor will generate $1,360 in premium with maximum risk of $6,140 representing a return potential of 22.15% in 2 months.

There is a lot of skew at the moment, notice that the puts are trading with implied volatility around 24%, but the calls are only 12%. This means traders are willing to pay a lot more for puts. Makes sense if you think about it, because the market is looking shaky and traders are rushing to buy downside protection.

In cases like this, I like to trade and unbalanced Iron Condor by selling more puts than calls. This helps to keep the position more delta neutral. Notice that this position has -2 Delta. If we increase the calls to 3 contracts, the delta would jump to -5.

The short put delta is at -0.15 and the short call delta is and 0.11. Adjustment points will be if the put delta hits -0.25 or the call delta hits 0.25.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.