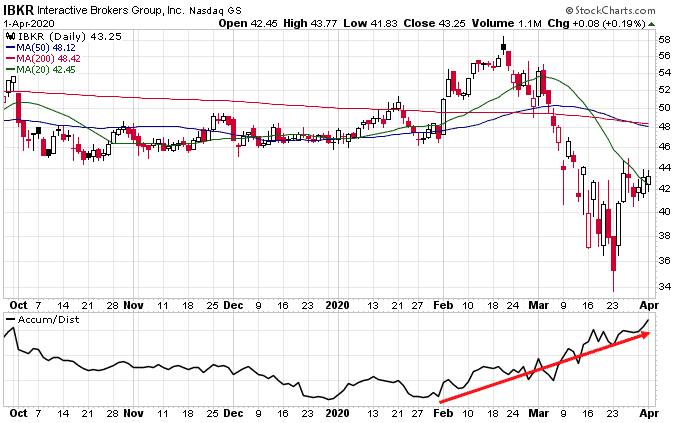

In this market, there are very few stocks showing strength, but Interactive Brokers (IBKR) is one of them.

Interactive Brokers has been showning significant accumulation, an impressive feat during one of the most severe bear markets in history.

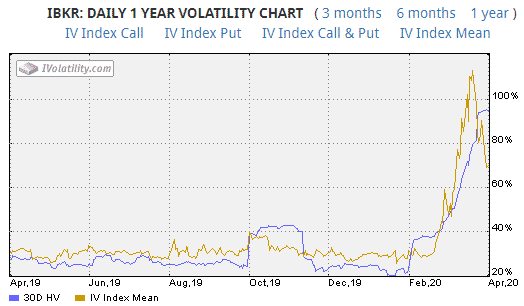

Implied volatility is also high at around 70%. Not quite as high as it was a few weeks ago, but still a lot higher than the 30% at which it typically trades.

That means it’s a great time to be a seller of options on IBKR. That coupled with the potential bullish action makes it a great candidate for a cash secured put.

A cash secured put is a conservative options strategy that can be used to purchase a stock for lower than the current price.

With IBKR currently trading at $43.25 an investor might be happy to buy the stock for $40.

The June $40 put is trading at around $3.40.

If an investor was to sell this put, they would receive $340 in premium income. That’s theirs to keep no matter what happens to the stock over the course of the trade.

However, the investor does have an obligation to buy 100 shares of the stock at $40, even if the stock drops well below that level.

A purchase price of $40 less the $3.40 premium received gives an effective purchase price of $36.60, which is 15.38% below the current price.

If IBKR stays above $40 and the put expires worthless, the trader makes $340 in profit which equates to a 9.29% gain in just over 2 months.

SET A STOP LOSS AT THESE LEVELS

Looking at the chart above, there are two obvious places to set a stop loss depending on how conservative the investor is.

- If the stock breaks back below the 20-day moving average

- If the stock breaks below $40, which is the strike price of the sold put and also an area of significant chart support.

Sticking to those stop loss levels will help avoid large losses if the trade goes south.

Of course, if the stock drops below $40 and the investor is happy to take ownership at $40, they can always let their put be assigned and take ownership of the 100 shares with a cost basis of $36.60.

KEEP IN MIND EARNINGS AROUND APRIL 16TH

One potential spanner in the works is the next quarterly earnings release which is scheduled for around April 16th. Some stocks tend to experience large moves after an earnings announcement so there is a risk of a gap lower if the report is not well received by the market.

On the other hand, if the stock continues to rally, and crosses above the 200-day moving average, I would look to roll the sold put up to $44 and bring in some extra premium.

IN SUMMARY

The best stocks to buy are those showing relative strength and accumulation and Interactive Brokers is looking good on both counts.

A June $40 cash secured put has the potential to return a 9.29% profit is the put expires worthless.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.