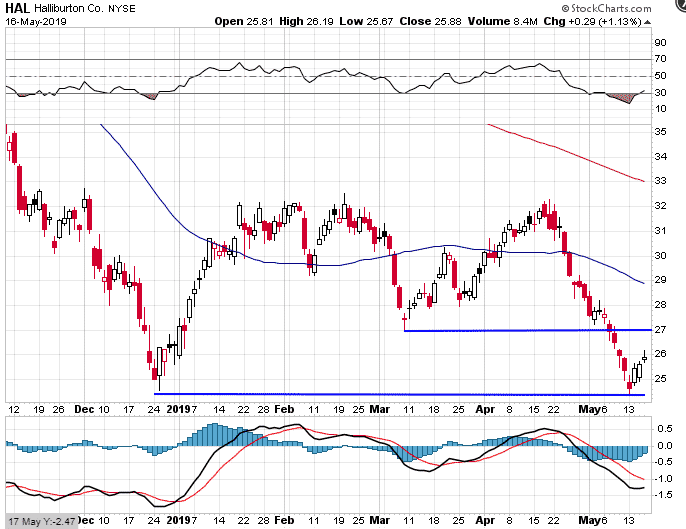

HAL is a stock that recently dropped 25% in the space of a month. It got pretty oversold and put in a short-term bottom almost exactly where it bottomed back in December.

I think there’s a good chance it will head up to test resistance around $27 in the next two weeks. I can’t see it getting much above that level.

I think there’s a good chance it will head up to test resistance around $27 in the next two weeks. I can’t see it getting much above that level.

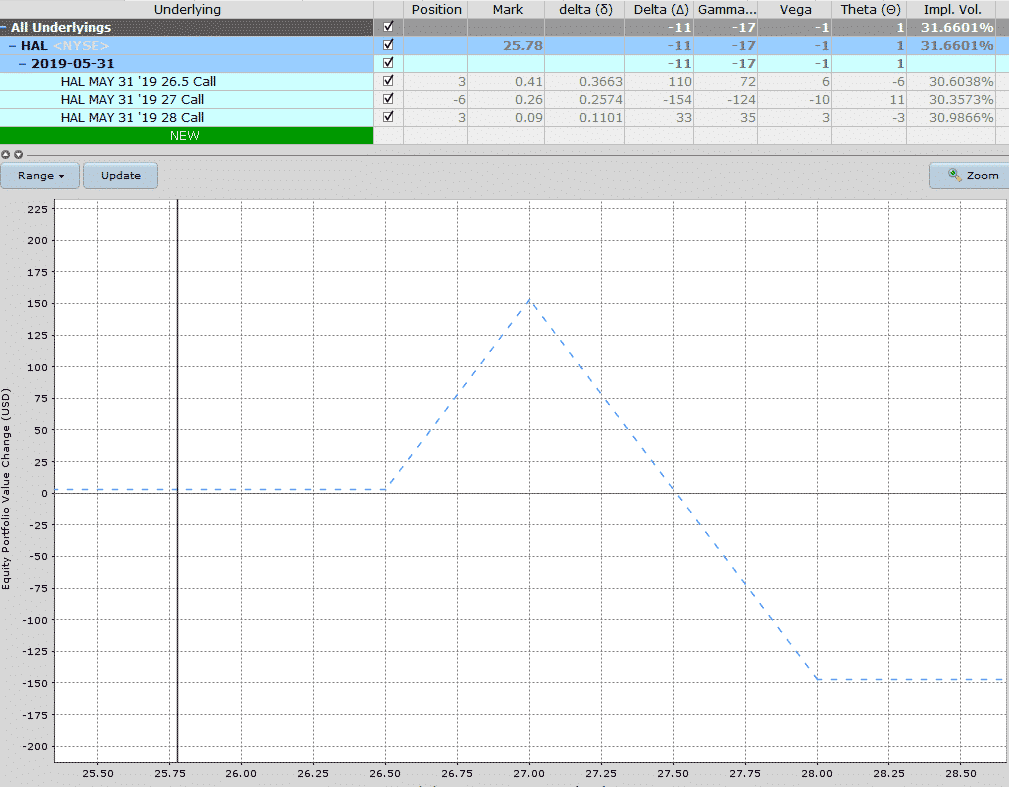

In this scenario I like using a broken wing butterfly to create a profit zone around the area where I think the stock will be at expiry.

If HAL continues to drop lower, I have no risk on the downside.

Ideally I want the stock to be around $27 towards expiration. If it gets there two quickly, the trade will be under pressure.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.