Vega is a crucial concept for option traders to understand. Having a solid understanding of this option greek is essential for long term success. Enjoy!

Contents

- What Is Vega?

- How Do You Calculate Vega?

- How Does Vega Change?

- How Can I Use Vega In My Portfolio?

- Conclusion

One of the most important metrics in option trading is implied volatility as it is a projection of what the future volatility of an underlying asset will be. In turn, this projection is used to determine what the current market price of an option will be.

Over time, as implied volatility changes, so too will the price of an option. Knowing how implied volatility affects the price of an option will form a valuable part of your trading toolkit.

So how do you determine the impact of implied volatility changes on the price of an option? By understanding a metric called Vega.

What is Vega?

Vega forms one of the metrics of options analysis called the Greeks. At its core, Vega measures what the theoretical price change will be for an option, based on the percentage change in implied volatility for that option.

More specifically, it measures the amount that an option’s price will change as a result of a 1% change in the implied volatility of the underlying asset.

Like implied volatility, Vega is not uniform and changes over time. In general, options that are bought have positive Vega, while options that are sold will have negative Vega.

Vega is highly correlated with another option greek called Gamma.

How do you calculate Vega?

Like the other Greeks, Vega is calculated as part of the option pricing model. While you can calculate it yourself, it’s probably better to spend some time understanding how it works and to simply use an option chain to provide you with the value.

An option chain shows all the puts and calls for a certain expiration and underlying. Most brokerage firms provide this information for free (and is where most option traders get these values) and you can also find a number of websites that provide free tools such as Nasdaq.com.

When you look up the value for Vega, note that unlike implied volatility which is expressed as a percentage, Vega is expressed as a dollar amount.

The value you see in dollars is the amount by which the option’s price will increase for every 1% increase in volatility.

As an example, say you have a long call on company ABC with a premium of $9.50, Vega of 0.30 and implied volatility of 17%. If the implied volatility were to increase to 22%, what would the long call now be worth?

To calculate the answer, take the original price and add the Vega times the increase in volatility.

So, in this case it would be: $9.50 (the original price) plus 0.30 (the Vega) times 5 (the increase in volatility) = $11.00 (the new price).

One important note is to remember that when buying options, Vega is positive. When selling options, Vega is negative.

The sign is not affected regardless of whether you are trading a call or a put.

How does Vega change?

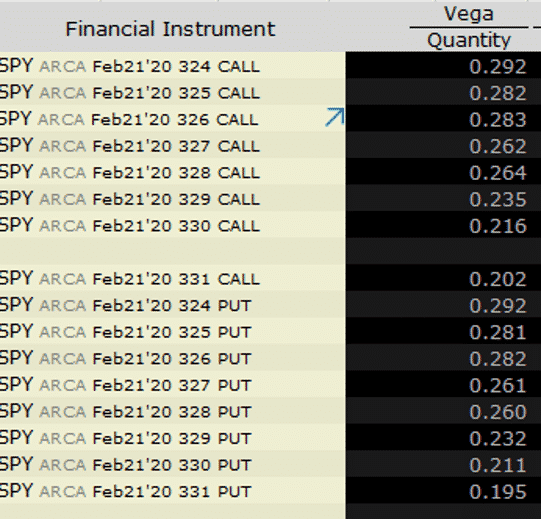

There are several key influences on Vega. The first is based on the strike price.

When options are at-the-money, they will be heavily affected by Vega.

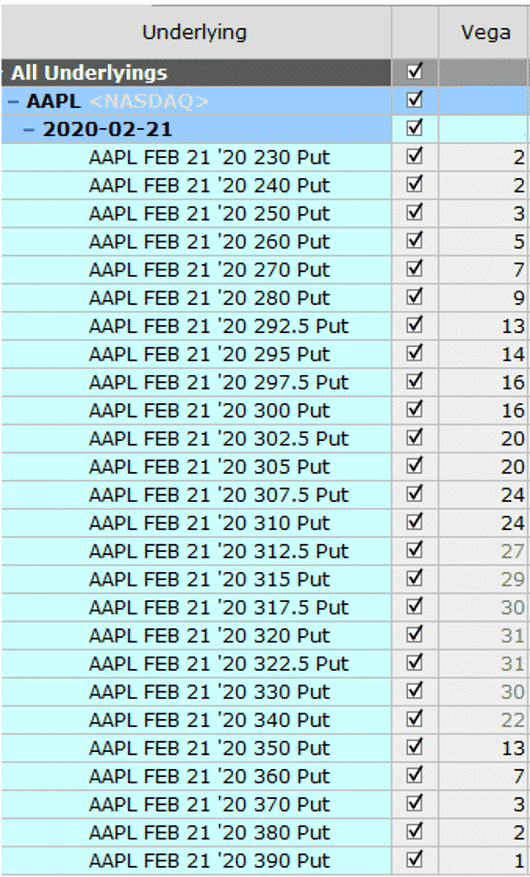

As you move further away from the at-the-money strikes, the Vega exposure starts to shrink. This can clearly be seen below in this option chain for AAPL, when AAPL was trading around $324.

Deep out-of-the-money and deep in-the-money options will have minimal impact from Vega and can largely be ignored.

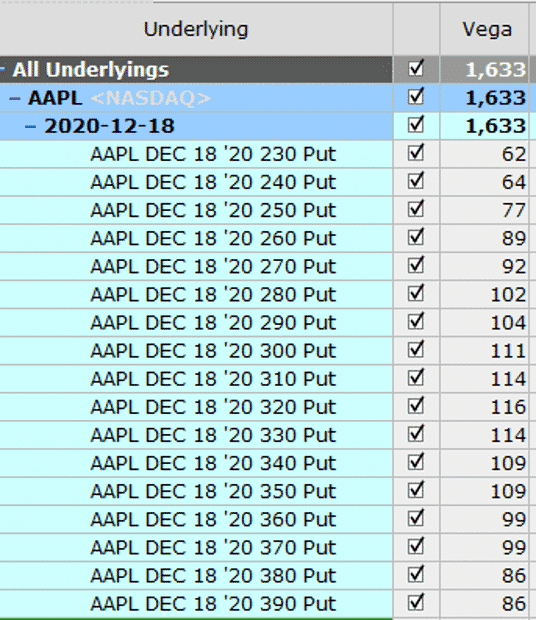

The second way that Vega changes is based on the time to expiration. More specifically, the longer the expiration date, the higher Vega will be.

The reason for this is that the more time there is before expiration, the more opportunity there is for a move to happen.

It’s a lot easier to predict tomorrow’s price than it is to predict a price six months from now.

This can easily be seen when comparing the Feb 2020 options above with the Dec 2020 options below.

The final key influence on Vega is changes to implied volatility. As implied volatility increases, so too does Vega.

The reason being is that the increased implied volatility will mean that the strike moves closer to being at-the-money. As the likelihood of the option finishing in-the-money increases, so too will Vega.

How can I use Vega in my portfolio?

One of the effective uses for Vega in your portfolio (apart from monitoring exposure and risk) is to use it together with long puts to hedge your portfolio.

Since we know that Vega decreases as we get closer to expiration, it wouldn’t make sense to buy hedges that are short term.

Instead, we could look at potential hedges that are quite far out, such as six months or more, since we know Vega will be higher.

When selecting your strike, consider out-of-the-money options. The reason being is that they respond better to higher volatility levels, and they begin to act more like at-the-money options as implied volatility rises.

At-the-money strikes don’t make a good hedge even though they have the greatest Vega as they would be quite expensive, most likely negating any financial benefit from making the hedge in the first place.

Another example is to mix in some long volatility trades like Long Straddles and Strangles (positive Vega) to offset core position such as Iron Condors (negative Vega).

Conclusion

Vega is one of the Greeks and is determined via the option pricing model. It measures the amount that an option’s price will change as a result of a 1% change in the implied volatility of the underlying asset.

Vega is not uniform and it changes over time, decreasing as the option gets closer to expiration.

By understanding Vega, you will understand how the option premium will be affected as implied volatility changes.

For advanced traders, they may consider using Vega when constructing hedges for their portfolio.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.